Price Movement Summary

| Apr 7 Open | Apr 18 Close | Price Change | |

|---|---|---|---|

| Brent Crude | 64.90 | 67.96 (Apr 17) | N/A |

| WTI Crude | 61.12 | 64.01 (Apr 17) | N/A |

| Dubai Crude | 66.00 (Apr 8) | 68.77 (Apr 17) | N/A |

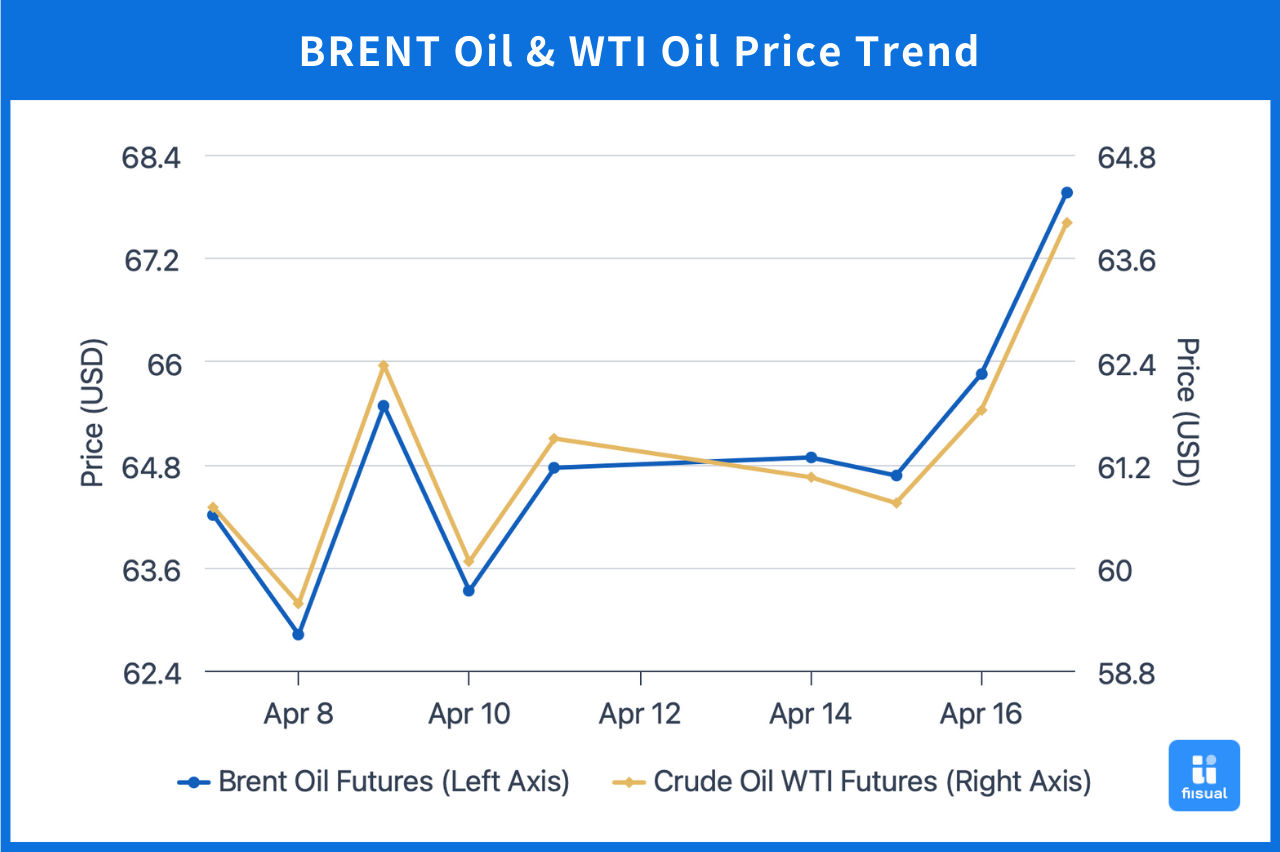

In the first week, oil prices remained weak due to continued market reactions to earlier tariff shocks. Midweek, the U.S. raised tariffs on Chinese imports from 34% to 84%. China retaliated with reciprocal tariffs, and the EU imposed up to 25% tariffs on U.S. steel and aluminum, escalating the trade war and dragging oil prices to new recent lows. Later in the week, Trump’s policy U-turn—delaying reciprocal tariffs on 57 countries and temporarily lowering rates to 10%—sparked a surge in market risk appetite, with oil prices jumping 13–14% in a single day. However, lingering economic uncertainties capped the rally, and prices returned to early-week levels.

In the second week, markets continued to digest the potential demand-side impact of tariffs. Midweek, OPEC+ announced compensatory production cuts, and the U.S. imposed sanctions on Shandong refiners for allegedly importing over $1 billion of Iranian crude, intensifying U.S.-Iran tensions. Positive news from U.S.-EU trade talks also buoyed sentiment. Supported by these multiple tailwinds, oil prices rose about 4% during the week.

Crude Oil Data Update

Crude Inventories Rising Steadily; Refined Product Demand Remains Strong

| Apr 11, 2025 | Apr 4, 2025 | Mar 28, 2025 | |

|---|---|---|---|

| Inventories (mn bbl) | |||

| Commercial Crude (ex-SPR) | 442.9 (+0.6) | 442.3 (+2.5) | 439.8 |

| Strategic Petroleum Reserve (SPR) | 397.0 (+0.3) | 396.7 (+0.3) | 396.4 |

| Gasoline | 234.0 (-2.0) | 236.0 (-1.6) | 237.6 |

| Distillates | 109.2 (-1.9) | 111.1 (-3.5) | 114.6 |

| Production Metrics | |||

| Rig Count | 480 (-9) | 489 (+5) | 484 |

| Refinery Utilization (%) | 86.3 (-0.4) | 86.7 (+0.7) | 86.0 |

Over the past two weeks, U.S. commercial crude inventories rose by a cumulative 3.1 million barrels, while SPR increased by 600,000 barrels, indicating a steady inventory build. On the supply side, active rig count dropped by 4, reflecting reduced drilling enthusiasm among shale producers due to falling prices and cost uncertainties from new tariffs. Refinery utilization edged up 0.3 percentage points. On the demand side, gasoline and distillate stocks fell by 3.6 million and 5.4 million barrels respectively, indicating continued strong refined product demand despite the seasonal slowdown.

Recent market behavior has been driven more by headline risks than fundamentals like inventories or utilization rates, and technical indicators have failed to offer support. The central level of international oil prices has shifted downward due to the tariff dispute. With unresolved global trade tensions and demand uncertainty, upward momentum is limited, and prices are expected to fluctuate within a range in the short term. Over the long run, with the global energy transition underway, the outlook remains bearish. Key factors to watch include U.S. trade talks, U.S.-Iran and Russia-Ukraine geopolitics, and OPEC+ output decisions.

Trade War Dampens Energy Outlook: All Three Major Agencies Lower Demand Forecasts

| Unit: million barrels/day | Supply | Demand | |||||||

|---|---|---|---|---|---|---|---|---|---|

| EIA | OPEC (non-DoC liquids + NGLs) | OPEC+ | IEA | EIA | OPEC | IEA | |||

| World | Est. | 2024 | 102.75 | 61.5 | 42.3 | - | 102.74 | 103.75 | 102.90 |

| 2025 | 104.10 | 62.5 | 42.6 | 104.20 | 103.64 | 105.05 | 103.70 | ||

| 2026 | 105.35 | 63.5 | 42.8 | - | 104.64 | 106.33 | - |

EIA: The release of the EIA’s April Short-Term Energy Outlook was delayed to April 10 due to uncertainties around Trump’s trade policy. The EIA forecasts global oil demand to grow by 900,000 bpd in 2025 and 1 million bpd in 2026—both revised down by 400,000 and 100,000 bpd from March projections. Oil price forecasts were also lowered: Brent to $67.87 and WTI to $63.88 per barrel for 2025, down $6–7 from previous estimates. The EIA cited heightened uncertainty in GDP growth due to trade policy fluctuations.

OPEC: Although OPEC remains optimistic about strong aviation and road travel demand supporting oil consumption, it acknowledged rising uncertainty in global economic prospects following new U.S. tariffs. In its latest monthly report, OPEC revised down global GDP and oil demand forecasts for 2025 and 2026. Supply forecasts were also trimmed, mainly due to declines in non-OPEC production, though some OPEC output expectations were raised due to planned increases.

IEA: While the U.S. exempted energy imports from its new tariffs, the IEA noted market fears about inflation and growth risks, prompting a downward revision in global demand forecasts. On the supply side, falling oil prices and the tariff effect have squeezed U.S. oil profits and raised production costs, further weakening shale drilling activity. The IEA expects OPEC’s planned increases to be offset by compensatory cuts, resulting in a limited net supply impact and a downward revision to global supply.

Geopolitical Developments

U.S. Suspends Tariffs

On April 9, 2025, Trump announced a 90-day suspension of reciprocal tariffs on 57 countries including the EU, Japan, and South Korea, and temporarily reduced the tariff rate to 10%. Meanwhile, tariffs on China were further raised to 125%. Following the announcement, market sentiment improved markedly, and oil prices surged over 13% that day. However, prices remained well below pre-announcement levels, reflecting persistent concerns over the broader trade environment. Looking ahead, oil price trends will hinge on trade negotiations and the strength of global economic fundamentals. A low-price environment may persist in the near term.

Summary

The core range of international oil prices has shifted lower due to the latest round of tariff actions. Although markets showed a rebound this week, short-term upside remains limited amid unresolved trade conflicts and weak demand expectations. Key factors to monitor include U.S. trade negotiations, geopolitical risks involving Iran and Ukraine, and OPEC+ production management.