When it comes to e-commerce, gaming, and mobile payments in Southeast Asia, Sea Limited (NYSE: SE) is a name that can't be ignored! From endlessly shopping on Shopee, to gaming on Garena and checking out with Monee, Sea has become a part of many people’s daily lives. Following this article, we will walk you through a deep dive into this dynamic company.

Company Overview

Sea Limited is an internet company headquartered in Singapore and listed on the New York Stock Exchange. It was founded in 2009 by Forrest Li, then CEO of GGgame (now Garena). Sea focuses on three main business segments: digital entertainment, e-commerce, and digital financial services. The company’s core markets are in Southeast Asia—including Singapore, Taiwan, the Philippines, Malaysia, Thailand, Indonesia, and Vietnam—and it is actively expanding into other regions.

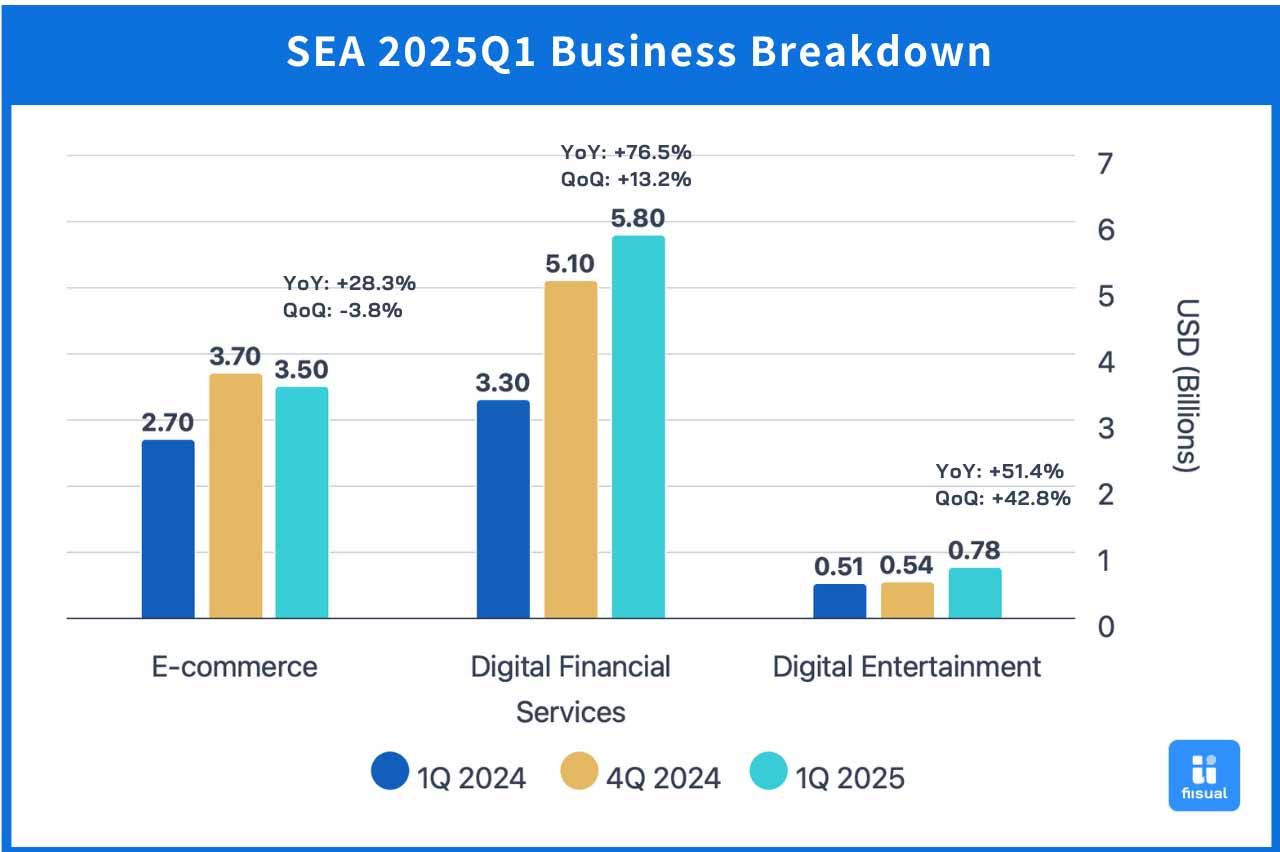

Business Breakdown

| Q1 2025 | Revenue Share | YoY Growth |

|---|---|---|

| E-commerce | 73% | +28.3% |

| Financial Services | 16% | +76.5% |

| Digital Entertainment | 10% | +51.4% |

| Others | 1% |

E-commerce: Shopee

Shopee is one of the top e-commerce platforms in Taiwan and Southeast Asia and represents Sea’s largest revenue stream—accounting for 73% of revenue in Q1 2025. The business focuses on competitive pricing, improving service quality, and expanding its content ecosystem. Shopee’s strong logistics infrastructure is key to differentiating its service quality. In Asia, about 50% of Shopee Xpress orders are delivered within two days. Its “Shopee Guarantee” return policy enhances the shopping experience. Shopee has also reduced logistics costs by $0.05 per order annually, helping support higher ad and commission take rates. Additionally, product links are embedded into YouTube content to boost online reach and visibility. Overall, continued improvements in logistics costs, delivery times, and digital reach are the main drivers of Shopee’s sustained growth, especially in Asia and Brazil.

Financial Services: Monee

Sea’s financial services are driven by Monee (formerly SeaMoney), which began as an embedded e-wallet on Shopee and has since evolved into a full-fledged fintech platform offering both payment and lending services. In addition to making it easy for Shopee users to pay with various financial tools, the ecosystem includes AirPay digital wallet and payments, Garena prepaid card systems, and services for consumer loans, SME credit, insurance, and banking—serving a wide range of personal and business needs. Monee is not only solidifying its Southeast Asian presence but also expanding into underbanked regions in South America, particularly Brazil.

Digital Entertainment: Garena

The third-largest revenue source is Garena, Sea’s digital entertainment arm, which contributes 10% of total revenue and focuses on game development and publishing. Popular titles include Arena of Valor, Call of Duty: Mobile, and Free Fire. Free Fire is a major growth engine; by daily active users (DAUs), it’s the world’s largest mobile game and continues to draw in new players, topping global download charts. Garena also emphasizes localized content to engage users—for example, in Indonesia, Free Fire players complete missions to donate real-world goods for Ramadan, and in Taiwan, Garena supported a Mazu pilgrimage using a themed parade float.

Recent Developments

Shopee

In addition to its Southeast Asian footprint, Shopee is actively expanding into global emerging markets, especially in high-potential regions like South America. Brazil has become one of Shopee’s most successful international ventures.

Shopee is also enhancing logistics in key regions. Year-over-year, single-order logistics costs dropped by 6% in Asia and 21% in Brazil. Delivery times are improving, and coverage is expanding. Shopee launched real-time delivery in major Indonesian cities, added a VIP membership program (which had over 1 million subscribers by the end of March), and rolled out an AI shopping assistant. Its upgraded advertising tool, GMV Max, helps sellers run targeted ads and maximize ROI. While revenue growth slowed in Q1 2025, Shopee still maintained a positive year-over-year increase.

Monee

Monee is pushing for broader market adoption beyond Shopee by promoting its standalone app Shopeepay, aimed at increasing user engagement. Shopeepay supports gaming credits, mobile top-ups, bill payments, movie tickets, and online shopping—boosting usage across various scenarios and improving customer retention. By March, Shopeepay had over 30 million downloads in Indonesia. Monee’s SPayLater “buy now, pay later” feature—offering up to 12-month installment plans—saw rapid growth in Malaysia, capturing over 10% market share. Overall, Monee had over 28 million active users in Q1 2025 (up from 26 million in the prior quarter), with more than 4 million users taking out a loan for the first time.

Garena

Garena’s monetization has significantly improved. The percentage of paying users rose from 8.2% to 9.8%, and the average bookings per paying user increased from $10.5 to $12.0. Free Fire’s crossover with Naruto in January was a major success, achieving its best DAU performance since 2021. The game portfolio continues to expand: in April, Garena launched a first-person shooter game “Delta Force” across Southeast Asia, MENA, and Latin America, with over 10 million downloads; in May, it released an action-adventure game “Free City.” In July, it plans to collaborate with Netflix to bring “Squid Game” into Free Fire. Sea forecasts double-digit growth in both users and bookings for 2025.

Outlook & Competitive Landscape

Strong Growth Potential in Southeast Asia

Southeast Asia’s e-commerce market continues to accelerate. According to DBS Bank, sales have grown 46-fold from $4 billion in 2012 to $184 billion in 2024, with a compound annual growth rate of 21%. In 2024, Alibaba-owned Lazada reached monthly EBITDA profitability, while Shopee posted stellar results with $100.5 billion in GMV—up 28% year-over-year—and turned profitable with $156 million in earnings, marking its first full-year profit.

Rising Competition from Global Players

However, high-growth markets also attract strong rivals. Lazada and Shopee, once the dominant players, are now facing fierce competition from TikTok and Pinduoduo’s global brand Temu. According to a Q1 2025 report on Vietnam’s online retail market, TikTok Shop’s sales jumped 113.8%, pushing its market share from 23% to 35%, while Shopee’s share slipped from 68% to 62%, indicating TikTok Shop’s rapid expansion is eroding Shopee’s lead. Meanwhile, Temu’s search interest in Vietnam soared 961% in 2024 compared to the prior year, signaling a likely shake-up in Southeast Asia’s e-commerce landscape.

SEA’s Global Expansion, Focus on Latin America

Facing intense competition, Sea is expanding beyond Asia—especially into Brazil, which has a population of over 210 million and 91.3 million active online shoppers, many of whom are young and digitally engaged. According to Brazil’s eCommerce Association (ABComm), online sales hit 204.27 billion reais (approx. $33.7 billion USD) in 2024, up 10.5% year-over-year. With Brazil’s e-commerce penetration still lower than that of the U.S. or U.K., Shopee is gaining ground by leveraging Chinese supply chains, building local logistics centers, and joining Brazil’s tax compliance programs to offer fast and affordable service. At the same time, Latin America’s underdeveloped credit infrastructure opens further growth opportunities for Monee’s financial services.