Have you heard of UC Capital? If not, you’ve probably heard about the Taiwanese company that bought Shohei Ohtani’s historic “50 homers and 50 steals” commemorative ball. That company is UC Capital. In this article, we’ll explore what UC Capital actually does and why it has risen to prominence, based on a recent Bloomberg interview.

Company Overview

UC Capital is a quantitative proprietary trading firm based in Taipei. Its roots trace back to TripodStar Capital, co-founded by veteran quant trader Jim Chang and Liu Hsing-Han. In 2011, the duo launched the venture with NT$20 million in capital. Within ten years, their assets under management (AUM) surged more than 270-fold, reaching NT$5.6 billion by 2021.

Due to diverging visions, Liu split from TripodStar Capital in 2021, taking with him one trader, six engineers, and about half the firm’s assets to establish UC Capital, focusing on high-frequency quantitative trading in retail-driven markets across Taiwan and Southeast Asia. The firm maintained a low profile until it attracted international attention in 2023 by spending USD 4.39 million on Shohei Ohtani’s 50/50 milestone baseball.

The firm’s 47-person team, entirely based in Taipei, is comprised mainly of quantitative traders and software engineers. According to Bloomberg, UC Capital has achieved an average annualized internal rate of return of 51% since its founding in 2021—far exceeding the Taiwan Stock Exchange and most global hedge funds—making it one of the top quant trading firms in Asia.

Core Business & Strategies

Quantitative Proprietary Trading

UC Capital specializes in high-frequency proprietary trading of Taiwanese stocks, ETFs, and derivatives. The firm relies heavily on its proprietary algorithms and data-driven strategies to engage in large-volume, high-speed trading.

According to internal figures, as the Taiwanese market has grown in both size and liquidity, UC’s monthly trading volume has reached NT$250 billion. As a single quant fund, it is now one of the most influential institutional players in Taiwan’s capital markets.

Sentiment Trading

One of UC Capital’s most distinctive features is its integration of sentiment analysis into trading strategies. The firm’s engineering team developed a proprietary sentiment monitoring system that tracks social media, forums, news platforms, and comment sections in real time. Using this “sentiment thermometer,” the system captures irrational market behaviors and applies behavioral economics principles to inform strategy design. This capability has allowed UC to profit counter-cyclically during volatile periods.

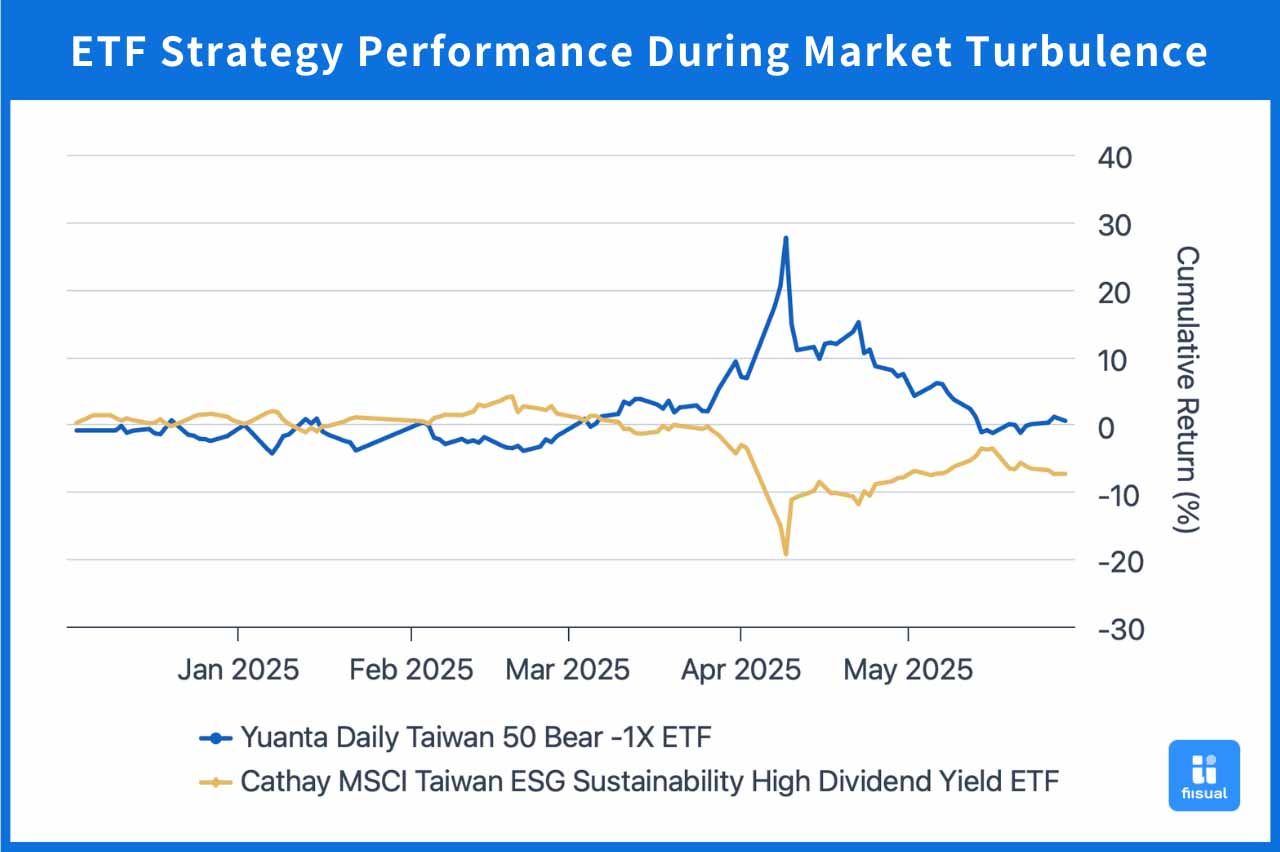

In April 2025, the Taiwanese stock market plummeted due to Trump’s tariff policy, sending major blue chips like TSMC sharply lower. UC had preemptively crafted risk mitigation strategies and deployed tools like ETF arbitrage, inverse ETFs, and futures to reduce drawdowns, demonstrating both its high-frequency agility and risk management strengths.

Asset Allocation

Since its spin-off, UC Capital has focused on retail-driven markets in Taiwan and Southeast Asia (including Thailand, Malaysia, and Vietnam). It actively tailors its high-frequency quant strategies to local market dynamics. Despite having a global outlook, UC has yet to enter China’s equity markets, largely due to capital mobility restrictions.

Alternative Real Assets

In 2023, applying its insights into scarcity and investor psychology, UC entered the high-end collectibles market by purchasing Shohei Ohtani’s “50-50” ball for USD 4.39 million. This bold move highlights UC’s acute awareness of asset uniqueness, opportunity cost, and risk management. It also reflects the firm’s innovative spirit in cross-sector investing, showcasing a broader capital deployment vision beyond traditional financial markets.

Corporate Culture

UC Capital is known for its ultra-low-profile culture. Founder Liu Hsing-Han rarely appears in public or on social media. Internally, the firm operates under a high-intensity, high-standard system. All traders are required to attend nightly strategy meetings to continuously enhance decision-making quality and execution discipline.

When recruiting, UC places particular emphasis on logical reasoning and creative thinking. Every candidate must read Misbehaving: The Making of Behavioral Economics before their interview and present their reflections during the session. This hiring practice reflects the company’s deep commitment to interdisciplinary and innovative talent.

UC takes pride in its “military-grade discipline fused with innovation,” emphasizing both risk control and strategic breakthroughs. The team is constantly encouraged to strive for elite performance.

Performance & Market Influence

Since its inception in 2021, UC Capital has achieved an average Sharpe ratio of 2.8, far exceeding most hedge fund benchmarks and indicating exceptional risk-adjusted returns. During the highly volatile Taiwanese market in 2024, UC effectively exploited large ETF discounts for arbitrage. Even as the market experienced sharp corrections, the firm kept its drawdown to just 6%, significantly outperforming the broader index.

As one of the largest single quant funds in Taiwan, UC Capital handles NT$250 billion in trades monthly, significantly impacting market liquidity and pricing. Its flexible use of 3x leverage and high activity levels have led local brokerages and global competitors alike to steer clear of direct confrontation.