What is Memory?

In today’s tech-driven world, electronic devices are integral to our daily lives. However, have you ever wondered what components enable actions like swiping your phone screen or opening apps on your computer? At the heart of these functions is a core technology: memory.

Whether it's DRAM for short-term data storage or Flash for long-term storage, memory is a foundational element in electronic systems. It influences processing performance and shapes both user experience and product design strategies. This article introduces key memory types, their technical characteristics, and how they’re used in everyday devices—also, which global companies manufacture them.

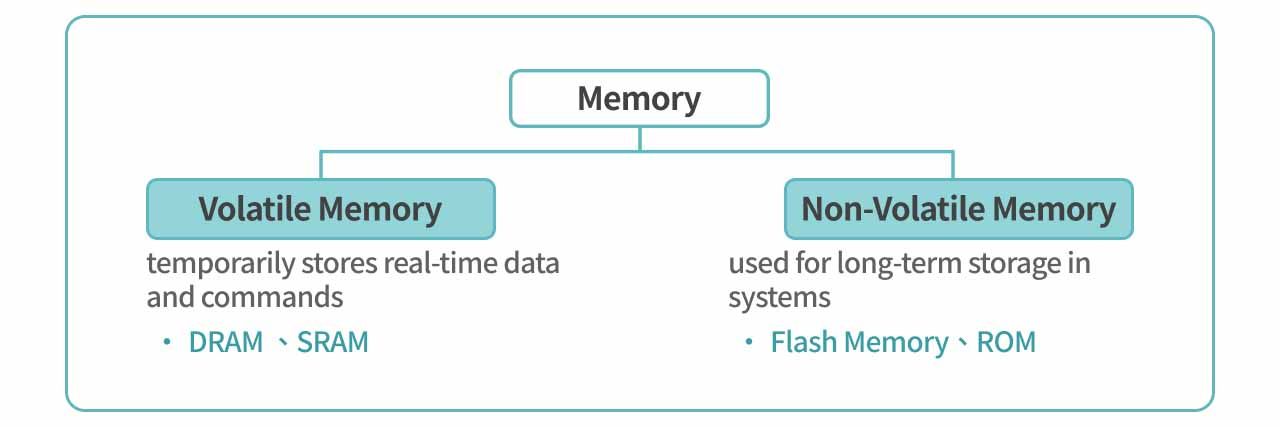

Memory is a critical component that stores data and executes commands in systems ranging from PCs and smartphones to servers and AI hardware. Think of it as a brain, split into short-term (volatile) and long-term (non-volatile) memory, handling temporary and permanent data.

Memory is broadly classified into two types based on whether it retains data after power-off:

Volatile Memory

Volatile memory temporarily stores real-time data and commands required for system operation. This data disappears once power is lost, making it an essential short-term memory component. The two main types are:

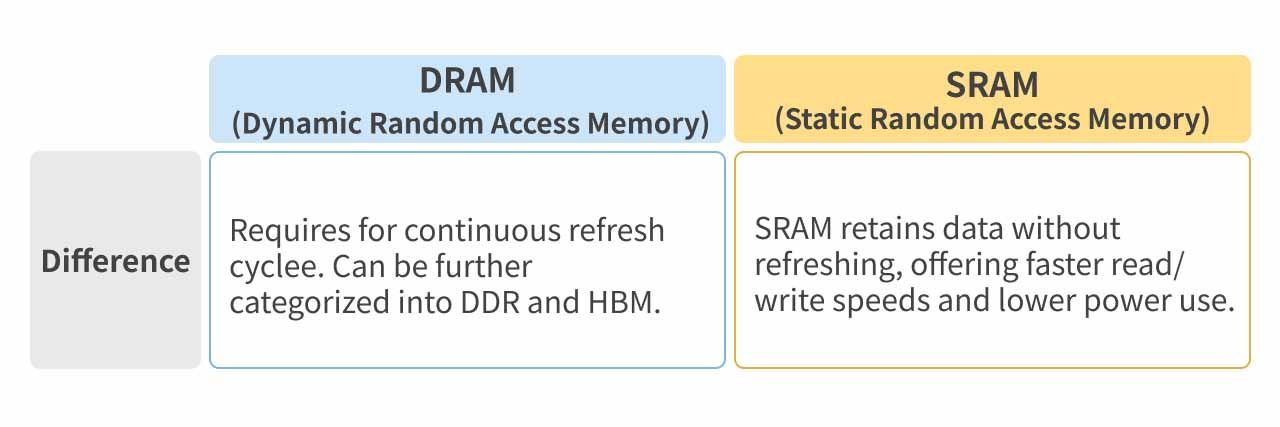

1. DRAM (Dynamic Random Access Memory)

The most widely used memory type, built with transistors and capacitors. While transistors control data access, capacitors store charge that leaks over time—hence the need for continuous refresh cycles, earning it the name “dynamic.”

Types of DRAM:

- DDR (Double Data Rate): DDR4, DDR5 – common system memory.

- HBM (High Bandwidth Memory): For GPUs and AI accelerators—high-speed and energy-efficient.

HBM uses 3D stacking (TSV) to boost bandwidth and is widely used in AI servers and performance-critical systems.

2. SRAM (Static Random Access Memory)

Unlike DRAM, SRAM retains data without refreshing, offering faster read/write speeds and lower power use. However, it consumes more space and costs more, so it's typically used in CPU cache for fast-access buffering.

Non-Volatile Memory

This type retains data after power-off and is used for long-term storage in systems such as SSDs and embedded devices. Major types include:

1. Flash Memory

The most common non-volatile memory, known for high density, cost-efficiency, and reusability—central to modern solid-state storage.

- NAND Flash: Serial structure, high density, great write efficiency—used in SSDs, smartphones, USBs.

- NOR Flash: Parallel structure, faster read speeds—used in firmware, BIOS, and embedded controllers.

2. ROM (Read Only Memory)

Early form of non-volatile memory, pre-programmed at the factory and not user-modifiable. While largely replaced by Flash, it’s still used in high-reliability embedded systems.

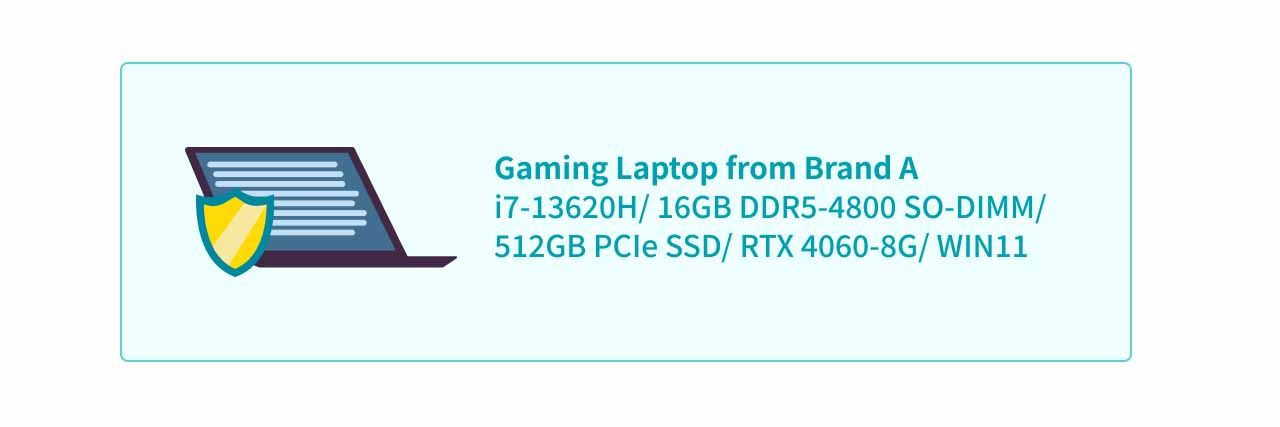

Real-World Example: Gaming Laptop from Brand A

By examining real product specifications, we can more intuitively understand the classification of memory and how it is configured within end-user devices. The following example uses a laptop from Brand A, with the key hardware specifications listed below:

- Intel Core i7-13620H: CPU for core processing.

- 16GB DDR5-4800 SO-DIMM: DRAM (DDR5), 4800 MT/s—high-speed memory for CPU/GPU tasks.

- 512GB PCIe SSD: NAND Flash—main storage for OS, apps, and files.

- NVIDIA RTX 4060 8GB GDDR6: GPU memory, a variant of DDR for graphics/AI tasks.

This kind of hardware configuration illustrates how memory systems in modern laptops are allocated to handle different computing tasks. It also highlights the indispensable roles of DRAM and NAND Flash in end-user devices.

To gain a deeper understanding of the technological evolution and application trends within the memory industry, we will next explore DDR and HBM within DRAM, as well as NAND and NOR within Flash memory. We will cover their technical characteristics, use cases, and market structure.

What Are DDR and HBM?

What is DDR?

DDR (Double Data Rate) is a mainstream DRAM memory technology that transfers data on both the rising and falling edges of the clock cycle, effectively doubling the data transfer rate without increasing the clock frequency.

Clock signal: Acts like a metronome to synchronize and control data flow between memory and the processor.

Put simply, DDR is like widening a data highway into two lanes—allowing more data to pass through in the same amount of time. This enhances overall memory bandwidth and efficiency. The technology has now advanced to its fifth generation (DDR5), with each iteration improving in bandwidth, power consumption, and capacity to support computing, server, and consumer electronics applications.

What is HBM?

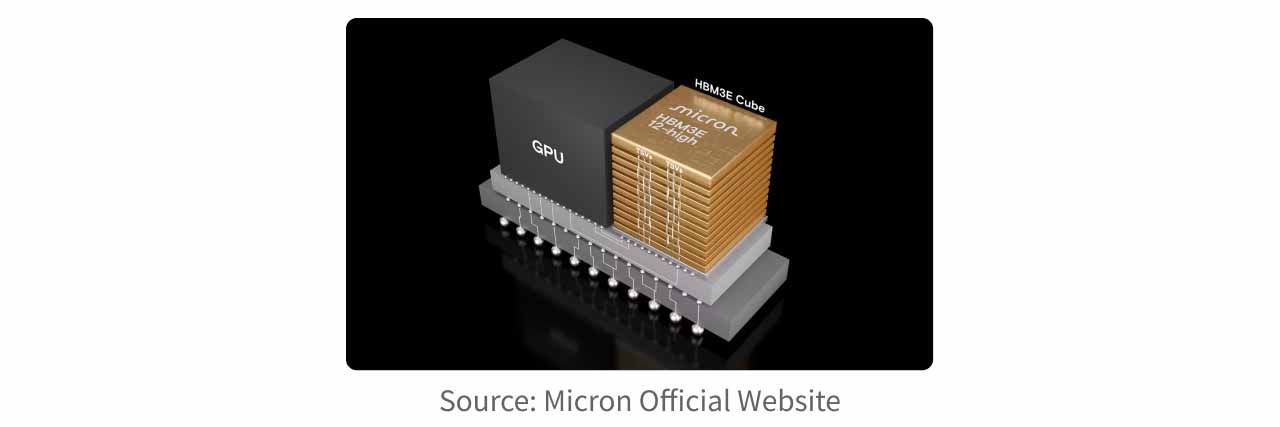

High Bandwidth Memory (HBM) is a memory technology specifically designed for high-performance computing (HPC) and artificial intelligence (AI) applications. It delivers high bandwidth, low latency, and low power consumption. HBM uses 3D stacking to vertically layer multiple DRAM dies, connected through Through-Silicon Via (TSV) technology, enabling ultra-fast data transfer.

This architecture is like building a 3D superhighway—supporting the massive data throughput required by AI chips and top-tier graphics cards.

As of 2025, HBM3E has become the mainstream high-performance memory. It extends HBM3 with newer process nodes (like Micron’s 1β) and advanced packaging technologies (e.g., CoWoS, SiP), enhancing performance and yield. HBM3E supports higher stack layers, with capacity increasing from 24 GB (HBM3) to 36 GB, and a single stack bandwidth reaching 1.2 TB/s. This makes HBM3E the top memory choice for advanced AI chips like NVIDIA GB300.

The industry is now pushing development and mass production of HBM4 and HBM4E. NVIDIA’s next-generation Rubin platform is expected to adopt HBM4 to handle even larger AI model training and inference workloads. HBM4 aims to further boost memory bandwidth and capacity to meet future HPC demands.

What is NAND Flash?

NAND Flash is the dominant non-volatile memory architecture today. Its name comes from its internal cell structure, which mimics a NAND logic gate configuration. It features high storage density, excellent write efficiency, and low manufacturing cost. Data is stored in blocks, making it ideal for bulk storage despite having slower random read speeds compared to NOR Flash.

NAND has evolved from 2D planar structures to 3D NAND, which stacks memory cells vertically to increase density. The number of layers has now exceeded 200.

NAND Flash types based on bits per cell:

| Type | Storage & Features | Primary Use |

|---|---|---|

| SLC (Single-Level Cell) | 1 bit/cell, highest speed and durability, ~100,000 write cycles | Industrial and enterprise-grade devices |

| MLC (Multi-Level Cell) | 2 bits/cell, balanced cost and performance, ~3,000–10,000 write cycles | Consumer products |

| TLC (Triple-Level Cell) | 3 bits/cell, lower cost, ~1,000 write cycles | Mainstream SSDs and memory cards |

| QLC (Quad-Level Cell) | 4 bits/cell, higher density and lowest cost, ~500 write cycles | Suited for read-heavy, write-light tasks such as cloud storage and AI inference |

Think of NAND Flash as a giant data warehouse—great for storing large volumes of data, but slightly slower for random access tasks.

What is NOR Flash?

NOR Flash is another type of non-volatile memory. Named after its NOR gate-style cell architecture, it uses a parallel structure that provides fast, random access and high reliability. It’s ideal for storing and executing boot code or firmware.

Common applications include:

- Firmware and BIOS in embedded systems

- Automotive electronics and industrial control devices

- Built-in microcontroller memory (MCU Flash)

Additionally, NOR Flash supports Execute in Place (XIP)—allowing devices to run code directly from Flash without loading it into RAM. This makes it an essential solution for embedded systems.

Think of NOR Flash as boot memory: fast, reliable, and built to handle small but critical tasks.

Major Global Memory Companies

Samsung Electronics

Samsung Semiconductor’s Device Solutions (DS) Division has long held the top position in the global memory industry, offering a full product lineup that includes DRAM, NAND Flash, HBM, and advanced packaging technologies.

- DRAM: Focus on DDR5, LPDDR5X, and HBM3E

- NAND: Initiated early mass production of 9th-gen V-NAND (~290 layers) in 2024, targeting premium SSDs and the server market

Future Trends & Outlook:

- DRAM: With strong demand from AI servers, Samsung plans to expand production of HBM3E 12-Hi stacks and high-density DDR5 modules (128GB+), aiming to increase the share of high-value-added products.

- NAND: The company is accelerating the adoption of 8th-gen V-NAND across all applications to lower cost, while gradually ramping up the volume of 9th-gen V-NAND production.

As next-generation GPUs are set to launch in the second half of the year, Samsung expects AI-related memory demand to remain robust. The company is also actively scaling its advanced packaging capacity (I-Cube/X-Cube) to maintain its leadership in the high-end memory market.

SK hynix

SK hynix is the world’s second-largest memory manufacturer. According to data from Counterpoint Technology Market Research, the company holds a leading 36% share of the global DRAM chip market and is also a front-runner in HBM (High Bandwidth Memory) technology.

- DRAM: The product lineup includes DDR5, LPDDR5, and HBM3E. As of March 2025, SK hynix became the first to deliver HBM4 12-Hi engineering samples to customers.

- NAND: The company plans to begin mass production of 321-layer 4D NAND in the first half of 2025. It has also expanded into the enterprise SSD segment through the acquisition of Intel’s NAND business (Solidigm). Capacity expansion is underway at the new M15X plant in Cheongju and the Yongin campus to meet growing long-term demand for AI memory.

Future Trends & Outlook:

- DRAM: The company maintains guidance for low-teen percentage growth in bit shipments per quarter. HBM3E is expected to complete its transition from 8-Hi to 12-Hi stacks in Q2. Full-year DRAM bit demand is expected to grow at a multiples-level pace, with HBM4 mass production slated for the second half of 2025.

- NAND: In the enterprise SSD (eSSD) and QLC high-capacity markets, SK hynix is pursuing a profit-first strategy. For Q2, bit shipment growth is targeted at high single-digit to low double-digit percentages (>20%, including Solidigm), with careful CapEx management.

With technological leadership in HBM3E and HBM4 and cost advantages in 321-layer NAND, SK hynix aims to continue expanding its market share in high-value segments such as AI servers and data centers.

Micron

Micron is the world’s third-largest memory manufacturer and the only U.S.-based supplier of DRAM.

- DRAM: Currently mass-producing 1β and 1γ process DDR5/LPDDR5X products. Its HBM product line has been upgraded from HBM3E 8-Hi to HBM3E 12-Hi, with HBM4 mass production clearly scheduled for 2026.

- NAND: Focused on 232-layer TLC and QLC 3D NAND (G9) as its primary node.

- Capacity Expansion: In early 2025, Micron broke ground on a new advanced HBM packaging plant in Singapore, slated for operation in 2027. Construction is also ongoing for a new DRAM fab in Idaho and a DRAM testing facility in Taiwan.

Future Trends & Outlook

- DRAM: Micron expects record-high revenues, with HBM3E 12-Hi becoming the main shipping configuration in the second half of 2025. The company’s entire HBM production for 2025 is already sold out. HBM4 mass production is planned for 2026.

- NAND: Its flagship 9550 PCIe Gen5 SSD has been certified for NVIDIA GB200 NVL72 and adopted by several major cloud providers. The G8 QLC NAND components have qualified for mass production in Pure Storage’s 150TB DirectFlash modules. Micron continues to leverage QLC technology to promote high-density SSDs as HDD alternatives.

Backed by technical and cost advantages in HBM3E, 1γ DRAM, and QLC-based high-capacity SSDs, Micron is positioned to expand its market share in AI servers, high-performance computing, and cloud storage.

Taiwan Memory Industry

Nanya Technology (2408)

Nanya Technology is the only IDM (Integrated Device Manufacturer) in Taiwan focused exclusively on specialty DRAM.

- Process & Products: The 10nm-class 1B node now accounts for one-third of total capacity. The company began shipping 16Gb DDR5-5600 in Q1 2025 and is sampling DDR5-6400 in Q2. Development of 1C, 1D, and custom DRAM products is also ongoing.

- Market Direction: According to recent earnings guidance, demand for DDR5 and low-power DRAM is being driven by AI cloud servers and edge computing. Nanya is also increasing its share of server, industrial, and PC customers.

- Capex & Supply: The capital expenditure ceiling for 2025 is set at NT$19.6 billion, primarily for 1B technology migration and yield improvements. The annual bit shipment growth target has been raised from >20% to >30%, signaling moderate capacity expansion.

Future Trends & Outlook

| Trend | Status | Assessment |

|---|---|---|

| DDR4 → DDR5 Transition | DDR5-5600 shipped, DDR5-6400 in sampling | 🟢 Positive |

| AI Servers / HBM | Developing custom HBM, expected by late 2026 | 🟡 Medium |

Winbond Electronics (2344)

Winbond focuses on Custom Memory Solutions (CMS) and NOR Flash, and is the global market leader in NOR Flash.

- Product Mix: In Q1 2025, revenue was split across Logic (42%), NOR Flash (32%), and CMS (24%). Winbond continues to lead in NOR market share. CMS offerings include low-density LPDDR4X, LPDDR3, and DDR3, catering to industrial, automotive, and consumer electronics.

- Edge-AI Strategy: Winbond introduced low-density LPDDR4X products and a CUBE 3D memory architecture, targeting Edge-AI SoCs (e.g., smartphones, smart speakers, and Kneron AI MCUs) that demand high bandwidth and low power.

Future Trends & Outlook

| Trend | Status | Note |

|---|---|---|

| HBM/AI servers | No involvement in HBM | ⚪ Limited benefit |

| Edge-AI memory | LPDDR4X + CUBE architecture tailored for Edge-AI SoCs | 🟢 Positive |

| DDR4 → DDR5 Transition | Still focused on DDR3 / LPDDR4X; no DDR5 deployment | ⚪ Limited benefit |

| Automotive / Industrial Demand | Consistent NOR Flash & Secure Flash shipments | 🟢 Stable exposure |

Phison Electronics (8299)

Phison is one of the world’s top three suppliers of NAND controllers and SSD solutions.

As of Q1 2025, over 70% of its revenue comes from non-consumer segments such as controllers, enterprise, embedded, and industrial SSDs—demonstrating a successful shift toward high-growth markets like data centers, automotive, and industrial applications.

- High-Speed Controllers & Enterprise SSDs: The latest E28 PCIe Gen5 controller supports 14.5 GB/s throughput and up to 32TB capacity. Based on this platform, the Pascari X200E 122TB Gen5 enterprise SSD was showcased at SC 2024, targeting I/O-intensive workloads in AI and HPC servers.

- Automotive & Interface ICs: Phison launched PCIe Gen4 BGA automotive SSDs (AEC-Q100) and PCIe 5.0/6.0 redrivers and retimers. Over 10 million units have shipped, making Phison the world’s largest supplier of PCIe 5.0 redriver chips.

- Edge-AI Platform: The proprietary aiDAPTIV™ software-hardware solution, designed to pair with NVIDIA Jetson, has been adopted in government, medical, and manufacturing edge generative AI projects.

Future Trends & Outlook

| Trend | Status | Note |

|---|---|---|

| AI server storage | Gen5 controllers and >100TB SSDs tackle I/O bottlenecks in AI/HPC | 🟢 Excellent fit |

| QLC NAND | Collaborating with Solidigm, Samsung, and others to promote QLC SSDs | 🟢 Direct benefit |

| Automotive/Edge-AI | Automotive-grade SSDs and aiDAPTIV™ platform entering growth stage | 🟡 Medium growth |

| Advanced Interface Ecosystem | PCIe 5.0/6.0 leadership, early move into CXL 2.0 support | 🟢 Technological lead |

ADATA (3260)

ADATA is the world’s second-largest DRAM and SSD module brand. According to its Q4 2024 earnings report, its revenue mix includes 52% from DRAM modules and 34% from SSDs, with a growing share of enterprise and industrial-grade products.

- High-Speed Consumer & Gaming Storage: In April 2025, ADATA launched the XPG MARS 980 PCIe Gen5 SSD, delivering up to 14 GB/s read/write speeds and up to 4TB capacity, targeting AI PCs and high-end desktops.

- Enterprise AI Storage: In May 2025, ADATA introduced its new enterprise brand TRUSTA, debuting T7 (PCIe Gen5 E3.S/E1.S) and T5 (Gen4/SATA) SSDs, to be featured at COMPUTEX 2025 and sampled to AI server customers.

- Industrial & Embedded Memory: ADATA Industrial has begun mass production of DDR5-5600 modules and introduced DDR5-6400 CU-DIMM / CSO-DIMM in early 2025 for servers, industrial controls, and edge AI systems.

- AI PC Memory Upgrades: At CES 2025, ADATA unveiled DDR5 CUDIMM 6400 and XPG LANCER CUDIMM RGB, targeting bandwidth-intensive AI PCs and generative AI software workloads.

Future Trends & Outlook

| Trend | Status | Note |

|---|---|---|

| AI Server Storage & I/O | TRUSTA’s Gen5 enterprise SSDs align with AI/HPC server requirements | 🟢 Strong match |

| AI PC / High-Speed DDR5 Demand | DDR5-6400 CUDIMM and XPG LANCER series driving retail and OEM adoption | 🟢 Direct benefit |

| Industrial / Embedded Edge-AI | DDR5 lineup supports niche sDR5-5600 in production; DDR5-6400 for industrial and edge AI systems | 🟡 Steady |

| HBM / NAND Fabrication | As a module/brand vendor, relies on third-party DRAM & NAND sourcing | 🟡 Indirect benefit |