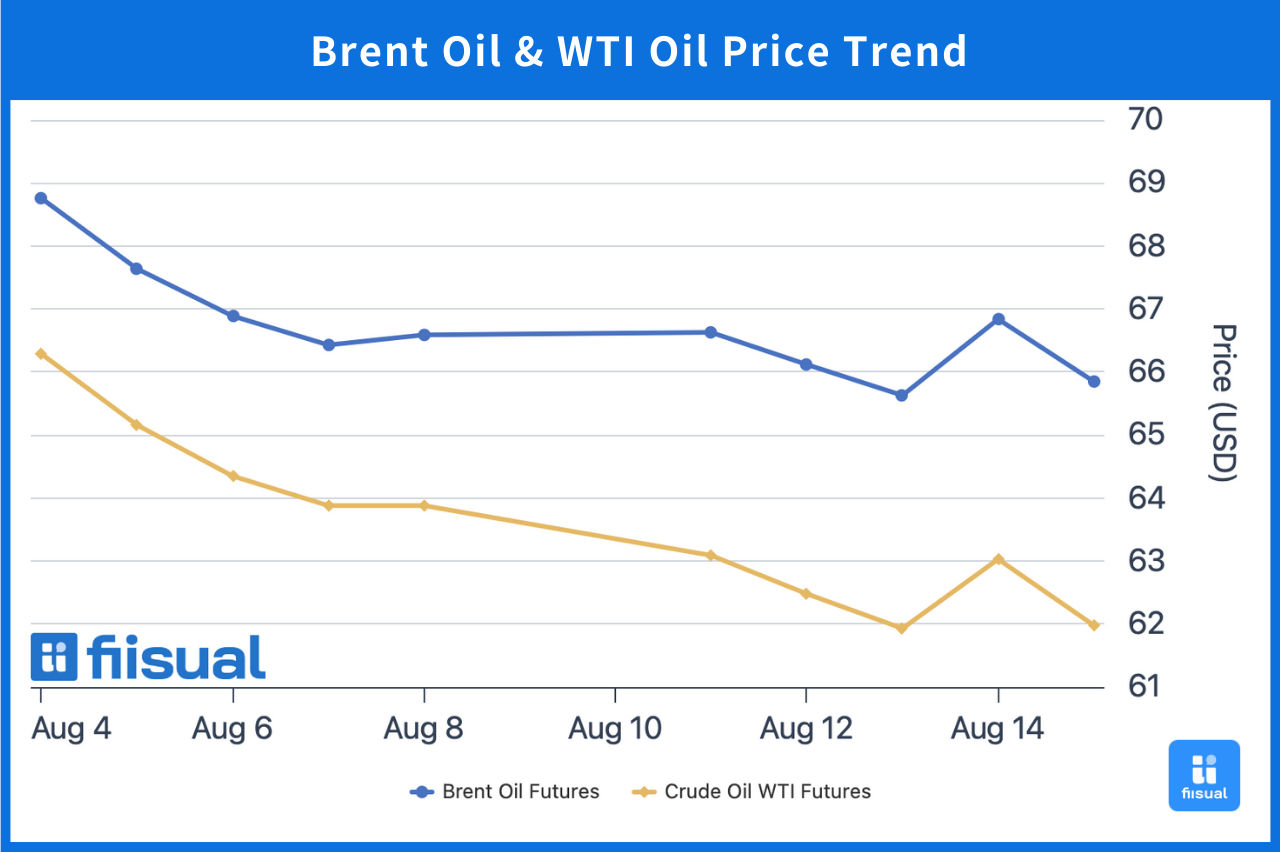

Price Trend Summary

| 8/4 Open | 8/15 Close | Change | |

|---|---|---|---|

| Brent | 69.11 | 65.85 | -4.72% |

| WTI | 66.85 | 62.80 | -6.06% |

| Dubai | 70.64 | 68.61 | -2.87% |

In the first week, prices fell as the market digested OPEC+’s plan to increase output in September and weaker-than-expected U.S. nonfarm payrolls. Mid-to-late week, Trump announced new tariffs on India and revealed his envoy had made “breakthrough progress” in talks with Putin. Heightened tariff concerns and easing geopolitical risks pushed oil lower. Still, better-than-expected inventory data provided some support, with crude ending the week down about 4%.

In the second week, EIA’s monthly report revised supply higher and cut its oil price forecast, pressuring crude, though some losses were offset by OPEC’s relatively optimistic outlook. Mid-week, small builds in U.S. crude and refined products further weighed on prices. Later, uncertainty around the Trump-Putin meeting drove a rebound, with Brent ending the week down about 1%.

Crude Oil Data Update

Crude Inventories Steady, Refined Product Demand Solid, Signs of Producer Investment Bottoming

| 8/13/25 | 8/6/25 | 7/30/25 | |

|---|---|---|---|

| Inventories (mbbls) | |||

| Commercial Crude (ex-SPR) | 426.7 (-3.0) | 423.7 (+3.0) | 426.7 |

| SPR | 403.2 (+0.2) | 403.0 (+0.3) | 402.7 |

| Gasoline | 226.3 (-0.8) | 227.1 (-1.3) | 228.4 |

| Distillates | 113.7 (+0.7) | 113.0 (-0.5) | 113.5 |

| Activity | |||

| Rig Count | 411 (+1) | 410 (-5) | 415 |

| Refinery Utilization (%) | 96.4 (-0.5) | 96.9 (+1.5) | 95.4 |

Over the past three weeks, U.S. commercial crude stocks have been broadly stable, staying at healthy levels. The SPR saw replenishment of 0.5 million barrels, though given Senate budget cuts, further refills may slow. On products, gasoline stocks fell by 2.1 million barrels while distillates rose slightly by 0.2 million, showing driving-season demand support. On supply, active rig counts fell another four but rebounded in the second week, suggesting drilling activity may be bottoming. Refinery utilization rose by 1 percentage point, highlighting firm spot demand, which should support prices near term.

Agency Reports: Wide Gap Between IEA and OPEC Forecasts

| mb/d | Supply | Demand | |||||

|---|---|---|---|---|---|---|---|

| Agency | EIA | OPEC (non-DoC liquids+DoC NGLs) | IEA | EIA | OPEC (OECD) | OPEC (non-OECD) | IEA |

| 2024 | 103.08 (+0.23) | 61.5 | 103.04 | 102.74 | 45.67 | 58.17 | 102.90 |

| 2025 | 105.36 (+0.75) | 62.7 (+0.0) | 105.50 (+0.4) | 103.72 (+0.12) | 45.81 (+0.01) | 59.33 (+0.00) | 103.58 (-0.02) |

| 2026 | 106.35 (+0.63) | 63.4 (-0.1) | 107.40 (+1.0) | 104.91 (+0.32) | 45.96 (+0.08) | 60.56 (+0.03) | 104.28 (-0.04) |

EIA: Revised 2025 global supply growth higher, cut 2026 growth, while slightly raising demand. Against an oversupply backdrop, it sharply lowered Brent price forecasts to $58/$51 for 2025/26 (from $69/$58). EIA also said higher well productivity will push U.S. crude output to a record high by Dec 2025, which it expects to be peak U.S. output.

OPEC: Maintained 2025 non-OPEC+ supply growth forecast but cut 2026 growth. Demand was revised slightly higher, reflecting stronger global economic outlook. On this basis, OPEC also upgraded GDP forecasts for the U.S., China, and Europe, noting that while trade risks could stoke inflation, fiscal and monetary policy should partly offset the impact.

IEA: Raised supply estimates but cut demand forecasts, warning that faster OPEC+ output growth would lead to a clear supply surplus. It flagged concerns over the supply-demand balance and cited new sanctions on Russia and Iran, which could disrupt flows, but weak economic growth would still cap demand.

Commentary

OPEC and IEA’s demand growth estimates diverge by as much as twofold. OPEC, as a producers’ group, is currently focused on raising output to capture market share and disciplining members that overproduce. Its optimistic economic outlook appears more aimed at justifying output hikes than reflecting actual market conditions. Conversely, IEA, as a consumers’ group, leans toward keeping oil affordable to support growth and avoid inflation shocks. Still, this month’s IEA revisions look excessive: U.S. inventories remain healthy, refined product demand has not slowed materially, and rig counts are down ~15% since the start of the year, suggesting future supply growth will be constrained. The credibility of IEA’s steep demand downgrade is questionable.

On geopolitics, as expected, despite no end to the Russia-Ukraine war, Trump has not imposed sweeping secondary sanctions on Russian crude. On August 15, his meeting with Putin yielded no breakthroughs but sent a positive signal, lowering the likelihood of harsher sanctions — a bearish factor for oil.

Fundamentally, refined product demand has been steady over the past two weeks, with refinery utilization hitting a multi-year seasonal high, underscoring solid spot market support. Heading into Labor Day, the key will be whether fuel demand drops sharply once the driving season ends. Rig counts show signs of recovery, and if sustained, OPEC+ supply increases could weigh more heavily on the market.

In addition, Trump said gasoline prices would fall below $2/gallon, while the U.S. average remains above $3, implying more than 30% downside in theory. Overall, crude lacks upward momentum in the near term, with focus on Russia-Ukraine developments, Iran talks, and whether current tightness in spot balances starts to ease.

Takeaway

While IEA and OPEC’s demand forecasts diverge sharply, both look extreme. Inventory and refined product data show spot demand remains firm, and a ~15% drop in U.S. rig counts since early this year suggests future supply growth will be limited. Key watchpoints are the Russia-Ukraine situation and whether refined product demand weakens materially after the driving season.