Price Performance Summary

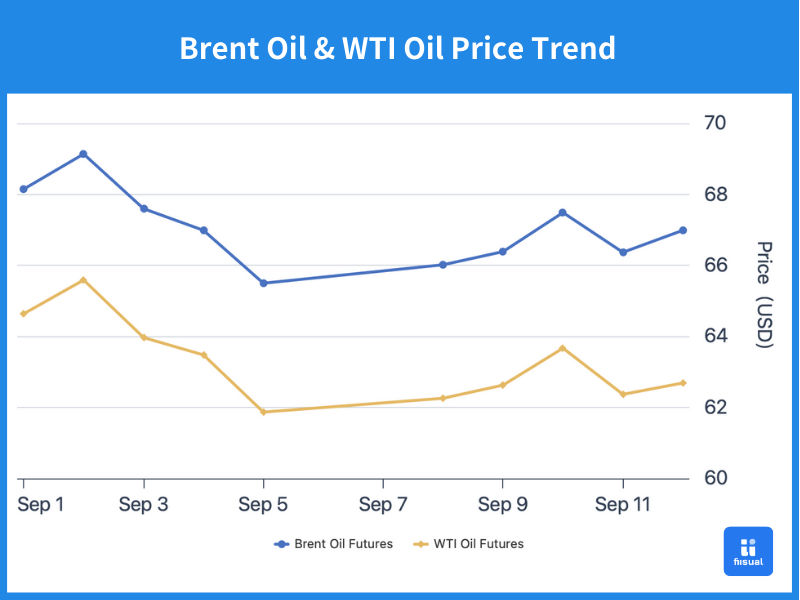

| Sep 1 Open | Sep 12 Close | Change | |

|---|---|---|---|

| Brent | 67.42 | 66.99 | -0.6% |

| WTI | 64.61 | 62.69 | -3.0% |

| Dubai | 71.68 (Sep 2) | 70.20 | -2.06% |

In the first week, prices climbed early on as Houthi forces attacked an oil tanker in the Red Sea and the Russia-Ukraine conflict intensified. Midweek, however, EIA data showed a build in U.S. crude inventories, while expectations of another OPEC+ supply increase weighed on sentiment. Even weaker U.S. economic data—boosting rate-cut expectations—failed to offset supply-side headwinds, and crude ended the week down about 3%.

In the second week, oil prices rebounded initially as OPEC+ slowed its pace of increases and several members pledged compensatory cuts, compounded by rising geopolitical risks in Eastern Europe. Later in the week, however, the IEA warned of a severe supply glut by 2026, triggering a sharp 2% single-day drop. Ultimately, prices still ended the week modestly higher by around 1%.

Oil Market Data Update

Crude Stocks Build, Gasoline Demand Firm, Signs of Production Bottoming

| Sep 10, 2025 | Sep 3, 2025 | Aug 27, 2025 | |

|---|---|---|---|

| Inventories (mbbls) | |||

| Commercial crude (ex-SPR) | 424.6 (+3.9) | 420.7 (+2.4) | 418.3 |

| Strategic Petroleum Reserve | 405.2 (+0.5) | 404.7 (+0.5) | 404.2 |

| Gasoline | 220.0 (+1.5) | 218.5 (-3.8) | 222.3 |

| Distillates | 120.6 (+4.7) | 115.9 (+1.7) | 114.2 |

| Production activity | |||

| Rig count | 414 (+2) | 412 (+1) | 411 |

| Refinery utilization (%) | 94.9 (+0.6) | 94.3 (-0.3) | 94.6 |

U.S. commercial crude inventories rose by a cumulative 6.3 million barrels over two weeks, highlighting short-term oversupply pressure, though overall stock levels remain within healthy ranges. The SPR was replenished by 1 million barrels, reflecting steady restocking. On products, gasoline inventories fell 2.3 million barrels—better than expected—signaling an extended driving season and resilient demand. By contrast, distillate inventories surged by 6.4 million barrels, underscoring weaker industrial and freight activity. On the supply side, refinery utilization edged up 0.3ppt, reflecting confidence in near-term demand, while active rigs increased by three, suggesting production has bottomed out.

Agency Reports: Demand Resilient, Supply Risks in Focus

| mb/d | Supply | Demand | |||||

|---|---|---|---|---|---|---|---|

| Agency | EIA | OPEC (non-DoC liquids+DoC NGLs) | IEA | EIA | OPEC (OECD) | OPEC (non-OECD) | IEA |

| 2024 | 103.19 (+0.11) | 61.7 | 103.04 | 102.91 (+0.17) | 45.69 (+0.02) | 58.16 (-0.01) | 102.90 |

| 2025 | 105.54 (+0.18) | 62.7 (+0.00) | 105.80 (+0.30) | 103.81 (+0.09) | 45.83 (+0.02) | 59.31 (-0.02) | 103.64 (+0.06) |

| 2026 | 106.64 (+0.29) | 63.4 (+0.00) | 107.90 (+0.50) | 105.09 (+0.18) | 45.97 (+0.01) | 60.54 (-0.02) | 104.34 (+0.06) |

EIA: Minimal changes this month. It warned that with global (ex-U.S.) inventories climbing, land storage capacity is tightening, forcing more costly floating storage. Prices could slide to $59/bbl by late 2025 and near $50/bbl by early 2026. On consumption, the EIA revised its 2026 U.S. gasoline demand forecast from decline to modest growth, citing higher working-age population and lower pump prices.

IEA: Raised its 2025 demand forecast, citing lower prices and improving manufacturing PMIs in the U.S. and Europe. It emphasized resilient OECD demand, particularly from industrial and aviation fuels, but still expects demand to soften in late 2025, leaving the year broadly flat. On supply, OPEC’s incremental increases prompted small upward revisions. The IEA also noted sanctions on Iran and Russia have had limited effect so far, but warned that the EU’s 2026 ban on Russian refined products could reshape trade flows.

OPEC: Left both supply and demand forecasts unchanged. It pointed to global manufacturing PMI rising to 50.9 in August—back in expansion territory—while services PMI eased slightly to 53.4 but remained solid. OPEC maintained global GDP growth at 3.0% for 2025 and 3.1% for 2026, citing steady consumption and supportive monetary policy.

Global Developments

OPEC Slows Output Growth, Adds Compensatory Cuts

On Sep 7, OPEC+ agreed to a modest production hike of 137,000 b/d from October. At the same time, Russia, Iraq, Kazakhstan, the UAE, Kuwait, and Oman must implement compensatory cuts to offset prior overproduction, with compliance required through mid-2026.

Commentary

This month’s OPEC move—smaller than recent hikes and paired with compensatory cuts—means actual net supply growth will be limited. It reflects a pragmatic balance between market stability and internal discipline, keeping downside price risks cushioned. Yet with the summer demand season winding down and U.S. drilling stabilizing, strict compliance with quotas remains key.

OPEC’s unchanged demand outlook reflects a more pragmatic tone, avoiding further upward revisions despite stronger U.S. GDP in Q2. This suggests its earlier bullishness has been tempered.

In spot markets, gasoline consumption continues to surprise on the upside, with inventories drawing and refinery runs rising, confirming refiners’ optimism. However, distillate builds highlight weakness in U.S. industrial and freight activity. The IEA’s emphasis on resilient OECD demand suggests risks are manageable for now.

Looking ahead, geopolitics and the post-summer demand drop will drive near-term volatility, while over the medium term, the focus shifts to whether rate cuts can translate into stronger consumption.

Takeaway

OPEC’s modest output hike, coupled with compensatory cuts, was welcomed by markets. Fundamentals show gasoline demand resilience and higher refinery utilization supporting prices near-term, though rising distillate inventories underscore industrial softness and fuel concerns about a 2026 glut. For now, prices remain range-bound, buffeted by geopolitical headlines, with attention turning to post-driving season demand and the potential boost from monetary easing.