In recent years, more and more companies have opted to go public through a SPAC (Special Purpose Acquisition Company), offering an alternative to the traditional IPO route. While the term "SPAC" may sound unfamiliar, the concept has actually been around in the U.S. since the 1990s. However, it wasn’t until the pandemic in 2020 that SPACs truly took off. At a time of extreme economic uncertainty, many businesses—especially startups—needed to raise capital quickly and access the public markets. SPACs provided just that opportunity, leading to a surge in activity over a short two-year period and drawing significant attention from investors and the media.

So, what exactly is a SPAC? How does it differ from a traditional IPO? Why is it considered a “shortcut to going public,” and why have some SPAC stories turned into cautionary tales? Today, let’s walk through how SPACs work, their evolution, and the key points and risks you should know.

What is a SPAC?

A SPAC (Special Purpose Acquisition Company) is essentially a shell company created to take a private business public through a merger.

A SPAC has no operating business. Its sole purpose is to go public, raise funds, and then, within a set period, look for one or more promising private companies to acquire. Once it successfully completes an acquisition, the acquired company effectively takes the SPAC’s place as a public company. This is known as the de-SPAC process.

SPACs have gained popularity because the process is faster, more flexible than traditional IPOs, and allows valuation negotiations early on. But while the structure may seem simple, the capital planning and risk management involved are far from straightforward.

In most cases, a SPAC has 24 months from its IPO to complete a merger with a target company. If it fails to find or finalize a deal within this timeframe, it must liquidate and return the funds (usually with a small amount of interest) to investors.

How Do SPACs Raise Capital?

Starting with a "Blank Check"

SPACs are typically created by sponsors—such as private equity firms, venture capitalists, or experienced entrepreneurs—who file to list the SPAC and raise money through an IPO. Interestingly, SPAC IPO filings don’t specify which company will be acquired, though they might hint at a preferred sector such as "clean energy," "healthtech," or "consumer brands."

In other words, when the SPAC goes public, it doesn’t yet know what it will buy. Investors are effectively putting their trust in the management team without knowing where the funds will be used. That’s why SPACs are often called "blank-check companies."

How Are SPACs Different From Traditional IPOs?

While both SPACs and traditional IPOs aim to take a company public, the processes, risks, and roles of the players involved are quite different.

Think of a traditional IPO as running a marathon—long, structured, and well-documented. A SPAC, on the other hand, is like taking a shortcut up the mountain: it’s faster but full of sharp turns and unknowns.

| SPAC | Traditional IPO | |

|---|---|---|

| Structure | Investors commit capital without knowing the final acquisition target; they’re betting on the team | Investors evaluate a clearly defined company with public disclosures |

| Timeline | ~3–6 months | 12–18 months |

| Retail Participation | SPAC shares trade before a merger; retail investors can buy in early | Retail investors typically join at the IPO date |

| Transparency | Limited until the acquisition is announced | Extensive disclosures available from the start |

| Use of Funds | Held in trust until a merger or returned | Immediately available to the operating company |

In short, SPACs offer a faster but trust-heavy path to going public. Each option has its pros and cons, depending on the nature of the company and its investors.

Regulatory Challenges and Risks

Under Biden: From Hype to Oversight

Under President Biden, SPACs came under greater regulatory scrutiny. Amid concerns about transparency and investor protection, Biden emphasized bringing IPO-level safeguards to SPACs.

In April 2021, the U.S. Securities and Exchange Commission (SEC) reclassified SPAC-issued warrants as liabilities instead of equity, changing accounting treatment. Then, in March 2022, the SEC released a 372-page proposal titled “Special Purpose Acquisition Companies, Shell Companies, and Projections (S7-13-22)” that tightened SPAC regulations.

Three key changes:

1. Removal of Safe Harbor Protections for Financial Projections: SPACs can no longer use forward-looking projections without being legally accountable if they turn out to be misleading.

2. Expanded Disclosure Requirements: SPACs must now clearly disclose sponsor compensation, potential conflicts of interest, dilution effects (e.g., through warrants, PIPEs, or redemption rights), and more.

3. Wider Legal Liability: De-SPAC transactions now require the target company and underwriters to be joint registrants, exposing them to the same anti-fraud rules (like Rule 10b-5) as in a traditional IPO.

Under Trump: A Shift in Tone

With Trump’s return to the White House in 2025, the newly formed Department of Government Efficiency (DOGE) has reportedly begun discussions with the SEC to loosen SPAC regulations. Proposals include restoring safe harbor protections, scaling back joint liability requirements, and accelerating review timelines. While SEC Chair Paul Atkins has pledged careful evaluation, some implementation timelines for SPAC rules have already been delayed.

fiisual Editor’s Take: Is Regulation Necessary?

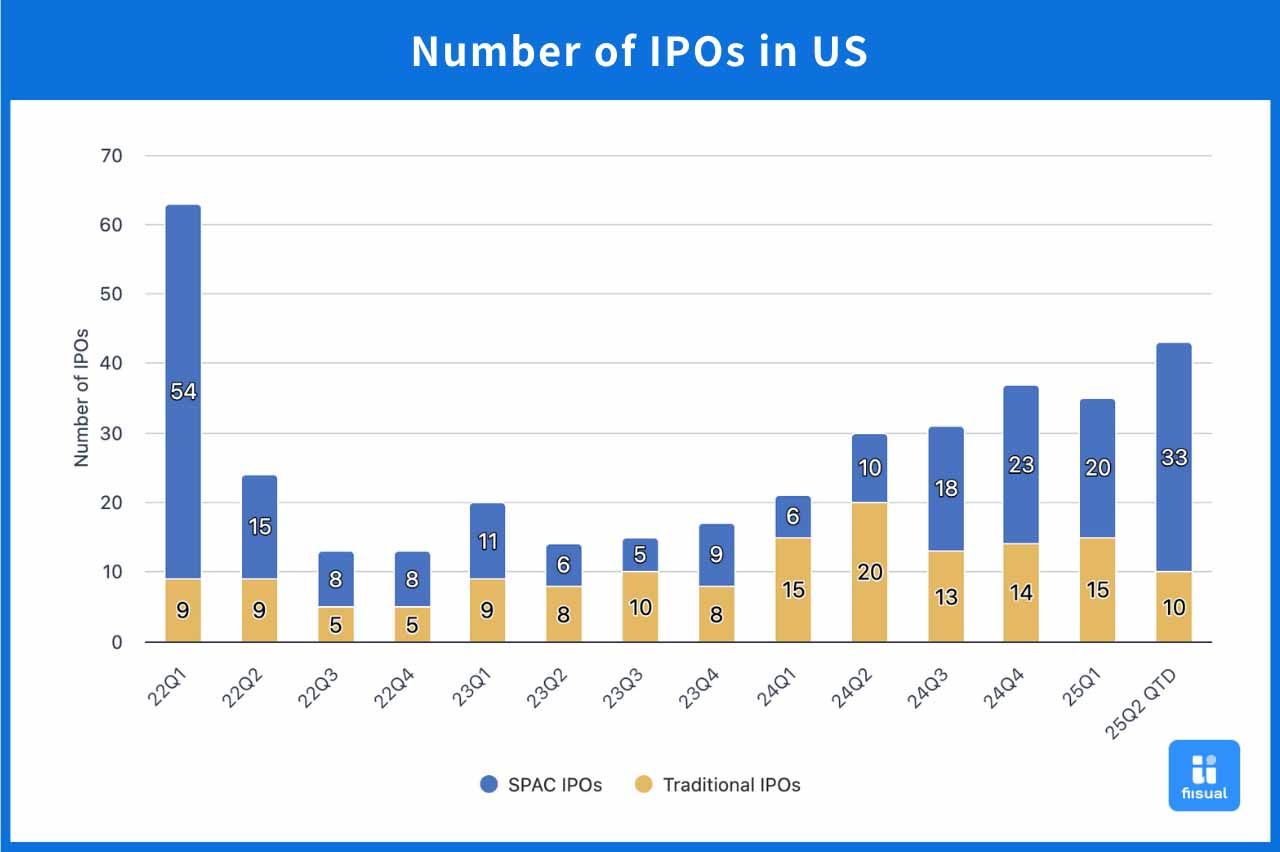

Since these tighter rules were introduced, the SPAC market has cooled. From 2022 onward, there has been a noticeable drop in SPAC listings and more liquidations. While the new regulations raised the bar, they also improved market quality and transparency.

In summary, the reforms are not meant to shut down SPACs, but rather to emphasize investor protection. Whether SPACs regain their former popularity will depend more on market confidence than regulatory loosening.

Case Studies: Maxpro Capital and Nikola

Maxpro Capital: Taiwan’s First SPAC Success

In March 2022, Maxpro Capital merged with precision oncology firm Apollomics, listing on Nasdaq under the ticker APLM with an estimated valuation of $900 million to $1 billion.

Maxpro launched its Cayman-based SPAC “Jade Mountain Acquisition Corp.” in October 2021, raising over $103 million, with strong backing from Taiwanese corporates. Unlike many SPACs, Maxpro’s team comprised professionals with cross-border capital and biotech expertise.

Why is this case notable?

- First Taiwan-led SPAC success—demonstrates local ability to operate in U.S. capital markets.

- End-to-end cross-border execution—the Taiwanese team led everything from fundraising to the final merger.

- Succeeded under tighter regulations—showcased solid governance, realistic forecasts, and compliance with SEC scrutiny.

Nikola: A $30 Billion Mirage

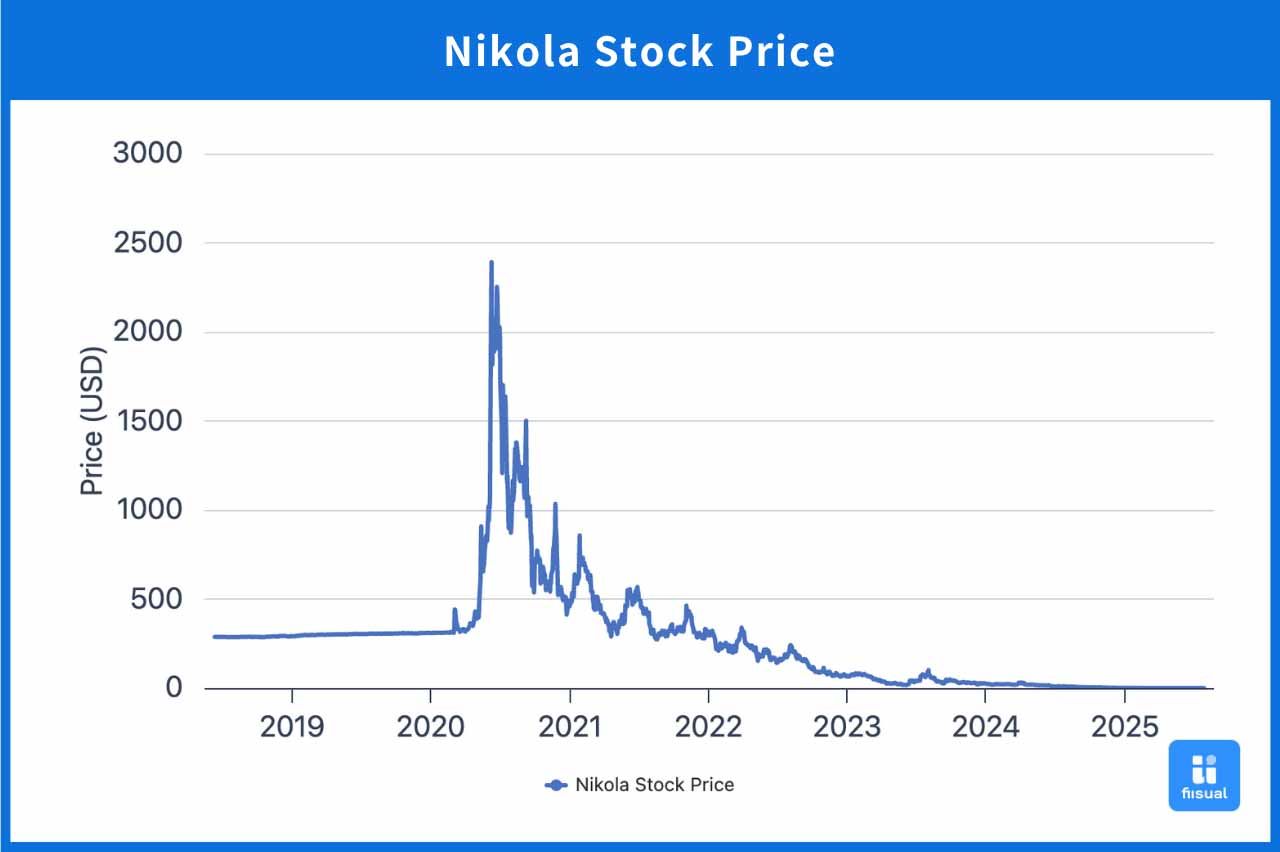

In sharp contrast is the case of Nikola, the U.S. electric truck maker that merged with SPAC VectoIQ in 2020. Its market cap soared past $30 billion before being accused by short-seller Hindenburg Research of overstating its technology. The SEC and DOJ launched investigations, and founder Trevor Milton was convicted of fraud.

As the chart shows, Nikola’s stock has collapsed nearly -100% since the de-SPAC transaction. The company faced delays in production, recalls, and ultimately filed for bankruptcy in 2025.

This case highlights the dangers of over-optimism, insufficient due diligence, and exaggerated projections in SPAC deals.

How Far Can SPACs Go?

After the 2021 boom and two years of slowdown, SPACs are entering a more mature and rational phase. What lies ahead?

Short Term (2025 H2 ): Recovery in Progress

By mid-2025, 53 SPACs have completed IPOs in the U.S.—a clear rebound from the 2023 lows. If the pace holds, the full-year total could reach 100.

However, conditions remain tough. SEC’s final rules have raised the bar, interest rates are still high, and investors are demanding better-quality targets.

For sponsors, the biggest short-term challenge is securing a solid merger target and closing the deal amid redemption pressure and rising costs.

Mid Term (2026–2027): Precision Filtering

SPACs will likely focus on select high-potential sectors such as AI infrastructure, biotech, or energy transition. If rates drop or Trump’s administration eases regulations, SPAC activity could further pick up. But due diligence and transparency will remain critical, weeding out weak or overhyped targets.

Long Term (2028+): Back to Fundamentals

SPACs are likely to evolve into a niche IPO alternative—targeting specific sectors or earlier-stage firms not yet ready for a traditional IPO. Meanwhile, financial hubs like Singapore, Abu Dhabi, and Hong Kong are launching SPAC platforms to compete globally.

Conclusion

Unlike earlier SPACs driven by hype and speculation, the Maxpro case represents what a mature, well-regulated SPAC should look like—with solid governance, transparent forecasts, and a credible target company.

For Taiwanese VCs and corporates eyeing U.S. markets, this isn’t just a one-off success, but a valuable blueprint. The contrasting example of Nikola serves as a warning of what can happen when diligence and accountability are lacking.

Ultimately, SPACs are more than a fundraising tool—they're a test of discipline, transparency, and execution.