Price Performance Summary

| Nov 3 Open | Nov 14 Close | Change | |

|---|---|---|---|

| Brent | 65.12 | 64.39 | -1.1% |

| WTI | 61.40 | 59.95 | -2.4% |

| Dubai | 66.30 | 65.18 | -1.7% |

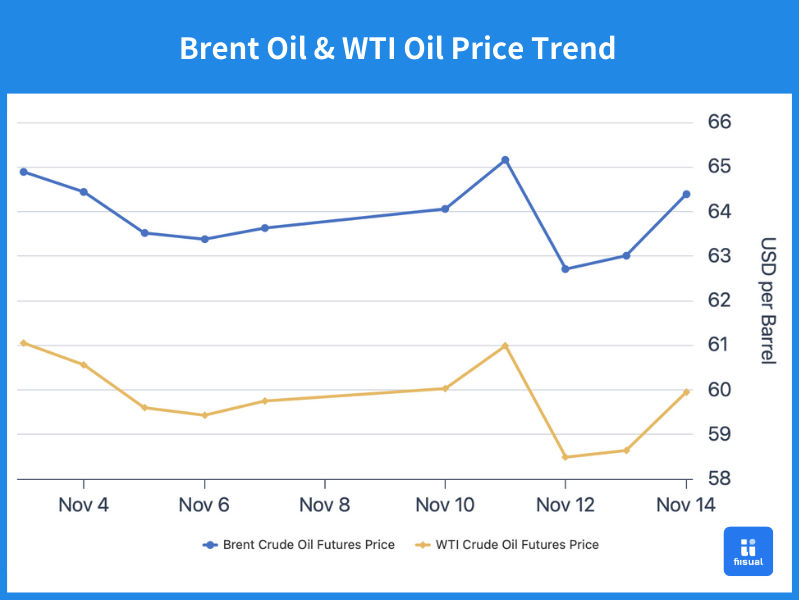

In the first week, crude opened higher on confidence from OPEC’s mild output increase, but later turned lower as U.S. commercial crude inventories rose and the U.S. dollar strengthened. Toward week-end, stricter U.S. sanctions on Russia and renewed tensions with Venezuela briefly pushed prices higher, but the momentum faded and crude still ended the week lower.

In the second week, crude initially gained as Russia–Ukraine tensions escalated. However, prices quickly dropped by about 4% after OPEC sharply revised up 3Q25 supply in its monthly report. Later in the week, another attack on Black Sea ports disrupted Russian exports and lifted prices again, allowing the week to finish roughly flat.

Crude Data Update

Crude and Refined Product Drawdowns Outperformed Expectations; Refining Output Limited by Maintenance

| Nov 14 | Nov 5 | Oct 29 | |

|---|---|---|---|

| Inventories (mn bbl) | |||

| U.S. commercial crude (ex-SPR) | 427.6 (+6.4) | 421.2 (+5.2) | 416.0 |

| SPR | 410.4 (+0.8) | 409.6 (+0.5) | 409.1 |

| Gasoline | 205.1 (-0.9) | 206.0 (-4.7) | 210.7 |

| Distillate | 110.9 (-0.6) | 111.5 (-0.7) | 112.2 |

| Production Activity | |||

| Rig count | 417 (+3) | 414 (+0) | 414 |

| Refining utilization (%) | 89.4 (+3.4) | 86.0 (-0.6) | 86.6 |

Over the past two weeks, U.S. commercial crude stocks rose by a total of 11.6 million barrels, above expectations but still at a healthy level. As refiners ramp up crude runs, inventories are expected to fall again. SPR also continued refilling, rising by 1.3 million barrels. Refined products posted continued draws—gasoline fell by 5.6 million barrels and distillate by 1.3 million barrels—still solid for the seasonal lull. On the supply side, refinery utilization rebounded by 2.8 percentage points as maintenance winds down, and rig count increased by three, showing upstream producers remain optimistic about demand and pricing.

Agency Reports: Future Supply Growth Led by the Americas; OPEC’s Upward Supply Revision is This Month’s Highlight

Monthly supply-demand forecasts :

| (Units: million barrels per day) | Supply | Demand | |||||

|---|---|---|---|---|---|---|---|

| Agency | EIA | OPEC (non-DoC liquids + DoC NGLs) | IEA | EIA | OPEC (OECD) | OPEC (non-OECD) | IEA |

| 2024 | 103.17 (-0.02) | 61.7 | 103.04 | 103.09 (+0.18) | 45.84 | 58.00 | 102.90 |

| 2025 | 105.98 (+0.11) | 62.7 (+0.1) | 106.20 (+0.10) | 104.14 (+0.15) | 45.97 (+0) | 59.17 (+0) | 103.69 (+0.09) |

| 2026 | 107.37 (+0.20) | 63.5 (+0.1) | 108.70 (+0.20) | 105.20 (+0.09) | 46.11 (+0) | 60.40 (+0) | 104.30 (-0.04) |

EIA

EIA raised its 2025 U.S. GDP forecast after BEA revised up 2Q25 GDP, while cutting its 2026 estimate. On supply, stronger output from Brazil, Guyana, and Canada pushed up 2025–2026 global supply growth. Notably, EIA still expects OPEC production to rise in 2026, implying continued increases even after OPEC halts its 1Q26 supply ramp. Demand growth was revised down due to historical data adjustments. EIA also raised its Brent forecasts to USD 54 in 1Q26 and USD 55 for the full year—USD 3 higher than last month—citing updated views on China’s stock build and Russian sanctions, which could drag Russian output below earlier expectations.

IEA

IEA raised its 2025 demand outlook, driven by improving trade flows and macro conditions. Stronger-than-expected industrial output and refined product consumption in China boosted transport fuels, jet fuel, and petrochemical restocking. Supply was also revised slightly higher, though without detailed explanation. IEA also highlighted that refinery outages and shipping risks have limited Russia’s exports, while OPEC+ remains cautious on adding supply.

OPEC

OPEC kept demand forecasts unchanged but slightly raised supply projections, with growth led by the U.S., Brazil, Canada, and Argentina. The key focus this month is OPEC’s large upward revision to 3Q25 non-DoC supply, while lowering estimates for other quarters without explanation. OPEC expects 2026 global demand at 106.5 mb/d and demand for OPEC+ crude at 43 mb/d. Since OPEC+ produced 43.02 mb/d in October, the market is currently in slight oversupply, likely easing only after the group pauses supply hikes in 1Q26.

Key News Commentary

U.S. Government Reopens

After the President signed a temporary funding bill approved by Congress, the federal government reopened on November 13, ending a 43-day shutdown that began on October 1.

Crude prices are primarily driven by supply–demand fundamentals and geopolitical risks, meaning the shutdown had little direct effect on oil. Early-October weakness largely reflected expectations of potential OPEC+ supply increases and easing geopolitical tensions. Options volume and open interest on October 1 also showed no unusual market reaction, suggesting the shutdown did not materially affect pricing.

In the near term, improving risk sentiment may place mild downward pressure on crude, but medium-term direction will still depend on weekly EIA inventory data, OPEC+ production strategy, and Middle East developments.

Viewpoint

This month, IEA and OPEC effectively switched positions: IEA turned more constructive on demand, while OPEC sharply revised up supply. IEA’s upward demand adjustment is largely a catch-up after months of conservative estimates, supported by consistently strong U.S. inventory and consumption data. By contrast, OPEC’s revision reflects updated historical figures rather than forward-looking changes. Since 1Q25 and 2Q25 supply were revised down without explanation and OPEC recently slowed its production increases, the report may be masking a more comfortable supply picture than previously signaled.

Overall, rising supply is now a clear trend, with both IEA and OPEC pointing to the U.S., Brazil, Canada, and Argentina as major contributors. Demand still has room for upward revisions as rate-cut expectations and easing global trade flows support consumption. The short-term focus is on refining margins: IEA noted that European and Asian refining profits rose to two-year highs in early November with high run rates. With Russia’s downstream output constrained, refiners must fill the supply gap while preparing for winter demand—any shortfall in restocking could tighten spot markets again.

Medium-term, OPEC’s unchanged 2026 supply forecast and EIA’s expectation of further OPEC output growth make the group’s March 2026 meeting a key watchpoint.

From a fundamentals standpoint, despite smaller-than-expected product draws in the past two weeks, the drawdown trend remains intact. U.S. gasoline inventory is at very low levels and distillate stockpiles are historically thin. Refining utilization has not yet returned above 90% because of seasonal maintenance. As winter peak demand approaches, the key issue is whether refiners can sufficiently ramp up runs to prevent tightness in transport and heating fuels.

Conclusion

U.S. refined product inventories continue to trend lower, and refinery utilization is recovering, keeping the physical market fairly resilient. OPEC’s sharp upward revision to 3Q25 supply reinforces medium-term oversupply risk. In the short term, crude prices are likely to remain range-bound, with geopolitical headlines and sanctions driving brief swings but not a sustained trend. Over the medium term, markets will closely monitor refinery restocking efficiency and OPEC+’s 2026 supply plan.