ETFs have recently become very popular investment products in Taiwan, and among them, high-dividend ETFs are one of the most favored by Taiwanese investors. However, concerns have arisen about certain high-dividend ETFs where the proportion of income equalization reserves in dividends is too high and the timing of activation is unclear. This has prompted the Financial Supervisory Commission (FSC) to step in and formulate a new policy to curb this distribution irregularity. The FSC now requires all major ETF issuers to clearly define how the income equalization reserve works, when it can be activated, the activation ratio and order, and to disclose details to investors once it is used.

For those who want to learn more about ETF, you can refer to the following

Introduction to ETF Net Asset Value (NAV)

Where do ETF dividends come from

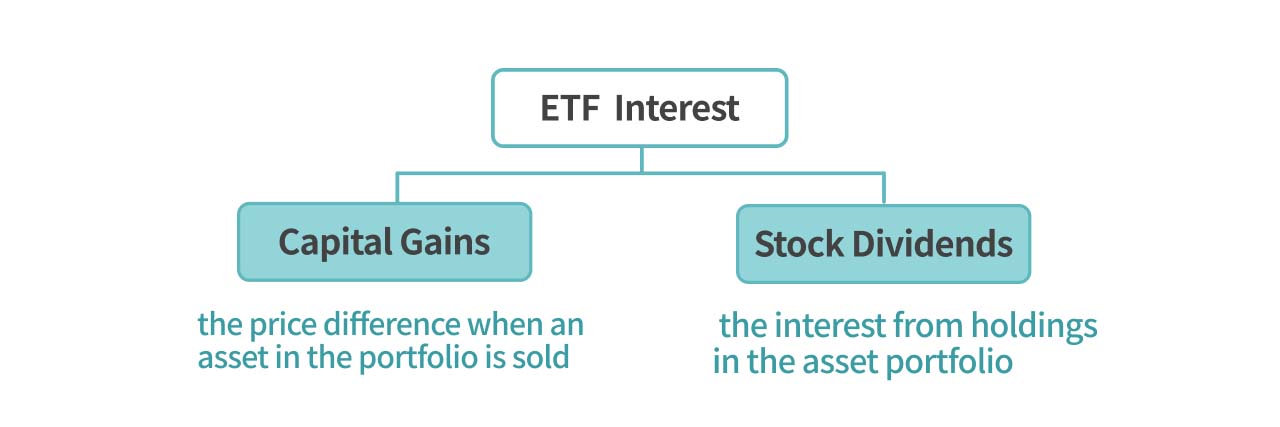

To understand the income equalization reserve, we must first understand where an ETF's interest originates. It doesn’t appear out of thin air but is distributed from the "returns" of the investment portfolio tracked by the ETF, which are divided into "capital gains" and "stock dividends."

- Capital gains: Simply put, this is the profit made from the price difference when an asset in the portfolio is sold. This profit may become part of the dividend distribution.

- Stock dividends: This refers to the interest from holdings in the asset portfolio. For example, if the Yuanta/P-shares Taiwan Top 50 ETF (0050.TT) holds TSMC (2330), and TSMC issues dividends, the relevant income, after tax, will be part of the dividends distributed by 0050.

In addition to the investment returns from the tracked portfolio, the income equalization reserve is another major source of dividends. Below, we will explain how the income equalization reserve works.

What is the ETF income equalization reserve

An ETF’s net asset value (NAV) can be divided into face value, capital equalization reserve, and income equalization reserve.

- Capital equalization reserve: This is used to maintain or adjust the size of the ETF, such as making adjustments to the portfolio it tracks or addressing unexpected risks.

- Income equalization reserve: This is the type of reserve discussed in this article. It’s used to smooth out interest rate fluctuations that might occur when large amounts of money are subscribed to or redeemed from the ETF.

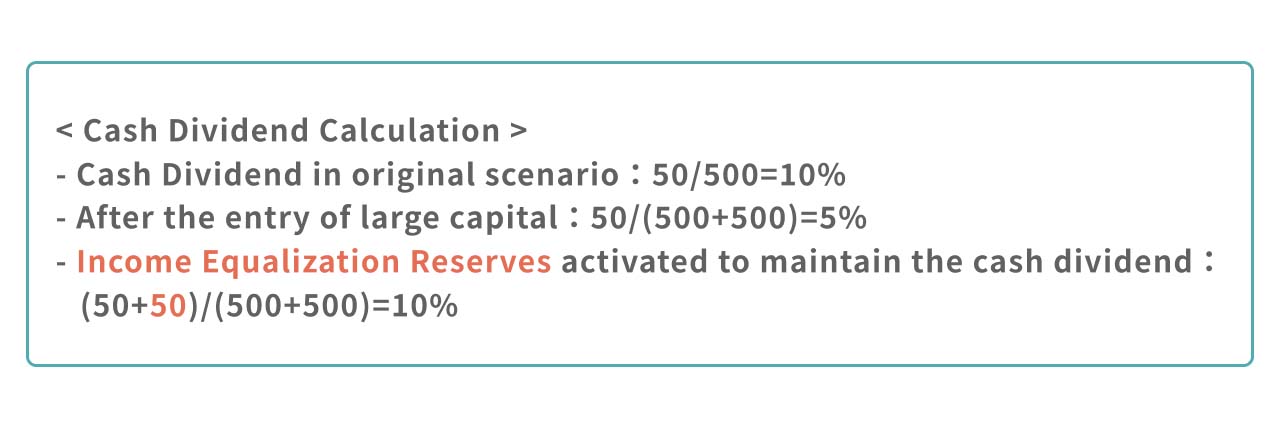

For example, if a large sum of money enters an ETF but the amount planned for dividend distribution doesn’t change, it could lead to a situation where dividends are "diluted." This may still seem abstract, so here’s a table to illustrate the role of the equalization reserve.

| Original Case | After the entry of NT$50 billion in capital (excluding equalization reserves) | After the entry of NT$50 billion in capital (including equalization reserves) | |

|---|---|---|---|

| Scale of ETF | NT$50 billion | NT$100 billion | NT$100 billion |

| The returns of the investment portfolio tracked by the ETF (Capital Gains & Stock Dividends) | NT$5 billion | NT$5 billion | NT$5 billion |

| Income Equalization Reserve | 0 | 0 | NT$5 billion |

| ETF Cash Dividend | 10% | 5% | 10% |

Let’s take a $50 billion ETF as an example. Initially, $5 billion was planned for dividend distribution. If a sudden $50 billion inflow occurs, the cash dividend would drop from 10% to 5% because the fund size has increased while the total dividend amount remains unchanged. In this situation, the income equalization reserve can be activated. The fund company can use $5 billion from the reserve to maintain the cash dividend at the original 10% level, thus protecting the interests of existing investors.

An example of ETF dividend distribution

Now, let’s look at a real-life example of the dividend distribution for the Yuanta/P-shares Taiwan Dividend Plus ETF (0056.TT) to see how much of the dividend comes from the income equalization reserve.

| Source Item | Distribution Per Beneficiary Unit | Proportion of Dividend Source (%) |

|---|---|---|

| Domestic Asset Sale Income | 0.144 | 12 |

| Post-1998 Dividend or Profit Income | 0.684 | 57 |

| Income Equalization Reserve | 0.348 | 29 |

| Capital Surplus | 0.024 | 2 |

| Total | 1.2 | 100 |

In the case of Yuanta High Dividend, the equalization reserve accounts for 29% of the total dividend, meaning that approximately 29% of the money returned to investors is essentially from the amount they originally invested, returned in the form of the income equalization reserve.

As the new policy is implemented, more ETFs using the equalization reserve system will disclose their dividend details, allowing investors to compare them. More and more ETFs are beginning to disclose this information, so investors should pay closer attention and compare before purchasing!