What is ETF

ETF (Exchange Traded Fund) is a type of investment fund that tracks the performance of a specific index. From the name itself, we can see that an ETF combines the characteristics of a fund and a stock: An ETF pools money from various investors to invest in a specific set of assets (fund) and can be traded on the secondary market (stock).

The Taiwan Stock Exchange defines an ETF as "an open-end fund issued by securities investment trust companies that tracks, simulates, or replicates the performance of a target index, and is traded on the stock exchange."

Characteristics of ETFs:

In addition to the basic characteristics mentioned above, most ETFs track specific indices and assets to replicate their returns. This means that the returns from investing in an ETF will generally be similar to directly investing in the index or assets it tracks. Therefore, investors can achieve the goal of using smaller amounts of money (fund) to invest in the stock market (stock) by easily buying or selling index products (tracked assets).

Advantages of ETFs

Advantage 1: Risk Diversification

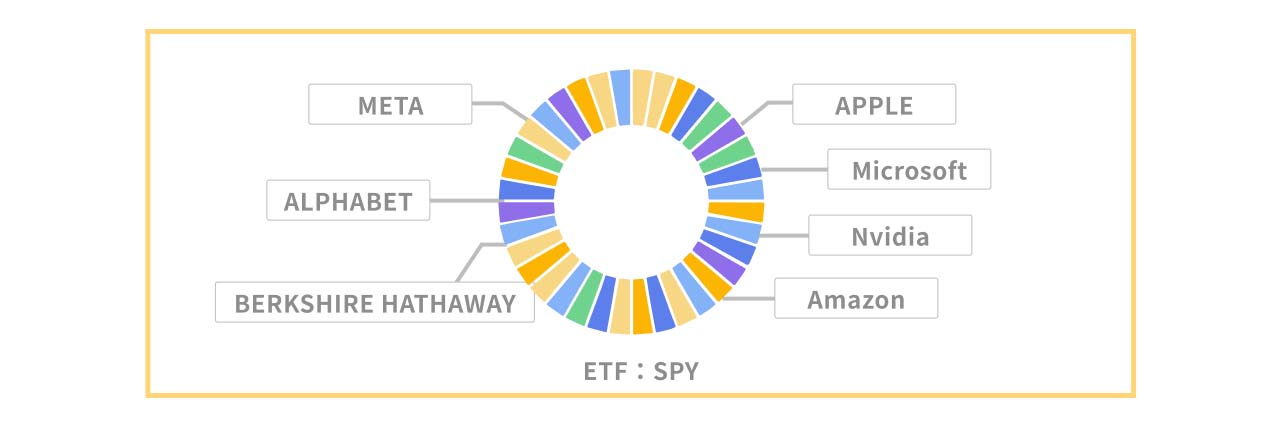

Most people think of risk diversification as the first advantage of ETFs. Investors can buy a basket of products with small amounts of money, achieving the effects of diversified investment. For example, one of the popular ETFs in Taiwan, Yuanta/P-shares Taiwan Top 50 ETF (0050), tracks the Taiwan 50 Index (the top 50 listed companies by market value in Taiwan). When investors choose to buy and hold 0050, they are essentially holding shares of the top 50 companies listed in Taiwan, weighted according to the Taiwan 50 index.

Advantage 2: Lowering Entry Barriers for Certain Products

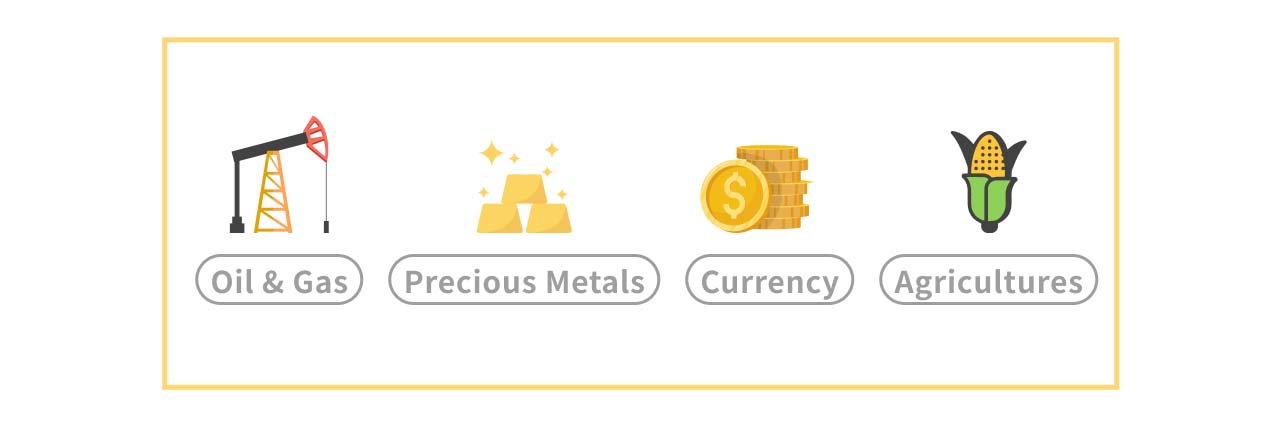

ETFs can lower the entry barriers for certain products. In the past, some products might have required trading on specific exchanges (such as futures or fixed income markets), but now ordinary investors can access these previously hard-to-reach products by purchasing ETFs. For example, investors can now invest in USO to replicate the performance of WTI crude oil futures. In the past, Taiwanese investors might need a futures trading account and relevant experience to invest in overseas crude oil futures.

Advantage 3: Lower Costs

The concept of costs is relative. ETFs offer cost advantages in two main aspects:

- Compared to a basket of stocks: As mentioned above, ETFs allow investors to replicate the performance of an index. Of course, investors could achieve similar returns by buying and holding a basket of stocks themselves, but the total purchase costs and ongoing management costs would be relatively high. This is one of the reasons why ETFs have the advantage of lower cost.

- Compared to other funds: Generally, some ETFs are passive investments that track index returns, meaning that fund managers need to do less in practice. In contrast, mutual funds aim for excess returns through active management, requiring more analysis and operations. Therefore, the management fees for ETFs are generally relatively lower.

Types of ETFs

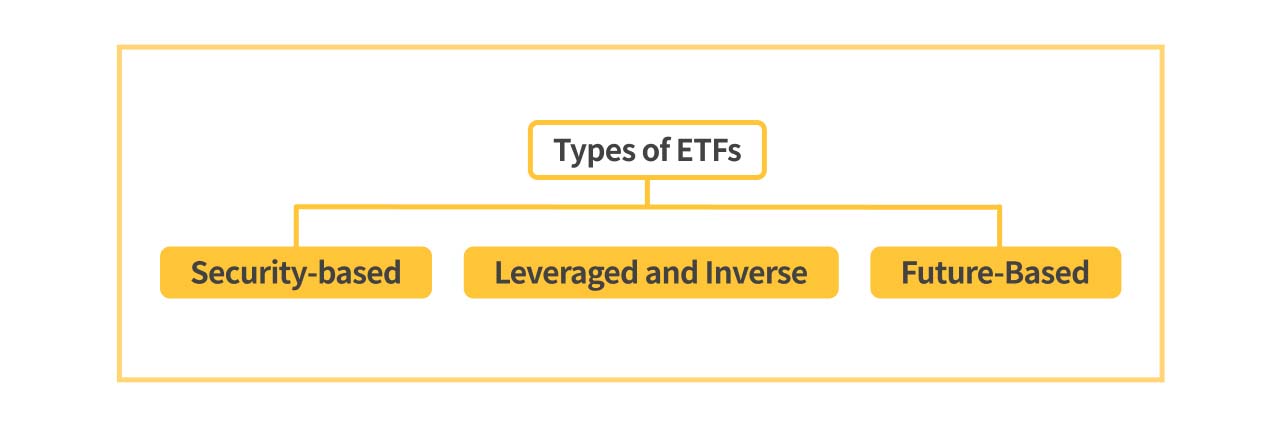

In Taiwan, ETFs can be broadly categorized into three types: security-based ETFs, futures-based ETFs, and leveraged ETFs. The main difference lies in the types of assets the ETF invest in. Generally, security-based ETFs invest in stocks and bonds, while futures-based ETFs mainly invest in futures. Below we will use the categories and ETFs in Taiwan sample.

Security-based ETFs

In the basic introduction, we mentioned that some ETFs consist of a basket of products. Therefore, we can further classify security-based ETFs based on their constituent stocks.

Domestic Component ETFs

If all the investment targets within an ETF are Taiwanese securities, it is classified as a domestic component securities ETF. This includes familiar ETFs such as Yuanta/P-shares Taiwan Top 50 ETF (0050), Yuanta Taiwan Dividend Plus ETF (0056), and Cathay Sustainability High Dividend (00878).

Foreign Component ETFs

If an ETF includes foreign targets in its investment portfolio, it is classified as a foreign component ETF. For example, Yuanta S&P 500 ETF (00646) and Fubon NASDAQ (00662), which track foreign indices, and Cathay Global Autonomous and Electric Vehicles ETF (00893), which includes a significant number of foreign stocks.

When the dividends of a foreign component securities ETF are denominated in foreign currency, the ETF's code ends with K. For example, Cathay FTSE China A50 (00636) is traded in TWD, while Cathay FTSE China A50 (00636K) is traded in USD.

Futures-Based ETFs

When an ETF primarily tracks futures products, it is classified as a futures-based ETF. Examples include Yuanta S&P GSCI Crude Oil ER Futures ETF (00642U), Yuanta S&P US Dollar ER Futures ETF (00682U), and JKO S&P GSCI Soybeans ER Futures ETF (00693U).

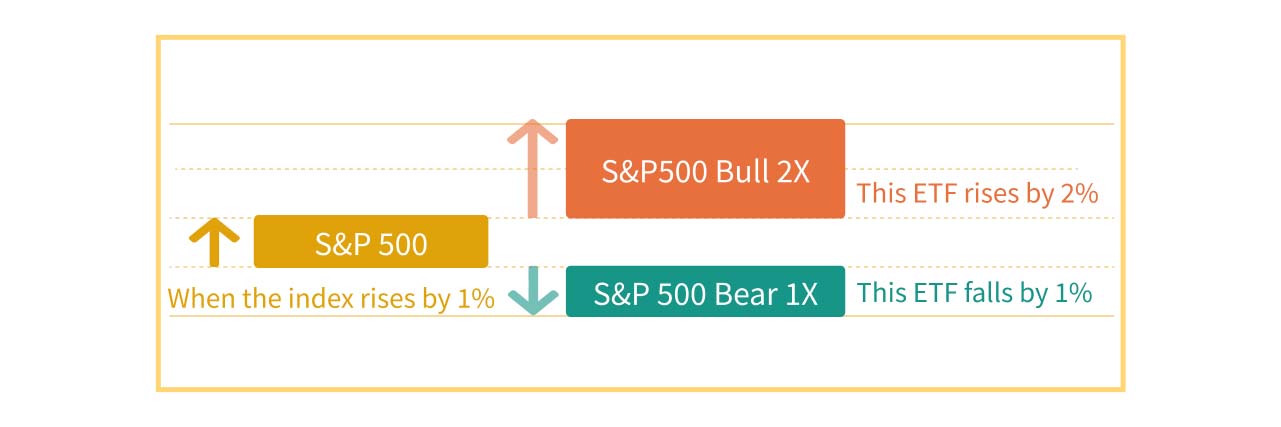

Leveraged and Inverse ETFs

In both security-based ETFs and futures-based ETFs, there are leveraged and inverse ETFs. This means that the ETF replicates a multiple or inverse performance of the index by using derivatives.

For example, Yuanta Daily Taiwan 50 Bull-2X ETF (00631L) replicates twice the return of the Taiwan 50 Index, while Yuanta Taiwan Daily Taiwan 50 Bear-1X ETF (00632R) replicates the inverse return of the Taiwan 50 Index.

(The suffix for leveraged ETFs is L, and R for inverse ETFs.)

Fees and Costs of ETFs

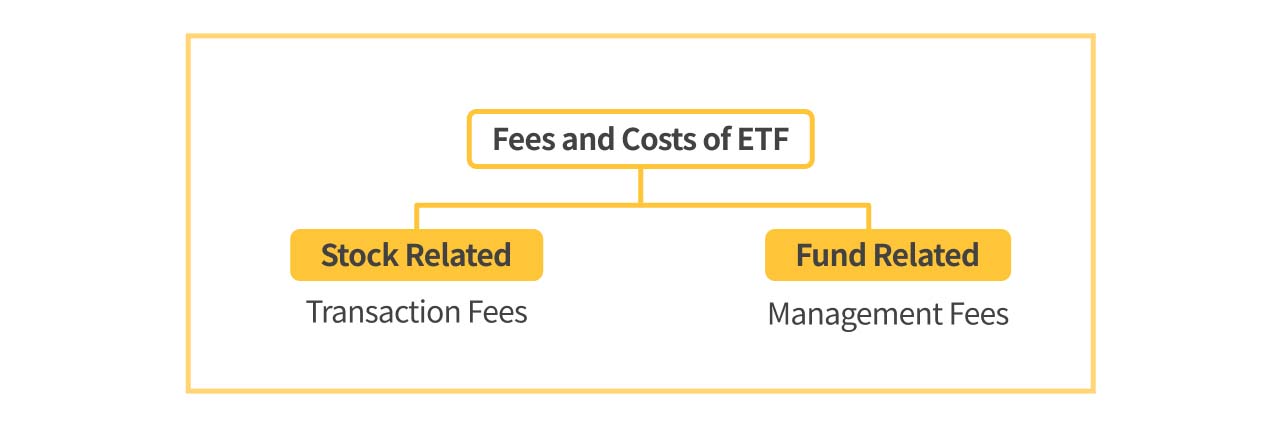

Types of Costs Derived from ETF Characteristics

In the ETF introduction above, we mentioned the two main characteristics of ETFs: funds and stocks. We can use these characteristics to classify costs roughly into fees similar to stocks: transaction fees and fees similar to funds: management fees.

Transaction Fees of ETFs

In Taiwan, the transaction fee for ETFs is the same as for stocks, which is a maximum of 0.1425%. Most brokerages now offer some discounts on transaction fees. The transaction tax, however, is different: the transaction tax for ETFs is 0.1%, only one-third of the transaction tax for stocks.

| Stocks | ETFs | |

|---|---|---|

| Transaction Fee | 0.1425% | 0.1425% |

| Transaction Tax | 0.3% | 0.1% |

Management Fees of ETFs

Since ETFs have characteristics similar to funds, pooling public funds and being managed by fund managers to achieve returns similar to those of the tracked index, investors also need to pay related management fees. These are mainly divided into two categories: management fees and custody fees.

1. Management Fee:

Unlike the active investing concept of mutual funds, some ETFs aim to replicate the returns of the tracked index, thus reducing the overall complexity of management. However, ETF managers would still need to operate various financial products to achieve the effect of replicating the tracked index, so investors would still need to pay a management fee.

2. Custody Fee:

In Taiwan, since regulations require that the large amount of ETF funds must be deposited in a third-party bank, investors would need to pay additional fees for the custodian bank. For example, the current management fee is 0.32% and the custody fee is 0.035% for Yuanta Taiwan Top 50ETF (0050). In addition to the fees mentioned above, managers may incur other expenses during transactions, such as transaction taxes when buying or selling securities, index licensing fees, and other accounting-related expenses. However, these amounts are relatively smaller compared to the two major categories mentioned above.

ETF Net Asset Value Reflects Expense Ratio

The way ETF expense ratio are charged differs from transaction fees: transaction fees are charged to investors when transactions occur, whereas expense ratio are reflected in the daily net asset value (NAV) of the ETF, so investors do not need to pay separately.

Checking ETF Expense Ratio

You can check the expense ratio of an ETF by visiting the issuing broker's official website and looking up the prospectus of the specific ETF, which contains detailed explanations regarding fees.

For those who want to know more about ETF, please refer to the following articles: