Price Summary

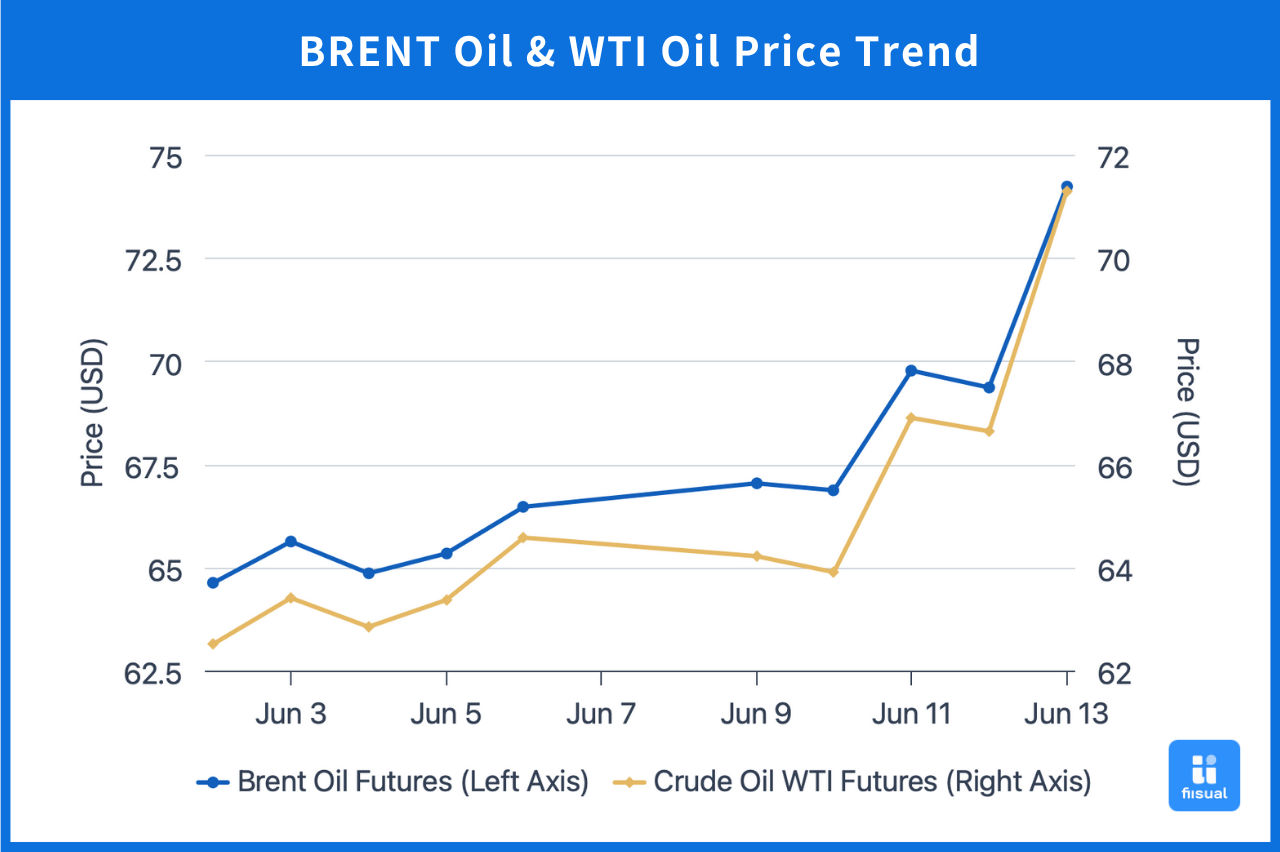

| Jun 2 Opening | Jun 13 Closing | Price Change | |

|---|---|---|---|

| Brent Crude | $63.20 | $74.23 | +17.5% |

| WTI Crude | $61.11 | $71.29 | +16.7% |

| Dubai Crude | $63.73 | $69.92 | +9.7% |

In the first week, oil prices initially rose as concerns over expanded OPEC+ production eased. Midweek, despite a larger-than-expected draw in crude inventories reported by the EIA, a significant build in refined products led to a pullback in prices. Toward the end of the week, a phone call between the Chinese and U.S. presidents revived optimism in trade talks, while strong non-farm payroll data helped ease recession fears, pushing oil prices up by around 5–6%.

In the second week, oil prices climbed as China and the U.S. resumed trade talks in London, easing trade-related concerns. Midweek, crude inventory draws again exceeded expectations, and the U.S. began withdrawing personnel from the Middle East while expressing declining confidence in a nuclear deal with Iran—both of which raised geopolitical risk and supported prices. Later, Israel’s surprise strike on Iran triggered intense market reactions, with oil prices spiking over 13% in a single day before partially retracing, ending the week with a 12% gain.

Crude Oil Data Update

Crude Stocks Continue to Draw Down While Refined Product Inventories Surge; Low Prices Weigh on Investment Appetite

| Jun 11, 2025 | Jun 4, 2025 | May 30, 2025 | |

|---|---|---|---|

| Inventory (M bbl) | |||

| Commercial Crude (ex-SPR) | 432.4 (-3.7) | 436.1 (-4.3) | 440.4 |

| Strategic Petroleum Reserve | 402.1 (+0.3) | 401.8 (+0.5) | 401.3 |

| Gasoline | 229.8 (+1.5) | 228.3 (+5.2) | 223.1 |

| Distillates | 108.9 (+1.3) | 107.6 (+4.2) | 103.4 |

| Production Activity | |||

| Active Rigs | 442 (-9) | 451 (-14) | 465 |

| Refinery Utilization (%) | 94.3 (+0.9) | 93.4 (+3.2) | 90.2 |

Over the past two weeks, U.S. commercial crude stocks declined by a total of 8 million barrels—more than expected. Meanwhile, the Strategic Petroleum Reserve (SPR) added 800,000 barrels, with rising prices slowing the pace of restocking. On the refined product side, gasoline and distillate inventories surged by 6.7 million and 5.7 million barrels, respectively—both well above forecasts—raising concerns about the effectiveness of demand during the driving season. On the supply side, the rig count dropped sharply by 23 units to 442, indicating that shale producers are facing cost pressures under low prices and OPEC+ competition, leading to weaker investment sentiment. In contrast, refinery utilization surged by 4.1 percentage points, signaling aggressive efforts to meet peak seasonal demand.

Geopolitical Developments

War Breaks Out Between Israel and Iran

In the early hours of June 13 local time, Israel launched an airstrike on Tehran, the capital of Iran, targeting nuclear research facilities, military-industrial production sites, senior military officials, and nuclear scientists. This action immediately triggered Iranian retaliation. As of now, both sides have exchanged airstrikes, with the conflict continuing to escalate. In response, oil prices surged by 13% intraday before correcting to an 8% gain.

Given that the conflict involves two of the world’s major oil-producing countries, market reactions have been intense. According to the latest EIA monthly report, global crude oil production is projected to reach 104.35 million barrels per day in 2025, with Iran accounting for approximately 3.3 million barrels per day. Should the conflict escalate, the market expects a supply disruption exceeding 2 million barrels per day—roughly 2% of global supply.

From a logistics standpoint, if the conflict worsens and Iran proceeds to blockade the Strait of Hormuz, approximately 20 million barrels per day of crude oil shipments—equivalent to 20% of global consumption and 33% of global oil trade—would be threatened. While OPEC+ currently holds around 5 million barrels per day in spare capacity, major exporters heavily depend on the Hormuz route. Even if rerouted through alternative pipelines, the volume would fall far short of Hormuz capacity, indicating limited substitution potential.

In the options market, implied volatility has risen sharply for deep out-of-the-money contracts (around NT$90), with near-term implied volatility increasing more significantly than long-term, suggesting that traders view the conflict as a short-term event. Meanwhile, open interest data shows active positioning by traders, indicating that the market has yet to fully price in the implications of this event.

Commentary

Oil prices have rebounded to levels seen before the equal-tariff announcement. As prices rise, the strategic contest between U.S. shale producers and OPEC+ will likely resume: shale operators may ramp up production, while OPEC+—having shifted from price control to maintaining market share—seems unlikely to cut output further in the short term. This raises the risk of oversupply.

Meanwhile, the significant buildup in refined product inventories signals that increased refinery runs are not being matched by demand. If gasoline inventories continue rising, it could weigh on crude demand.

Overall, the current rally is not driven by underlying fundamentals, suggesting the support for oil prices is fragile. A short-term correction remains a real risk. Markets should closely monitor geopolitical developments, details of the China–U.S. tariff negotiations, and refined product inventory trends.

Conclusion

In the short term, geopolitical tensions will likely be the main driver of oil prices. However, sustained price gains in the medium term will still require tangible improvements in fundamentals. Key areas to watch going forward include developments in Middle East conflict, progress in U.S.–China trade talks, and realized demand from the U.S. driving season.