How to Calculate ETF Net Asset Value (NAV)

The Net Asset Value (NAV) of an ETF can be seen as the true value per share of the ETF. To calculate the NAV, you need to add the value of all the fund’s assets (investment holdings + cash) and subtract any liabilities. Then, divide the total asset value by the number of outstanding ETF shares to get the NAV.

The assets in an ETF can be quite diverse, so the value of assets in the NAV calculation includes not only the common stock market values but also bonds, derivatives, and other financial instruments. NAV is typically calculated at the close of each trading day. For ETFs listed and traded in the U.S., NAV is usually calculated after 4:00 PM Eastern Time. Sometimes, you may also see quotes or brokers offering iNAV (intraday NAV), which represents an estimate of NAV calculated during market hours, providing more timely information for investors.

How to Check ETF NAV

For those who want to know more about the difference between an ETF's NAV and market price, refer to our article on ETF Premium and Discount.

Knowing the current price level of an ETF is crucial to avoid "buying high and selling low." Generally, investors can find relevant information on the ETF issuer’s website or through public disclosures on the Taiwan Stock Exchange (TWSE). Below are also some resources where you can easily find discount/premium information for both Taiwan and international ETFs.

Taiwan ETFs

1. Taiwan Stock Exchange

To find the discount/premium of Taiwan ETFs, you can visit the Taiwan Stock Exchange’s website under ETF sector.

2. Issuer Websites

Major brokerage firms often provide their own consolidated discount/premium information for ETFs they issue. For example, Yuanta provides real-time NAV estimates for its ETFs, and you can find the discount/premium data on its website.

Cathay Securities Investment Trust also provides real-time NAV estimates on its website.

International ETFs

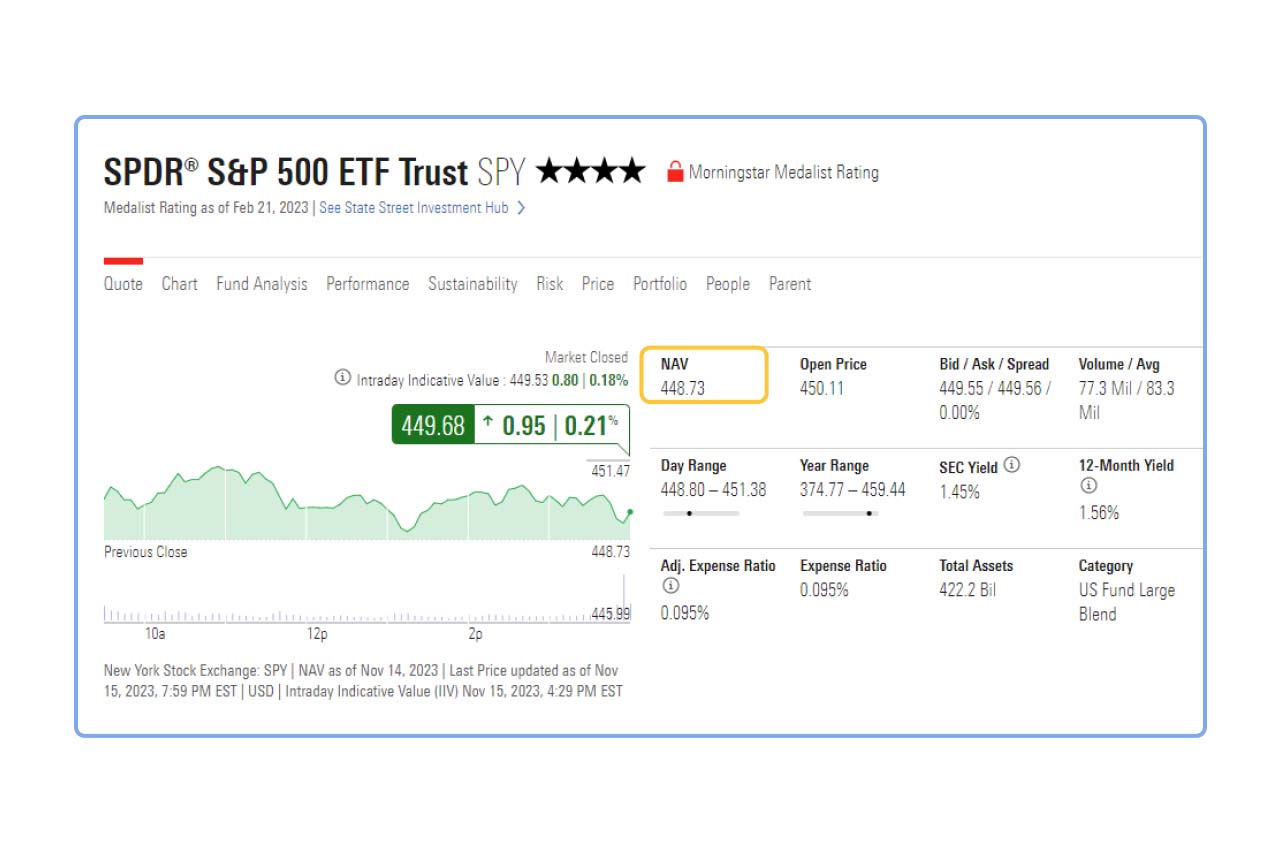

For international ETFs, you can find NAV data on financial information sites like Morningstar, where the NAV column displays the NAV of the respective ETF.