Last week, TSMC CEO C.C. Wei visited the U.S. and held discussions with Donald Trump regarding the company’s investment plans. Following the meeting, it was officially announced that TSMC will significantly expand its investments in the U.S. over the next four years, committing at least $100 billion (approximately NT$3.3 trillion).

This move is aimed at proactively addressing potential tariff policies under a future Trump administration, which could impose heavy taxes on chips manufactured in Taiwan and shipped to the U.S. The announcement has sparked widespread market discussions, with investors closely analyzing its impact on TSMC and the global semiconductor industry.

Political & Economic Background

Trump’s Tariff Policies

Unlike the Biden administration, which sought to attract semiconductor investment through subsidies (a "carrot" approach), Trump has consistently emphasized tariffs as a tool (a "stick" approach) to push for manufacturing to return to the U.S. With the ongoing AI boom, Taiwan's trade surplus with the U.S. has widened due to increased chip exports. Trump has repeatedly stated that Taiwan has “stolen” American semiconductor business. He has explicitly warned that if TSMC continues producing chips in Taiwan and shipping them to the U.S., those chips could face tariffs of 20% or even 50%. However, if TSMC shifts production to the U.S., it can avoid these tariff hikes.

TSMC’s Chairman C.C. Wei traveled to Washington, D.C. last week to meet with Trump at the White House. After their discussions, TSMC held a press conference to announce its expanded U.S. investment plan, drawing market attention.

Details of the Investment Plan

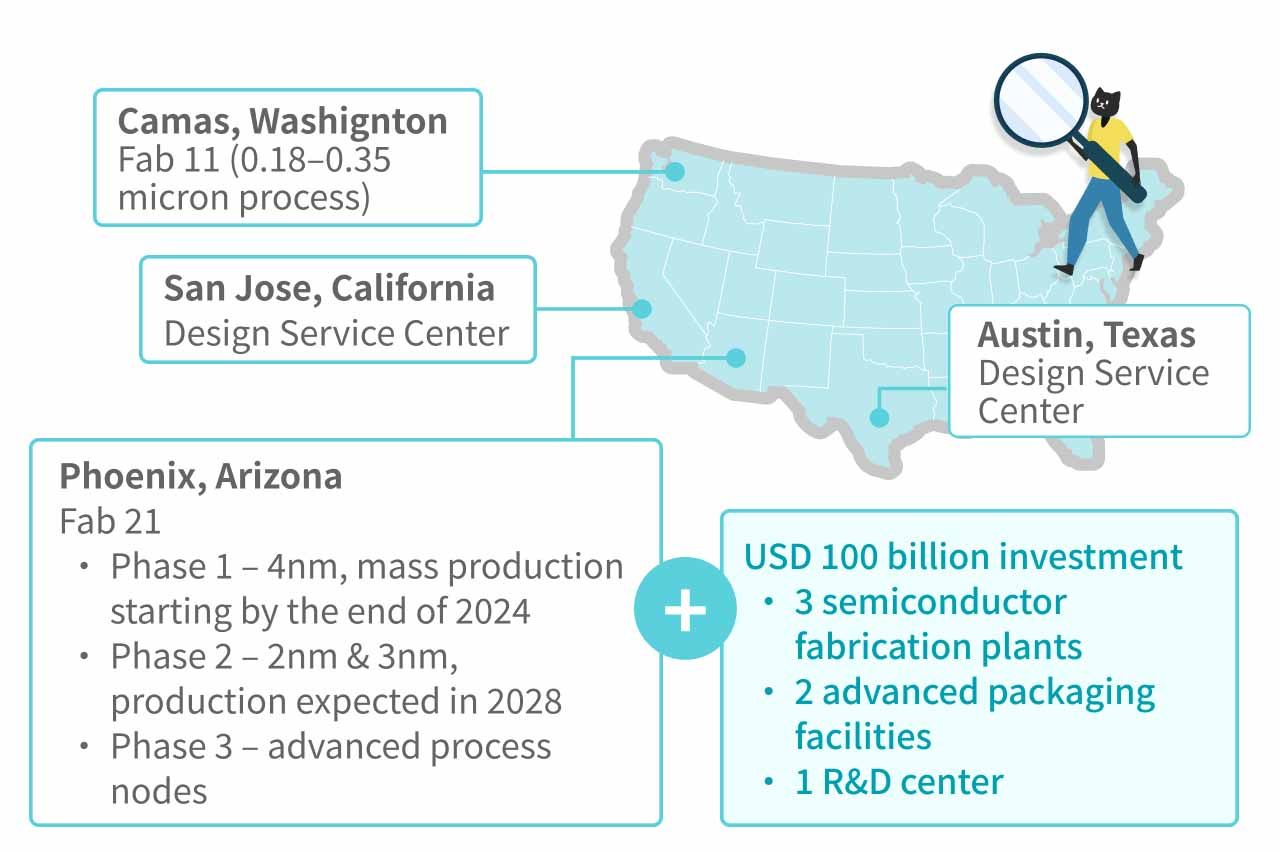

This expansion project plans to continue building in Arizona, with the construction of three advanced semiconductor fabrication plants, two packaging facilities, and one research and development center.

The additional investment is expected to reach at least USD 100 billion. Combined with the previously committed USD 65 billion, the total investment will amount to USD 165 billion (approximately TWD 5.4 trillion), making it the largest single foreign direct investment project in U.S. history.

TSMC’s first wafer fab in Arizona began phased production in 2024, and the second fab, featuring 3nm technology, is expected to start operations in 2026.

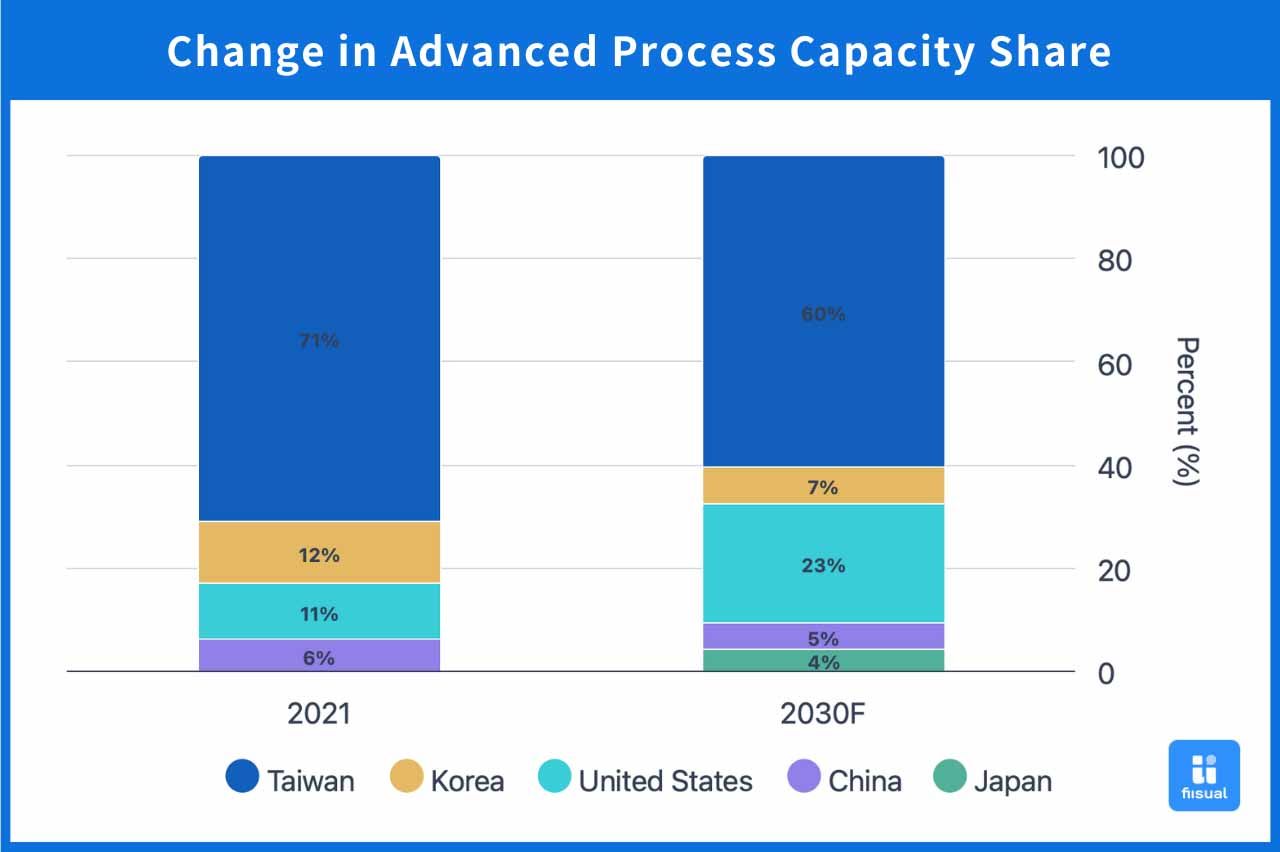

Together, the two fabs will have an annual production capacity of around 600,000 wafers. With the finalized expansion plan, U.S. chip manufacturing capacity is expected to further increase. According to the latest forecast by TrendForce, U.S. capacity could account for around 6% of global semiconductor production by 2035. However, from the perspective of advanced node processes, the U.S. share may rise to around 20%, while Taiwan’s share could decline to approximately 50%.

Impact Analysis

Implications for TSMC

Advantages

1. Expanding Capacity to Meet Surging Demand TSMC CEO C.C. Wei stated at a press conference that the company’s production capacity is fully booked through next year, and the existing capacity in Arizona still cannot fully meet the strong demand from the U.S. market. To address the robust global demand for TSMC chips, the company plans to add 11 new production lines in Taiwan and expand its facilities in Arizona. These efforts aim to further enhance supply capabilities, ensure market competitiveness, and maintain stable delivery for customer orders.

2. Reducing Trade & Tariff Risks By manufacturing chips within the U.S., TSMC can effectively avoid potential tariffs, enhancing supply chain stability and maintaining cost competitiveness in the global market.

3. Enhancing Geopolitical Security Establishing manufacturing facilities in the U.S. not only secures greater support from the U.S. government, but also serves as a strategic signal of cooperation that can partially offset potential political or military threats from China toward TSMC. Notably, former President Trump recently stated, “So we would have a big impact if something should happen with Taiwan,” which can be interpreted as a signal of strategic backing from the U.S. for Taiwan. This kind of stance may help TSMC reduce the risk of disruptions from China.

Challenges

1. High Capital Expenditures According to TSMC’s 2024 annual report, its free cash flow reached NT$945.3 billion (approximately USD 28.7 billion), which is about one-fifth of the current investment scale and roughly 2.5 times its current annual capital expenditure of USD 40 billion. As a result, it is expected that this investment will place some pressure on short-term cash flow and may potentially crowd out other planned capital expenditures. What particularly concerns the market is that the cost of building fabs in the U.S. is significantly higher than in other regions, and construction tends to proceed at a slower pace, which could impact overall capital efficiency in the U.S.

Structural engineer Brian Potter noted in his article “How to Build a $20 Billion Semiconductor Fab” last year that the cost to build a semiconductor plant in the U.S. is around USD 20 billion—30% to 4 times higher than in other regions. Additionally, TSMC had to mobilize around 12,000 workers for its Arizona facility, further driving up operating costs.

2. Shift in Production Focus May Impact Other Global Expansion Plans

With the U.S. becoming a primary overseas production base, TSMC may reduce its planned investments in Japan and Germany, affecting the diversification of its global supply chain.

According to TrendForce statistics, in 2021, Taiwan remained the dominant player in global foundry capacity, accounting for 71% of advanced process capacity and 53% of mature process capacity. However, following a series of overseas expansion efforts, these figures are expected to shift. By 2030, Taiwan’s share of advanced process capacity is projected to decline to 58%, and mature process capacity to 30%. Meanwhile, both the U.S. and China are actively expanding their presence in the advanced and mature process markets, respectively.

3. Talent & R&D Allocation Pressure TSMC will need to relocate part of its high-level R&D and talent resources to the U.S. to support local production and technology development. This may weaken the R&D advantages of its Taiwan headquarters while also facing challenges such as a shortage of skilled talent in the U.S. and significantly higher labor costs.

4. Political Uncertainty

If there is a change in the U.S. administration in the future, shifts in policy could impact subsidies, investment conditions, or collaboration models, thereby increasing TSMC's long-term investment risks. For example, after Trump’s term ends, a new administration might reassess current CHIPS Act subsidies and investment policies, potentially forcing TSMC to adjust its development strategy and cost structure in the U.S.

Implications for the U.S.

A More Complete U.S. Semiconductor Supply Chain

The advanced wafer manufacturing capabilities of U.S.-based companies still lag behind TSMC. Additionally, Broadcom’s recent evaluation of Intel’s 18A process chips found that the technology has not yet reached mass production readiness. As a result, TSMC’s investment in the U.S. will help fill the gap in high-end wafer fabrication. The construction of two packaging plants will also bring TSMC’s CoWoS advanced packaging technology to the U.S., further strengthening the domestic semiconductor supply chain. TSMC also plans to build a research and development center in the U.S. to enhance the country’s AI chip capabilities, support the advancement of AI technologies, and help secure America’s advantage in the global AI industry’s competitive landscape.

Attracting More AI-Related Companies to Set Up U.S. Operations

As mentioned above, TSMC’s investment is expected to fuel the growth of the U.S. AI industry. A more complete industry supply chain will likely attract more related companies to set up operations in the U.S. As the industrial ecosystem matures, companies will be more inclined to build facilities in the U.S., forming a larger semiconductor hub and reinforcing the country’s leading position in the AI sector.

Creating Job Opportunities

The construction of new plants will create immediate job opportunities in the building and construction sector. TSMC estimates that the expanded investment will support around 40,000 construction jobs over the next four years. Once the new fabs are operational, they will generate demand for highly skilled talent, supporting the long-term strength of the U.S. labor market. This will help retain top-tier professionals domestically, boost high-value output, and contribute to broader economic growth.

In summary, TSMC’s newly announced USD 100 billion investment in the U.S. is expected to significantly bolster the U.S. economy. It strengthens the foundation of the domestic AI industry, drives local job creation, and brightens the outlook for AI development. This investment represents a pivotal move by a foreign company, with strategic importance for both the U.S. economy and its leadership in the global AI race.

Global Semiconductor Industry Impact

Geopolitical-driven Supply Chain Shifts

In recent years, countries around the world have increasingly recognized the strategic importance of semiconductor capacity for the future. Whether through subsidy legislation to attract investment or through pressure tactics like the tariff policies under the Trump administration, the U.S., Europe, Japan, and even China are all intensifying their efforts to strengthen domestic chip industries. In addition to investing in manufacturing facilities in the U.S., TSMC has also partnered with Sony to build a wafer fab in Japan and is actively negotiating plans to establish a plant in Germany. The global semiconductor manufacturing landscape is gradually shifting from a centralized model to a more regionalized supply chain structure, aimed at better serving key customers in different regions.

Boosting local production helps countries reduce geopolitical risks and enhance supply chain resilience. Currently, the global semiconductor supply chain is increasingly shaped by a competitive dynamic centered around the U.S. and China. TSMC’s overseas investment strategies may further deepen this divide and could have profound implications for the global semiconductor industry landscape.

U.S.-China Tech War Intensifies

Amid the ongoing tech cold war between the U.S. and China, the Biden administration—followed by the Trump administration—has imposed strict export controls targeting chips, aiming to limit China’s access to advanced process equipment and semiconductors. These measures include prohibiting U.S. companies and individuals from assisting China in developing cutting-edge semiconductor, artificial intelligence, and quantum computing technologies. In response, China—led by companies such as Huawei—is working on developing its own chips and integrating them into products in an effort to bypass sanctions. The country is also making progress in areas such as memory, GPUs, and lithography machines.

Although the scale of China’s semiconductor supply chain still lags behind that of the U.S.-dominated ecosystem, it is aggressively pushing for self-sufficiency and gradually closing the gap. However, this “chip war” is expected to persist, with intensifying competition across technology, policy, and market dimensions.

Against this backdrop, TSMC’s global expansion strategy clearly reflects the evolving business approach of semiconductor firms under the U.S.-China chip cold war. Moving forward, chipmakers are expected to shift from centralized production to more decentralized manufacturing, in order to mitigate geopolitical risks and ensure greater supply chain resilience.

Conclusion

TSMC’s increased investment in the U.S. is primarily driven by the desire to avoid high tariffs, strengthen relationships with American clients, and shorten the supply chain. For Taiwan, TSMC is seen as a “silicon shield,” and finding the right balance between protecting technological know-how and pursuing overseas investments will be a key challenge for the company in maintaining its long-term technological edge.

TSMC’s expansion in the U.S. is a complex strategic decision that reflects both geopolitical pressures and a deliberate effort to reinforce its market position. While this investment will place short-term pressure on gross margins and capital expenditures, in the long run, it will help reduce tariff risks, expand market share, and deepen ties with U.S. customers.