On Wednesday, April 2, former President Donald Trump announced that starting April 5 at midnight, the U.S. will impose a 10% baseline tariff on all trade partners. In addition, countries deemed to have unfair trade practices will face "reciprocal tariffs", which will take effect on April 9. Trump also declared April 2, 2025, as "Liberation Day", calling it the rebirth of U.S. industry.

Reciprocal tariffs refer to tariffs that mirror the rates imposed by other countries. Trump proposed this during his second presidential term, arguing that the U.S. has suffered from trade imbalances and significant goods trade deficits. By levying the same rates that other countries impose on U.S. goods, the intention is to enhance the competitiveness of American products, support domestic manufacturing, and maintain U.S. industrial leadership.

Products already subject to separate tariffs—such as steel, aluminum, automobiles, and auto parts—are excluded from the reciprocal tariff regime. Additional exemptions apply to pharmaceuticals, semiconductors, timber products, energy goods, and certain minerals not produced in the U.S..

Reciprocal Tariff Rates

| Country | Proportion of U.S. Imports (2024) | Reciprocal Tariff |

|---|---|---|

| European Union | 18.5% | 20% |

| China | 13.4% | 34% |

| Japan | 4.5% | 24% |

| Vietnam | 4.2% | 46% |

| South Korea | 4% | 26% |

| Taiwan | 3.6% | 32% |

| India | 2.7% | 27% |

| United Kingdom | 2.1% | 10% |

| Switzerland | 1.9% | 32% |

| Thailand | 1.9% | 37% |

| Malaysia | 1.6% | 24% |

Trump released reciprocal tariffs for over 180 countries and regions, ranging from 10% to 50%. Notably, China will face a 34% reciprocal tariff, in addition to the existing 20% base tariff and a newly announced 50% penalty tariff, bringing the total tariff on Chinese imports to 104%.

Canada and Mexico were already subject to 25% tariffs and are not included in this new round of reciprocal tariffs.

How Reciprocal Tariffs Are Calculated

- In this formula: The price elasticity of import demand (ε) is assumed to be 4, and the import price elasticity to tariff (φ) is assumed to be 0.25.

Since ε × φ = 1, they cancel out, making them irrelevant to the final result. The simplified formula treats the U.S. trade deficit divided by import volume as the implied composite tariff rate that the other country is assumed to impose on the U.S. This rate is then halved to determine the reciprocal tariff.

Take Taiwan as example:

- U.S. trade deficit with Taiwan (2024): $73.93 billion

- Total imports from Taiwan: $116.26 billion

- Trade deficit ratio: 73,927.2 / 116,264 ≈ 64%

- Reciprocal tariff: 64% / 2 = 32%

Other Already Implemented Tariffs

Canada & Mexico

- As of March 4, a 25% tariff applies to all imported goods (products qualifying under USMCA are exempted indefinitely).

- Canada’s energy and potash imports are subject to a lower 10% tariff.

China

- As of March 4, a 20% tariff is applied to all Chinese imports.

Steel & Aluminum

- Effective March 12, a 25% tariff is levied on imported steel and aluminum products.

Automobiles

- Starting April 3, a 25% tariff applies to imported cars.

Upcoming Tariff Plans

Auto Parts

- A 25% tariff is expected by May 3.

Semiconductors

- A 25% tariff is planned, though no specific date has been announced.

Pharmaceuticals

- A 25% tariff is planned, pending announcement.

Copper

- Under investigation by the U.S. Department of Commerce; no official policy yet.

Timber

- Also under review by the U.S. Department of Commerce; no confirmed policy.

Tariff Exemption Clause

According to Annex III, released by the White House last Friday:

- Under tariff code 9903.01.34, if an imported product includes more than 20% U.S. content (based on customs value), the U.S.-sourced portion is exempt from additional tariffs.

- The rest of the product will still be taxed, contrary to online rumors suggesting full exemption.

This provision could benefit Taiwan’s AI hardware and smartphone industries, where U.S.-made chips often account for over 20% of the product’s cost. However, the language remains vague, especially regarding whether "U.S. content" refers to "made in" or "made by" the U.S.—leaving final interpretation to Trump’s discretion.

Note: "U.S. content" refers to the portion of a product’s value attributable to components that are entirely obtained, produced, or substantially transformed in the United States.

Global Financial Market Trends

Stock Markets

U.S. Stocks

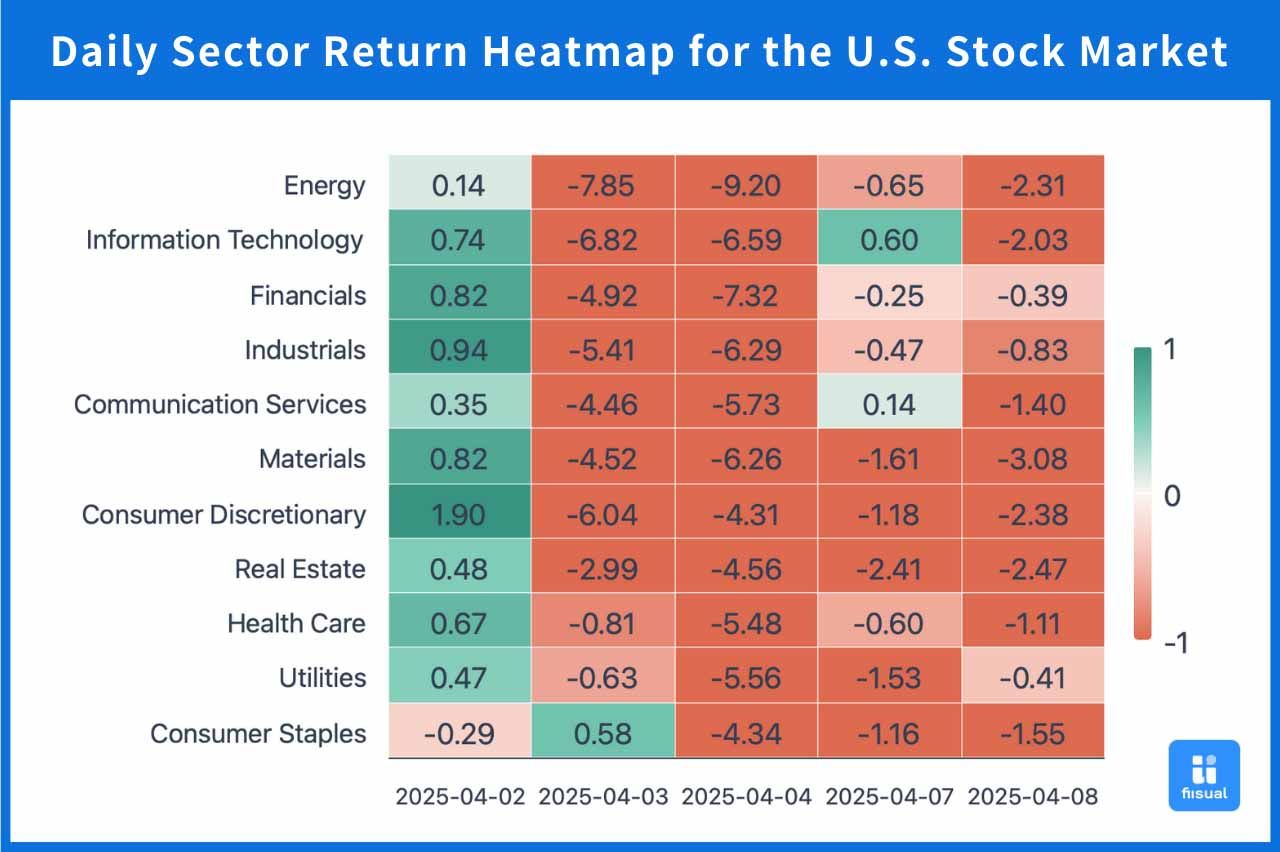

Following the tariff announcement, all three major U.S. indices experienced sharp corrections. Sector-wise, energy posted the steepest losses, followed by information technology, financials, and industrials, each down more than 10%. Defensive sectors such as consumer staples and utilities were comparatively resilient.

| Rank | Sector | Ticker | Cumulative Decline (Apr 2–7) | Analytics |

|---|---|---|---|---|

| 1 | Energy | XLE | -15.24% | Expected to benefit from oil volatility, but hit by weak demand and capex downgrades |

| 2 | Info Tech | XLK | -11.62% | High global supply chain reliance; impacted by export controls and trade tensions |

| 3 | Financials | XLF | -11.06% | Bond yield volatility, rising credit risk, and reduced market risk appetite |

| 4 | Industrials | XLI | -10.23% | Multinational manufacturers face export retaliation and rising component costs |

| 5 | Communication Services | XLC | -9.19% | Concerns over Chinese equipment bans and supply chain restructuring |

| 6 | Materials | XLB | -9.18% | High raw material volatility and difficulty passing costs to consumers |

| 7 | Consumer Discretionary | XLY | -8.61% | Autos, appliances hit by rising import costs and weakening demand expectations |

| 8 | Real Estate | XLRE | -6.53% | Risk-off sentiment dragging capital inflow |

| 9 | Healthcare | XLV | -5.42% | Large exporters exposed to tariff and regulatory uncertainty |

| 10 | Utilities | XLU | -5.37% | Defensive assets, yet pressured by systematic corrections |

| 11 | Consumer Staples | XLP | -3.68% | Relatively resilient, supported by domestic demand |

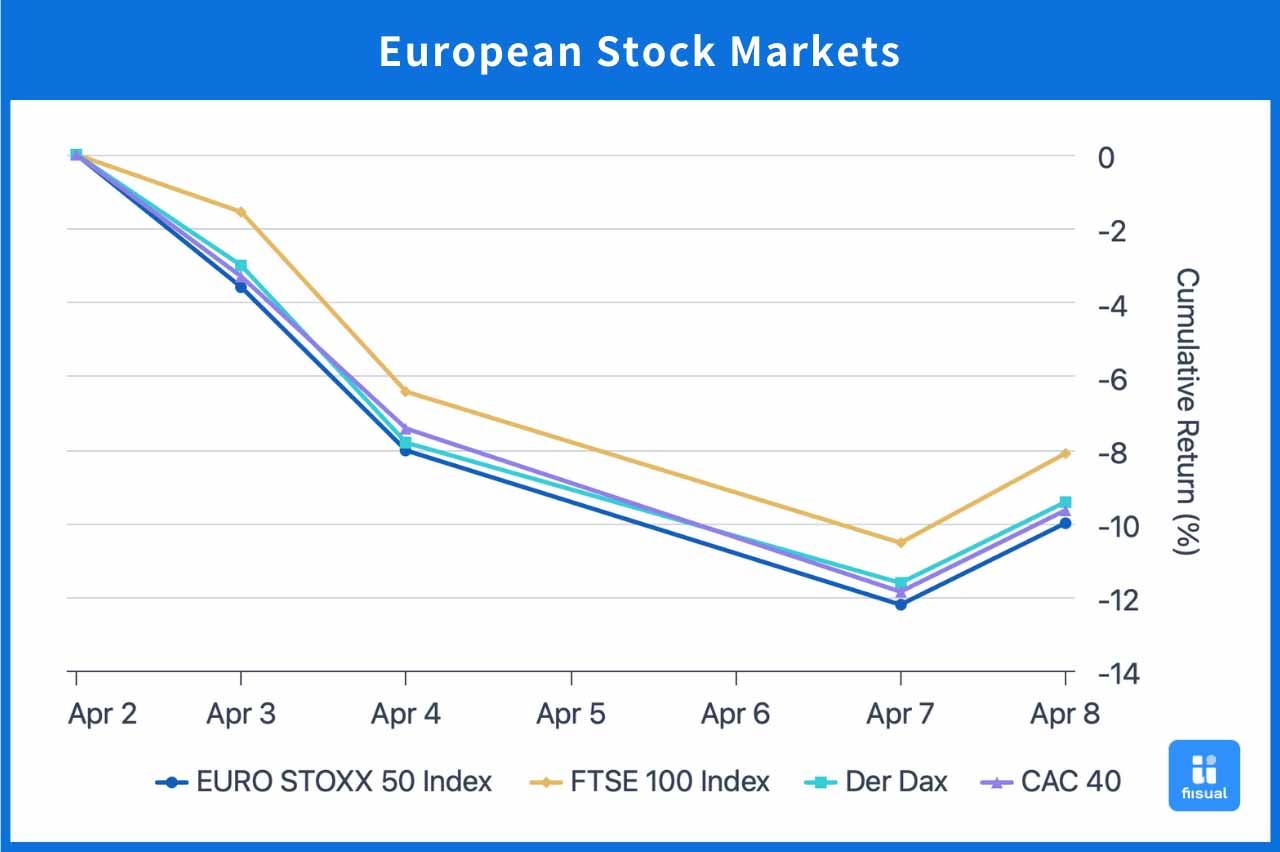

European Stocks

European markets also saw steep declines—nearly 10% across all major indices—amid widespread uncertainty. Investors not only focused on the impact of the U.S. tariffs but also worried that heavily taxed producers might engage in dumping in the near future.

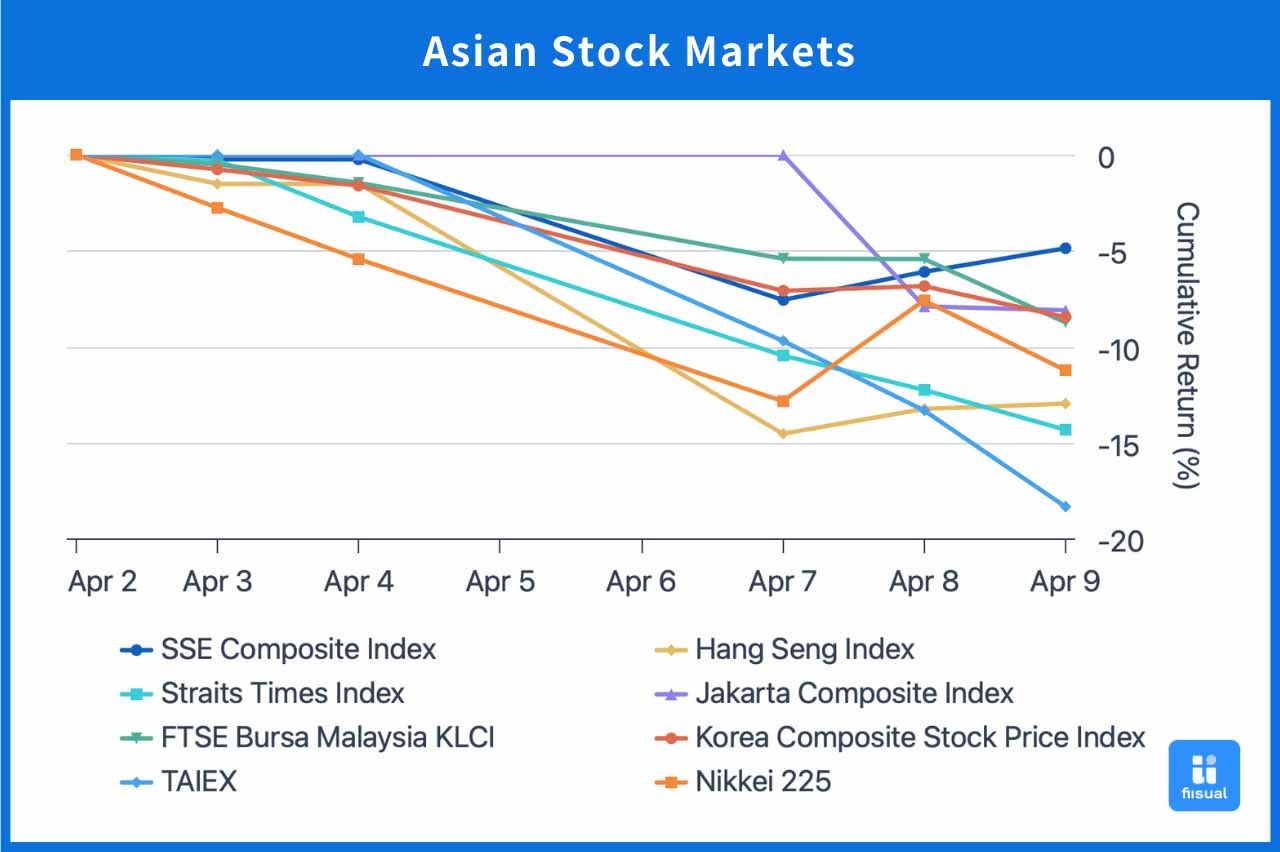

Asian Stocks

Asian equities also slumped. While Shanghai saw limited losses, export-driven economies such as Taiwan and Singapore experienced significant pullbacks. The Nikkei Index showed high volatility as Japan entered trade negotiations with the U.S.

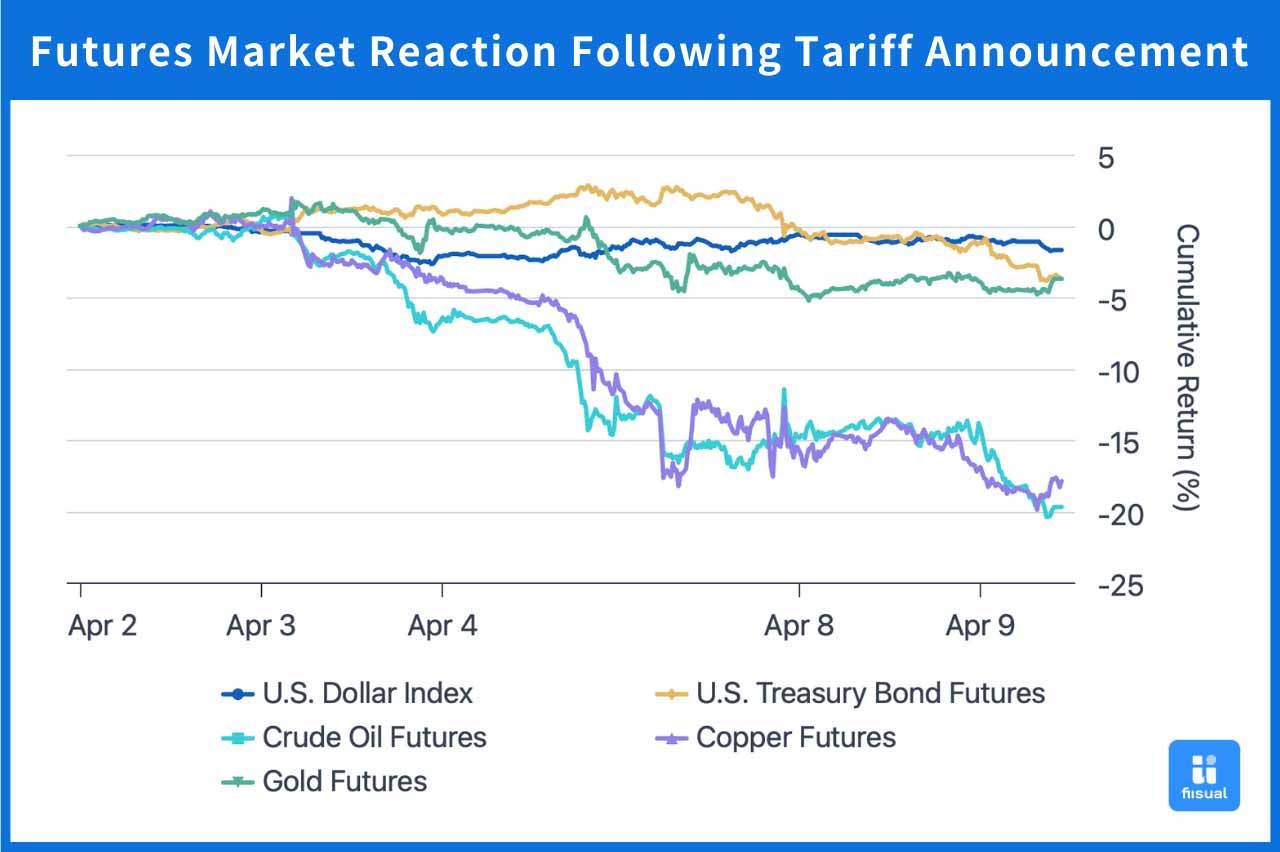

Crude Oil

Although energy products were excluded from U.S. tariffs, retaliatory actions from other countries fueled fears of a global recession, dampening oil demand. Oil prices logged their largest single-day percentage drop in three years.

Prices were already trending lower before the new tariffs, but the severity of the market’s reaction underscores concern about escalating trade disputes and potential economic slowdowns. The oil market is expected to remain under pressure as trade war risks linger and could potentially trigger a wider economic crisis.

Gold

As Trump's tariff escalation threats spread, safe-haven demand surged, sending gold prices to record highs. However, following a steep equity sell-off, gold—being a highly liquid asset—was heavily sold off to meet margin calls in other markets, resulting in a dramatic $121 single-day drop.

In the short term, gold may remain under pressure due to margin call-related liquidations, but could rebound once that cycle ends. In the medium term, retaliatory trade actions and global instability are expected to support gold as a hedge asset. Over the long term, with global de-dollarization trends and a likely U.S. rate-cutting cycle, the bullish outlook for gold remains intact.

Copper

Following the tariff announcement, fears of slowing manufacturing demand and unwinding of previous gains led to copper’s largest five-year drop.

U.S. Treasuries

Initially, Treasury prices rose as investors sought safety. However, as the U.S.-China trade conflict intensified, markets grew concerned that China may begin offloading its U.S. bond holdings, causing capital outflows and declines in Treasury prices in recent sessions.