This year on May 3rd, Warren Buffett officially announced at Berkshire Hathaway’s annual shareholders meeting that he will be retiring by the end of the year. At the same time, he named Greg Abel as his successor and the next CEO.

This announcement quickly made headlines across major media outlets. In this article, we will take a look back at this legendary investor, the holding company Warren Buffett has led as CEO for 60 years, and briefly introduce his chosen successor.

Warren Buffett's Investment Philosophy

"I don’t look to jump over 7-foot bars. I look around for 1-foot bars that I can step over." — Warren Buffett

Influenced by his father, who worked as a stockbroker, Buffett showed remarkable business acumen from a young age. He made his first stock purchase at just 11 years old. In his youth, Buffett was eager to make quick gains—only to see the shares he sold rise far beyond his exit point in the years that followed. This experience taught him the importance of investing in high-quality companies and holding onto their shares long term.

After earning a master’s degree in economics, Buffett founded Buffett Partnership Ltd. in 1956. He closely followed the teachings of his mentor Benjamin Graham, identifying undervalued stocks and investing in them with a long-term mindset—a strategy that brought him tremendous success.

Berkshire Hathaway

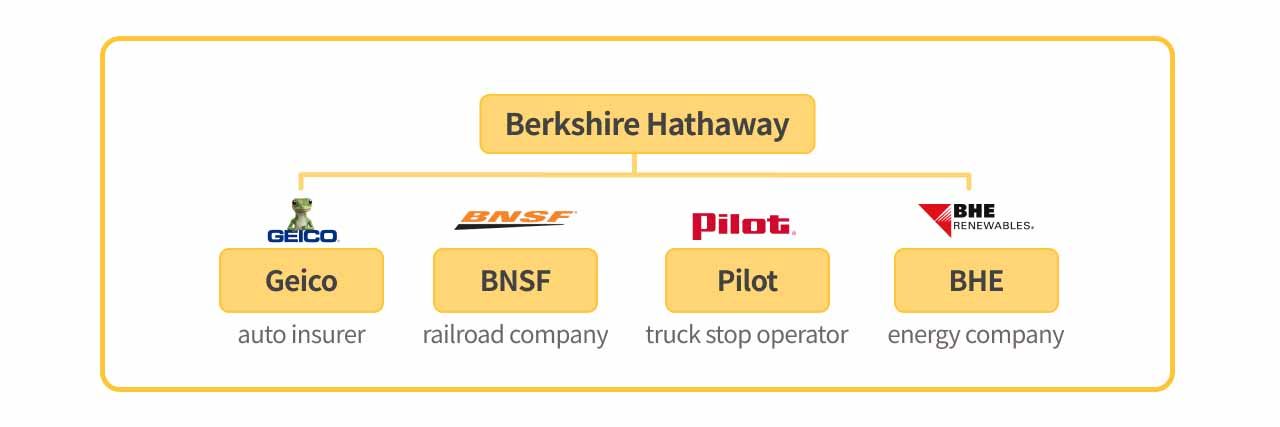

In 1962, Buffett began purchasing shares of Berkshire Hathaway, originally a textile company. After gaining control, he restructured it into an insurance business. Influenced by his close friend Charlie Munger, Buffett shifted his investment strategy to focus on buying great businesses at fair prices. He sought out companies with strong competitive advantages—what he calls "economic moats"—and used the insurance float (cash reserves) to fund these investments.

By taking substantial equity positions, allowing acquired businesses operational independence, and retaining existing management teams, Buffett's investment approach turned Berkshire into one of the world’s largest and most successful holding companies. Buffett himself has earned widespread admiration and is regarded globally as the "Oracle of Omaha."

Who Is Greg Abel?

Greg Abel is Buffett’s handpicked successor. He currently serves as Vice Chairman of Berkshire Hathaway and oversees all non-insurance operations. Abel is known for his cautious and steady investment approach, which aligns well with Berkshire’s long-standing corporate culture. He is widely seen as someone capable of upholding and continuing Buffett’s value investing legacy.

Greg has emphasized that Berkshire’s future capital allocation will focus on three main pillars: strengthening subsidiary operations, actively seeking acquisition opportunities, and continuing to invest in publicly traded companies. If attractive market opportunities arise, the company’s sizable cash holdings will be a crucial "strategic resource" that can be quickly deployed.