Price Trend Summary

| Opening Price (01/27) | Closing Price (02/07) | Price Change | |

|---|---|---|---|

| Brent Crude | 78.34 | 74.66 | -4.7% |

| West Texas Intermediate (WTI) | 74.54 | 71.00 | -4.7% |

| Dubai Crude | 80.44 | 77.59 | -3.5% |

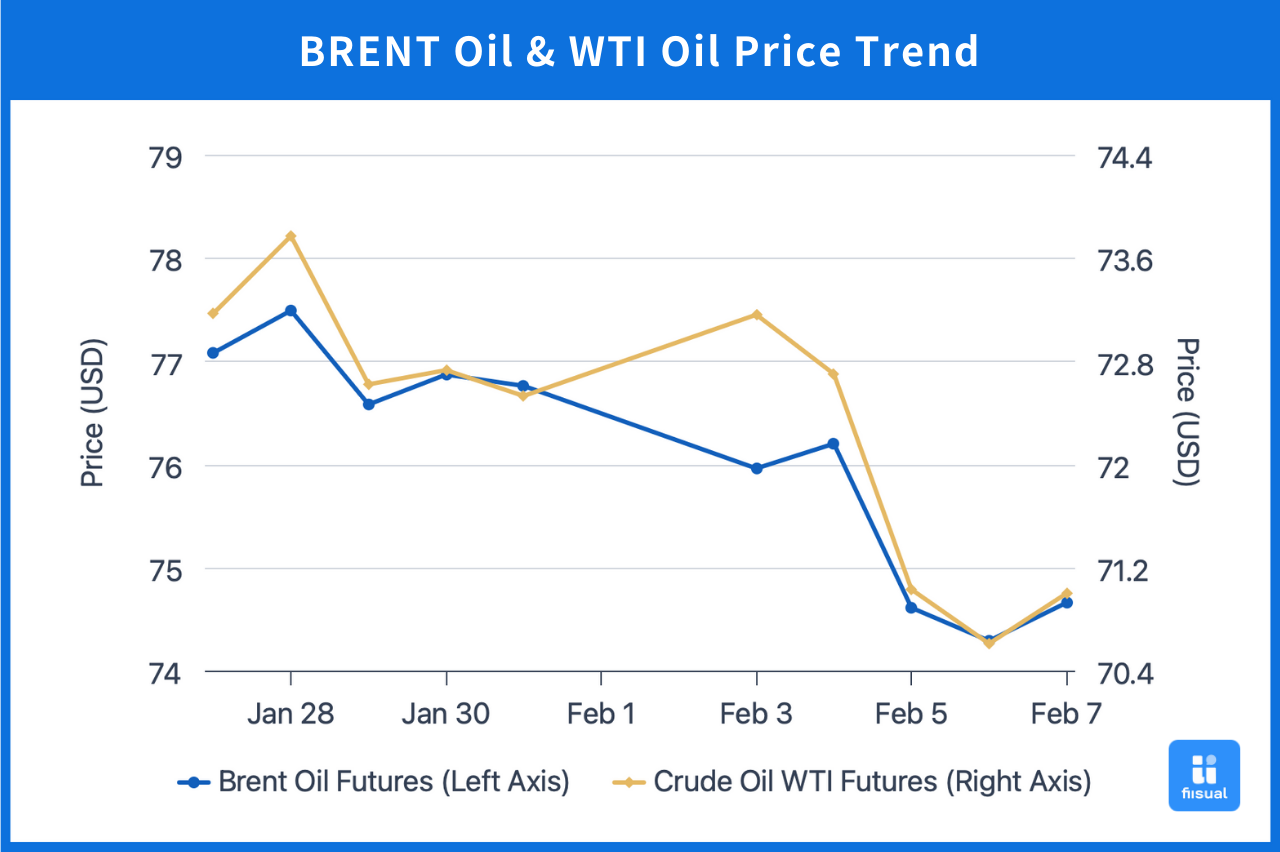

In the first week, oil prices fell by approximately $1.5 to $2 per barrel, primarily due to China’s manufacturing PMI falling below expectations and entering contraction territory. Furthermore, data from the U.S. Energy Information Administration (EIA) indicated that the previous trend of declining U.S. crude oil inventories had ended. Meanwhile, former U.S. President Donald Trump announced new tariffs on Canada, Mexico, and China, raising concerns that trade tensions might hinder economic growth. However, these concerns also partially curbed the decline in oil prices.

In the second week, Trump’s announcement of the "zero crude oil exports" policy on Iran temporarily boosted oil prices by approximately $2 per barrel. However, prices soon retreated as the EIA reported a significantly larger-than-expected increase in U.S. crude inventories, coupled with indications of a possible ceasefire in the Russia-Ukraine war. The cumulative decline over the two-week period amounted to approximately 4% to 5%.

Crude Oil Data Update

| 01/31/25 | 01/24/25 | 01/17/25 | |

|---|---|---|---|

| Inventory (Million Barrels) | |||

| Inventory (Million Barrels) | 423.8 (+8.7) | 415.1 (+3.4) | 411.7 |

| Strategic Petroleum Reserve (SPR) | 395.1 (+0.5) | 394.6 (+0.3) | 394.3 |

| Motor Gasoline | 251.1 (+2.2) | 248.9 (+3.0) | 245.9 |

| Distillate Fuel Oil | 118.5 (-5.5) | 124.0 (-4.9) | 128.9 |

| Production Activities | |||

| Rig Count | 480 (+1) | 479 (+7) | 472 |

| Refinery Utilization Rate (%) | 84.5 (+1.0) | 83.5 (-2.4) | 85.9 |

Over the two-week period, commercial crude oil inventories increased by 12.1 million barrels, while the Strategic Petroleum Reserve (SPR) also rose by 800,000 barrels. During the same period, the number of active drilling rigs increased to eight, and refinery utilization rates remained at approximately 84%.

For refined products, gasoline inventories increased by 5.2 million barrels, whereas distillate inventories declined by 10.4 million barrels. These figures indicate that crude oil inventories have diverged from the downtrend observed since late November 2024. This reflects weaker short-term demand, driven by global economic conditions, policy shifts, and seasonal factors.

From a medium-to-long-term perspective, as Trump's presidency progresses, policy uncertainty may gradually decrease. Combined with the potential de-escalation of geopolitical conflicts and OPEC+ production increases, oil prices could continue their downward trajectory. However, major crude oil suppliers will likely adopt flexible production adjustments to balance market share and price stability. These dynamics will be a critical variable influencing future oil price trends and should be closely monitored.

Global Developments

Trump's Tariff Measures

On January 7, 2025, Donald Trump announced plans to impose stringent tariffs on Canada and Mexico, citing their inadequate efforts in controlling fentanyl trafficking and illegal immigration into the U.S. On January 31, Trump formally declared that, effective February 4, a 25% tariff would be imposed on imports from Canada and Mexico, while Chinese imports would be subjected to a 10% tariff.

However, on February 3, after Canada and Mexico pledged to strengthen border security and combat fentanyl smuggling, the Trump administration decided to delay these tariffs by at least 30 days. Meanwhile, the 10% tariff on Chinese goods remained on schedule. These tariff measures could increase crude oil import costs, suppress end-user demand, and reduce the incentive for foreign suppliers to maintain exports, weakening global crude oil supply and demand simultaneously. Additionally, China's countermeasures in response to U.S. tariffs have raised concerns over demand prospects, contributing to the decline in oil prices.

Conclusion

Recent fluctuations in oil prices reflect significant global policy changes and weak market demand. Moving forward, geopolitical developments, OPEC+ production strategies, and the ultimate trajectory of U.S. policies will need to be closely monitored, as these factors will collectively shape the medium-to-long-term trend of oil prices.