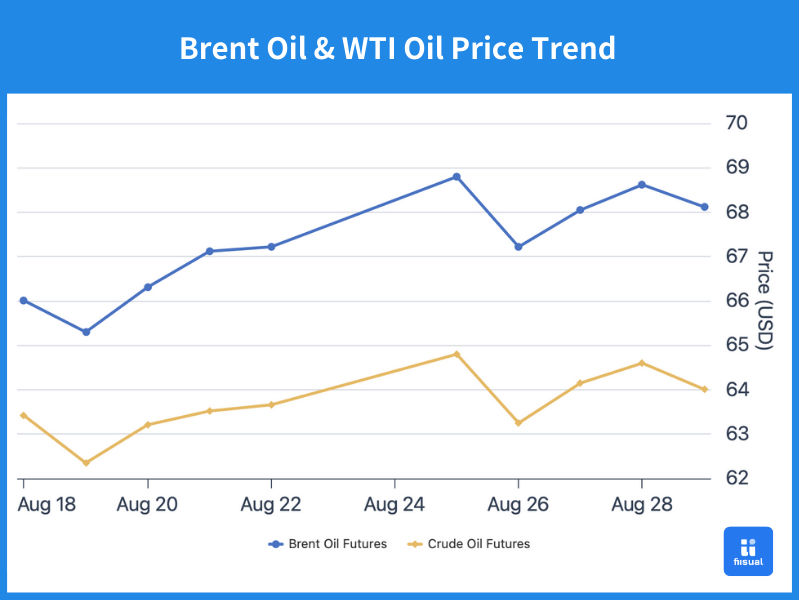

Price Trend Summary

| Aug 18 Open | Aug 29 Close | Price Change | |

|---|---|---|---|

| Brent Crude | 65.26 | 68.12 | 4.38% |

| WTI Crude | 63.00 | 64.01 | 1.6% |

| Dubai Crude | 68.94 | 69.39 | 0.7% |

In the first week, oil prices fell as Trump pushed forward peace talks between Russia and Ukraine, leading markets to expect the U.S. would refrain from imposing sweeping sanctions on Russia, thus easing supply concerns. Prices rebounded later in the week after EIA reported larger-than-expected draws in both crude and gasoline inventories, with crude ending the week up roughly 1–2%.

In the second week, Ukrainian drone strikes on Russian refineries initially lifted prices on geopolitical concerns. However, as Russia ramped up oil exports—signaling limited disruption from the refinery attacks—and Trump proposed a trilateral summit, markets priced in ceasefire expectations, triggering a sharp drop. Later in the week, Israel’s strike on Houthi forces renewed tensions, offsetting earlier losses, and crude finished flat.

Crude Oil Data Update

Strong Inventory Draws, Resilient Gasoline Demand, Producers Stabilizing Investment

| Aug 27, 2025 | Aug 20, 2025 | Aug 13, 2025 | |

|---|---|---|---|

| Inventories (m bbls) | |||

| Commercial Crude (ex-SPR) | 418.3 (-2.4) | 420.7 (-6.0) | 426.7 |

| Strategic Petroleum Reserve (SPR) | 404.2 (+0.8) | 403.4 (+0.2) | 403.2 |

| Gasoline | 222.3 (-1.3) | 223.6 (-2.7) | 226.3 |

| Distillates | 114.2 (-1.8) | 116.0 (+2.3) | 113.7 |

| Production Activity | |||

| Rig Count | 411 (-1) | 412 (+1) | 411 |

| Refinery Utilization (%) | 94.6 (-2.0) | 96.6 (+0.2) | 96.4 |

Over the past three weeks, U.S. commercial crude inventories fell by a cumulative 8.4 million barrels, a larger-than-expected draw. At the same time, the SPR was replenished gradually by around 1 million barrels. On the product side, gasoline inventories fell by 4 million barrels while distillates edged up by 0.5 million barrels, indicating driving-season demand remained firm. On supply, rig activity was broadly stable, suggesting producers’ investment bottoming, which implies U.S. output will likely see limited downside. This could magnify the supply-demand pressures from future OPEC+ increases. Refinery utilization, while down 1.8 percentage points, still remains well above seasonal averages, underscoring resilient U.S. consumption despite the tariff backdrop.

International Developments

Trump Fires Fed Governor Lisa Cook

| Date | Event Summary |

|---|---|

| Aug 15 | Pulte accused Cook of filing false residency information |

| Aug 20 | Trump asked Cook to resign; Cook refused and pushed back |

| Aug 25 | Trump announced Cook’s dismissal |

| Aug 26 | Cook filed suit and sought an injunction |

| Aug 28 | Cook formally sued Trump |

| Aug 29 | Hearing produced no ruling; Cook remains in position for now |

On August 25, U.S. President Trump dismissed Federal Reserve Governor Lisa Cook—appointed by former President Biden—on allegations of loan fraud. If the court ultimately upholds Trump’s order, he would control four out of the seven Fed Board seats, raising concerns about the Fed’s policy independence and the risk of greater political influence.

From a monetary policy perspective, the main concern is whether this development disrupts the Fed’s easing cycle. In practice, rate cuts still hinge on inflation and labor data. As long as long-term yields do not spike excessively on fears over Fed independence, the easing cycle is unlikely to be derailed.

Should the Fed proceed with rate cuts, crude demand could benefit. Historically, accommodative policy has fueled industrial and transportation activity, driving higher crude imports and refinery runs, providing additional support to oil prices.

Commentary

Geopolitical tensions—centered on Russia-Ukraine and Israel-Hamas conflicts—have again overshadowed fundamentals, leaving oil price direction unclear. We continue to expect the U.S. will not impose sweeping secondary sanctions on Russia, though other measures remain possible. Fundamentally, while refinery utilization has eased from recent highs, it remains well above seasonal norms, showing that demand resilience persists even as the driving season winds down and despite tariff effects.

On rate cuts, we see market expectations as overly optimistic. Core CPI remains near 3%, still above the Fed’s 2% target. PCE has recently climbed to a multi-month high, underscoring sticky inflation. In addition, tariffs are only beginning to show in the data, with their impact likely to build in the months ahead. Labeling these as “one-off” shocks seems premature. Overall, the U.S. backdrop remains insufficient to justify an imminent pivot to easing. The main risk lies in employment: non-farm payrolls undershot expectations last month, and if the Fed delays easing, downside risks to growth could mount. Attention now turns to the upcoming jobs report—if payrolls surprise strongly to the upside, confidence in rate cuts could weaken further, adding downward pressure on crude.

Takeaway

Driving-season demand has proven resilient, with gasoline inventories and refinery utilization showing strength, lending support to oil prices. However, near-term price moves will remain volatile, driven largely by geopolitical risks. While markets are pricing in aggressive rate-cut expectations, actual policy timing still depends on labor data. Looking ahead, we are watching the Fed’s easing path, U.S. physical crude indicators, and upcoming OPEC meetings.