Price Trend Summary

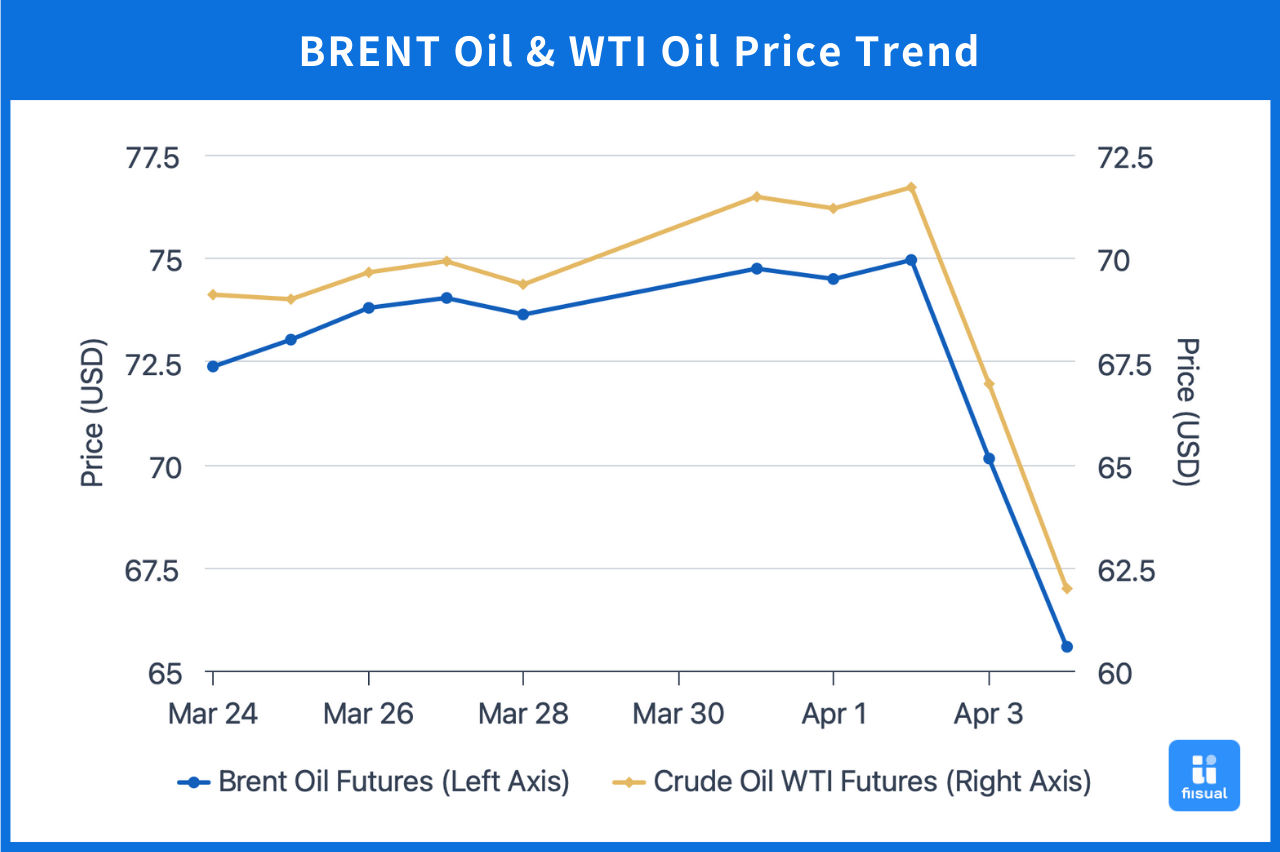

| Opening (Mar 24) | Closing (Apr 4) | Price Change | |

|---|---|---|---|

| Brent Crude | 71.70 | 65.58 | -8.54% |

| WTI Crude | 68.35 | 61.99 | -9.31% |

| Dubai Crude | 72.36 | 72.53 (Apr 3) | N/A |

Week 1: Crude prices rose about 2–3%. Early in the week, U.S. President Trump announced a 25% import tariff on all nations purchasing Venezuelan oil and gas, which raised expectations of tighter oil supply. Prices surged accordingly. Additionally, an EIA report showing a sharper-than-expected drop in crude inventories further boosted prices. However, late in the week, fears of a potential global recession triggered by U.S. tariffs briefly pulled prices lower—until renewed pressure from U.S. sanctions on Venezuela and Iran helped support the market.

Week 2: Crude prices plunged by roughly 11%. At the beginning of the week, Trump issued renewed threats of sanctions against Iran and Russia, sparking concerns over supply disruptions and lifting prices at the open. Mid-week, the U.S. administration announced a new baseline tariff of 10% on all imported goods starting April 5, with higher rates targeting specific economies. In response, China imposed a 34% additional tariff on all U.S. imports. These developments heightened market fears of a global recession and weakened oil demand outlook. In addition, OPEC+ announced it would triple the planned production increase for May to penalize long-time non-compliant members, exacerbating the supply-demand imbalance and accelerating the price decline.

Crude Oil Data Update

Seasonal Demand Fades; EIA Inventory Continues to Build

| Mar 28, 2025 | Mar 21, 2025 | Mar 14, 2025 | |

|---|---|---|---|

| Inventories (Million Barrels) | |||

| Commercial Crude (Excluding SPR) | 439.8 (+6.2) | 433.6 (-3.4) | 437.0 |

| Strategic Petroleum Reserve (SPR) | 396.4 (+0.3) | 396.1 (+0.2) | 395.9 |

| Motor Gasoline | 237.6 (-1.5) | 239.1 (-1.5) | 240.6 |

| Distillate Fuel Oil | 114.6 (+0.2) | 114.4 (-0.4) | 114.8 |

| Production Activity | |||

| Rig Count | 484 (-2) | 486 (-1) | 487 |

| Refinery Utilization Rate (%) | 86.0 (-1.0) | 87.0 (+0.1) | 86.9 |

Commercial crude inventories rose by a total of 2.8 million barrels over the past two weeks, while the Strategic Petroleum Reserve increased by 0.5 million barrels. On the production side, the number of active rigs decreased by three, and refinery utilization dropped by around 1 percentage point. Regarding refined products, gasoline inventories fell by 3 million barrels, and distillate inventories decreased by 200,000 barrels, suggesting stable downstream demand.

Medium-Term Outlook: While the new U.S. tariff policy excludes energy products, rising inflation due to the tariffs could weaken consumer purchasing power and indirectly reduce demand for gasoline and other oil products. Additionally, increased export challenges and higher equipment costs may prompt shale oil producers to cut capital expenditures, potentially accelerating the slowdown in production. Continued attention is needed on Trump’s future tariff actions and whether refining margins begin to decline more significantly.

Global Developments

U.S. Retaliatory Tariff Policy

On April 2, 2025, President Trump announced a new tariff regime: a 10% baseline tariff on all imports, and significantly higher "retaliatory tariffs" for certain countries—34% on China, 20% on the EU, and 32% on Taiwan. The policy is aimed at protecting U.S. manufacturing and addressing long-standing trade deficits. However, it has also triggered global market volatility and raised concerns over the economic outlook.

Even before the new round of tariffs was introduced, international oil prices were showing weakness. However, the severity of the recent drop highlights the market’s strong reaction to the risks of escalating global trade tensions and a possible recession. Panic sentiment is rising rapidly. In the short term, the global tariff war is expected to intensify, with the potential to evolve into an economic crisis, leading to further downside pressure on oil prices. Over the long term, as the global energy transition advances and oil demand declines, the outlook remains bearish. Key factors to watch include Trump’s future sanction policy shifts, OPEC+ output management, and the latest developments in geopolitical conflicts.

Summary

The U.S. retaliatory tariff policy has heightened concerns over trade conflicts and a global economic downturn, driving oil prices sharply lower. In the short term, the tariff war is likely to continue escalating, putting further pressure on crude prices. Going forward, market watchers should monitor Trump’s sanctions policy changes, OPEC+ production responses, and developments in geopolitical risk.