The term “inflation” comes across in various contexts. It might appear on the news when reporters ask vendors about the impact of the rise on electricity costs, or in financial reports where central banks reiterate the importance of inflation targets for economic growth. In fact, inflation not only reflects price changes but is also one of the key drivers of economic momentum. Below we will be introducing the concept of inflation in simple terms.

What is Inflation

By definition, inflation occurs when "the prices of goods and services in the market continuously rise over a certain period" or "the purchasing power of the same amount of currency steadily declines over time."

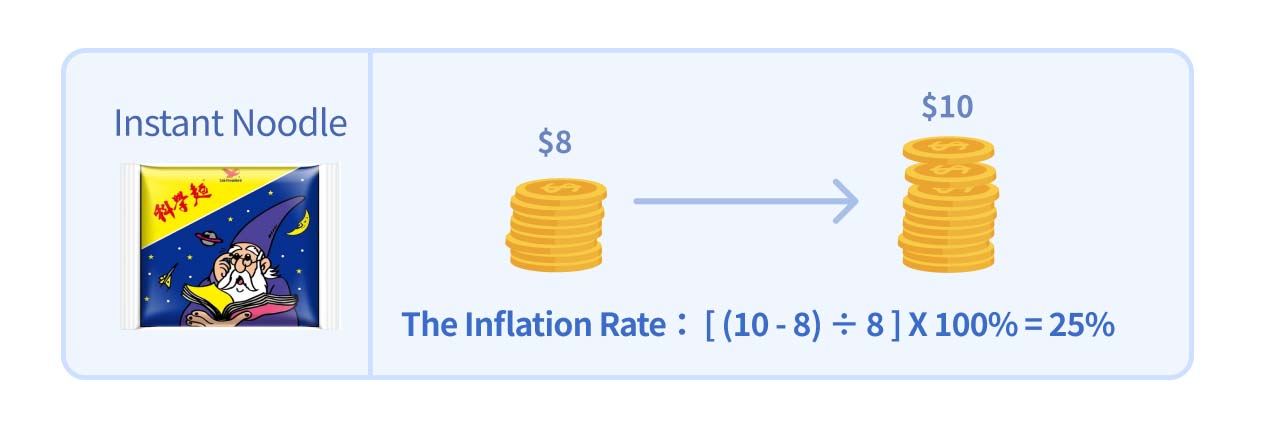

A real-life example of inflation is how snacks that once cost $5 or $8 during childhood now cost $10. This shows how inflation affects consumers. In terms of purchasing power, it means that the same $5 that used to buy a pack of noodles can now only buy part of it. In simpler terms, inflation "eats away" the value of each unit of currency.

For example, if the price of the snack-instant noodles rises from $8 to $10, the inflation rate is [(10 - 8) ÷ 8] × 100% = 25%. For consumers, the purchasing power of money decreases with inflation. What $8 once bought now only buys 0.8 packs of noodles.

Over time, the impact of inflation becomes more significant. By using a price index, we can estimate the following conclusion based on Taiwan's inflation rate: The goods that cost NT$10,000 today could have been bought for less than half that amount (NT$4,970) 35 years ago. It’s important to note that inflation is a double-edged sword. In a healthy economy, moderate inflation (as the U.S. Federal Reserve defines, around 2% as a long-term target) supports business activity. However, if inflation becomes too high or accelerates too quickly, it can greatly reduce the value of the currency, leading to hyperinflation. Zimbabwe is one of the example of hyperinflation.

Note: If prices move in the opposite direction—falling over time—it’s called deflation.

| Inflation | Deflation | |

|---|---|---|

| Definition | The price of goods increases over time; purchasing power declines. | The price of goods decreases over time; purchasing power increases. |

Inflation vs. Economic Growth

As mentioned earlier, moderate inflation helps maintain a healthy environment for economic growth. There are many ways inflation affects the economy, but let’s start with a simple example of how inflation and personal consumption relate to economic growth.

Take the previous of snack-instant noodles for example, when prices steadily increase over time, it means that the same amount of money will buy fewer goods in the future (inflation rises, purchasing power falls). In this situation, consumers tend to spend now, knowing that future purchases will be more expensive. This normal level of consumption growth can contribute to positive economic growth.

However, in a deflationary economy, where prices fall over time, consumers may delay purchases, believing they can buy more in the future with the same amount of money. This reduction in consumer spending can be harmful to stable economic growth.

Inflation vs. Personal Finance

Inflation doesn’t just affect the overall economy—it’s also closely tied to personal financial planning. If inflation is positive and we don’t take any financial action, our wealth may shrink due to inflation.

One scenario is leaving money in the bank to earn interest. If the interest paid by the bank is lower than the inflation rate, that money will lose value over time, effectively becoming "thinner" as it sits in savings. This is why inflation impacts personal investment and financial planning. In financial terms, real purchasing power increases only when the rate of return exceeds the inflation rate.

Summary

In summary, inflation reflects the relationship between currency and purchasing power. Inflation rises while the purchasing power of money declines, and vice versa:

- Inflation: The future purchasing power of money decreases.

- Deflation: The future purchasing power of money increases.

How is Inflation Measured

Inflation is something we can see in everyday life—from the price of tea eggs to housing prices, inflation affects anything related to money. However, while inflation is visible, as everyone buys different items daily, it’s not always easy to quantify.

So how can we measure inflation in an economy? For those who are interested, check out our article Macroeconomics 101: Introduction to the CPI Indicator