In the article, Macroeconomics 101: What is Inflation?, we discussed how inflation affects the overall economy and our daily lives. However, how exactly do we measure inflation?

Different Perceptions of Inflation

Each person may experience inflation differently depending on their spending habits. The nature of goods or services can also shape how consumers perceive price increases.

Essential Goods

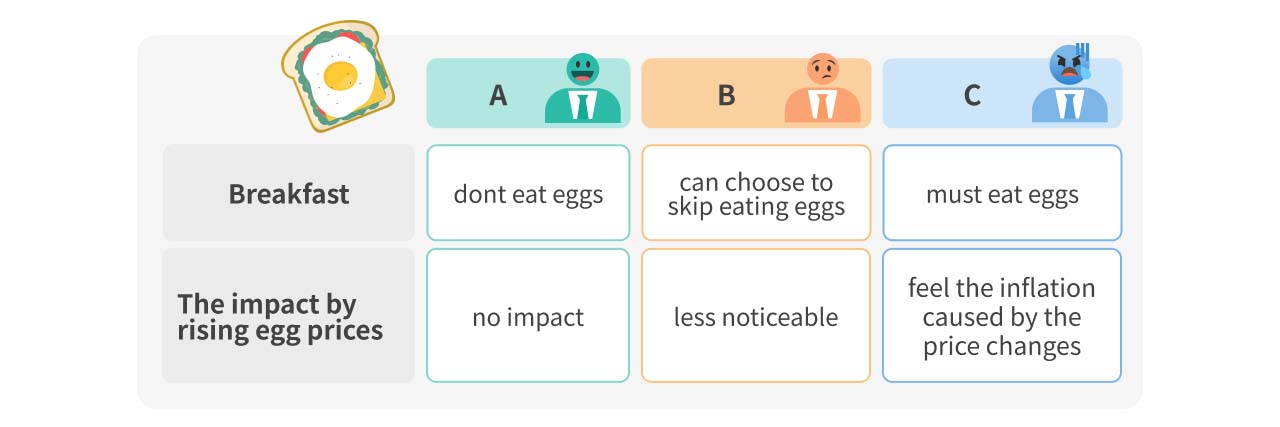

For example, due to rising egg prices, breakfast shop XYZ announces a NT$5 price increase for meals with eggs, while other items remain unchanged.

- Person A doesn’t usually add eggs to his breakfast, so the egg price increase has no impact on him.

- Person B often adds eggs to her meals but can choose to skip eggs to save money, making the price increase less noticeable to her.

- Only consumers with an essential need for eggs (like person C, who always needs eggs for breakfast) will feel the inflation caused by this price changes.

Substitutable Goods

Person D is another regular customer of breakfast shop XYZ, who usually orders egg meals. However, she notices that shop QRS at the same plaza hasn't raised its prices despite the egg price hike. Person D feels no difference in switching to shop QRS, meaning she can avoid the negative effects of shop XYZ's price increase by finding a substitute product in the market.

In terms of economics, this situation is explained by the concept of demand elasticity. When a product has high demand elasticity, price changes will significantly affect its sales volume, reducing the impact of inflation on consumers. For instance, if consumers have equal satisfaction from Coca-Cola and Pepsi, a price hike for one will lead to a noticeable drop in its sales, as consumers switch to the other. In such cases, the price increase has a lower negative impact on consumers.

Upstream and Downstream Goods

Price increases in upstream goods can have a broader inflationary effect, impacting more consumers. For example, price increase in utility bills may increase operational costs for businesses, which in turn leads to higher prices at your favorite restaurant. Thus, inflation in raw materials (upstream goods) not only directly increases the cost for consumers but can also indirectly drive up prices of other goods, affecting a wider range of consumers.

CPI Index

Creating a Standardized Basket of Goods

As mentioned earlier, different consumers experience inflation differently. To better measure inflation in an economy, it’s essential to find a standardized "basket of goods" that represents the average consumption structure. Statistical agencies in each country collect data on household spending to determine this representative basket.

By measuring the cost of this basket of goods over time, we can calculate the inflation rate. For example, if last year the basket of goods cost $1,000 and this year it costs $1,050, using last year as the base year (100), the price index for this year would be 105.

1050/1000*100 = 105

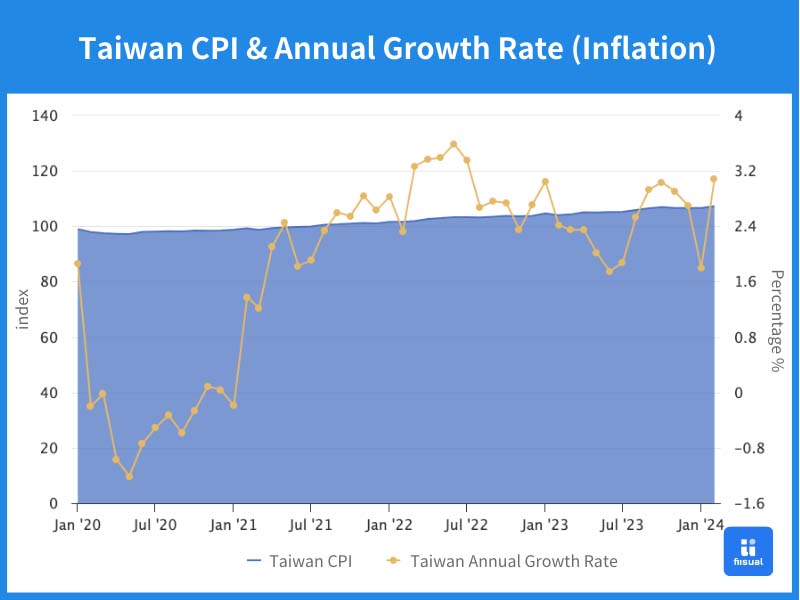

By tracking the CPI index over time, we can observe the inflation level in an economy. For instance, Taiwan's consumer price index allows us to calculate the year-over-year growth rate, revealing long-term inflation trends.

Conclusion

Now that you’ve reached the end of this article, we hope that you have a good understanding of what the CPI index is and how it’s calculated. In simple terms, the price index attempts to fix a set of goods and services and observe how their prices change over time. The CPI index has many applications, ranging from central bank policies to government subsidies, and is closely related to inflation trends.