Among the three financial statements, the income statement helps us understand a company’s profitability, the balance sheet reveals financial structure, and in this article we will be introducing the “ statement of cash flows”. We will be explaining how to interpret the different sectors in the statement of cash flows and what it means for investors.

The Significance of the Statement of Cash Flows

We all know that cash holds a special meaning due to its high liquidity for both individuals and companies. Observing a company's cash inflows and outflows is a simple yet effective way to assess how the company manages its funds and whether its finances are stable.

| Company A | Company B | |

|---|---|---|

| Revenue | 1 million | 1 million |

| Cash Collection Status | Cash collected | Accounts receivable |

| Financial Flexibility | More financial flexibility | Potential liquidity issues |

Let’s look at a simple example. Both Company A and Company B have earned 1 million in profits this year. However, Company A has already received 1 million in cash, while Company B has only recorded the amount as accounts receivable and hasn’t collected the cash yet. Even though both companies have the same revenue (1 million), Company A clearly has greater financial flexibility. With cash in hand, it can pay suppliers, invest, or pursue other opportunities. Meanwhile, Company B, despite the same revenue, might face challenges with cash flow and could struggle to cover expenses.

The 3 Main Sections of the Statement of Cash Flows

The cash flow statement can be divided into three key sections: operating, investing, and financing activities. Below, we’ll introduce each section in detail.

| Operating Cash Flow | Investing Cash Flow | Financing Cash Flow | |

|---|---|---|---|

| Classification | Cash flow from core business operations | Investments in stocks, equipment, and future output | Borrowing, fundraising, dividend payouts |

| Key Point | Focusing on cash flows related to operations | Assess how the company invests to expand production | Evaluate if the company has a funding gap and fund sources |

1. Operating Cash Flow

Cashflow from Operating Activities

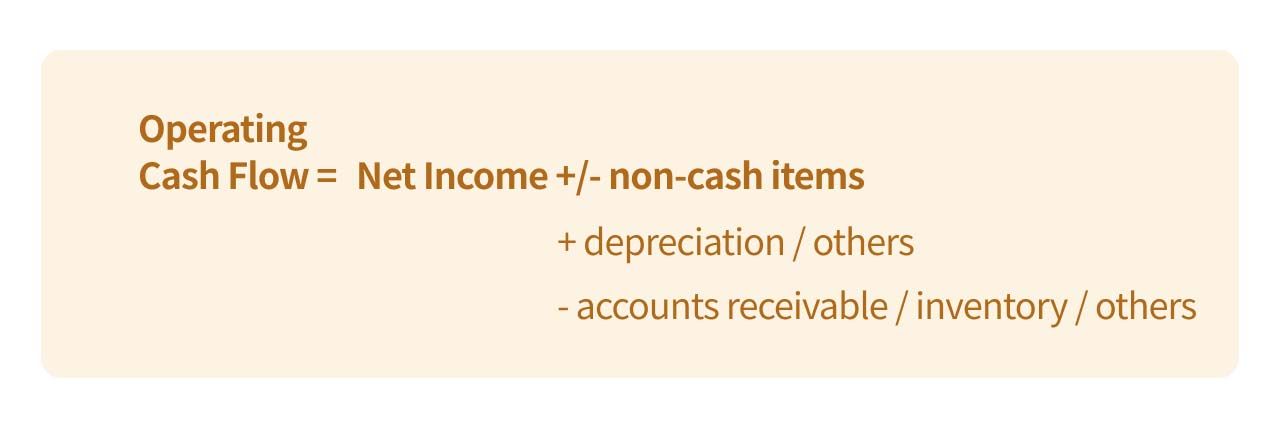

Operating cash flow refers to all cash inflows and outflows related to core business activities, including production and sales. It starts with net income from the income statement, then adjusts for non-cash items such as depreciation and deducts non-collected revenue like accounts receivable. Since the focus of the cash flow statement is on "movement," any non-cash items are either added back or deducted, depending on the type of account. For example, depreciation, although recorded on the balance sheet, does not result in an actual cash outflow, so it should be added back. Similarly, accounts receivable, which represent money owed but not yet collected, should be deducted because no actual cash has been received yet.

2. Investing Cash Flow

Cashflow from Investing Activities

From a company's perspective, investments go beyond just purchasing stocks—they also include investments in future output, such as buying machinery, property, or equipment. During periods of growth and expansion, companies may show negative investing cash flows due to significant capital expenditures, which many investors consider a positive growth signal. As companies mature and their industries stabilize, investing cash flow may shrink, reflecting fewer new investments. Investments in fixed assets like machinery and equipment are a major component of investing cash flows, giving insight into the company’s capital expenditures during the period.

3. Financing Cash Flow

Cashflow from Financing Activities

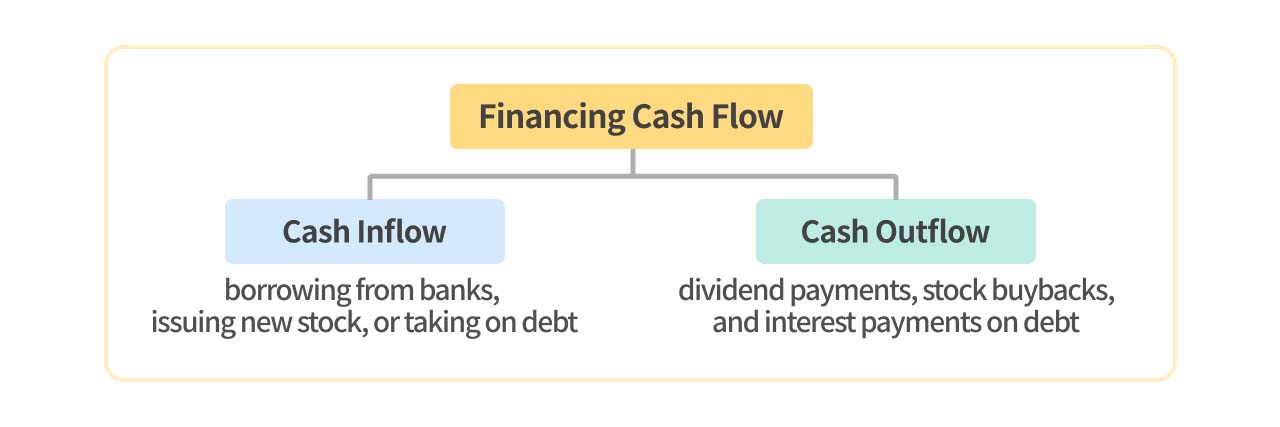

When a company needs funds, it can raise capital through borrowing or equity financing. Financing cash flow includes activities that increase a company’s cash, such as borrowing from banks, issuing new stock, or taking on debt. On the flip side, it also includes cash outflows like dividend payments, stock buybacks, and interest payments on debt. Changes in financing cash flow offer insight into a company’s external capital management and can signal potential future strategies or actions.

Conclusion

The cash flow statement helps us understand whether a company’s cash flow is stable and how it utilizes the cash generated from its operations. The cash flow statement is a versatile tool for investors, whether you're looking to invest in stocks or corporate bonds. By analyzing cash flow in conjunction with other financial statements, you can uncover valuable insights.

Interested in learning about the other two major financial statements? Check out our articles: