Before making an investment, it's important to confirm whether a company is profitable. The income statement, also known as the profit and loss statement, shows a company's profitability over a specific period, making it one of the three key financial statements investors use to quickly assess a company's performance. Below we will introduce some basic terms in income statement.

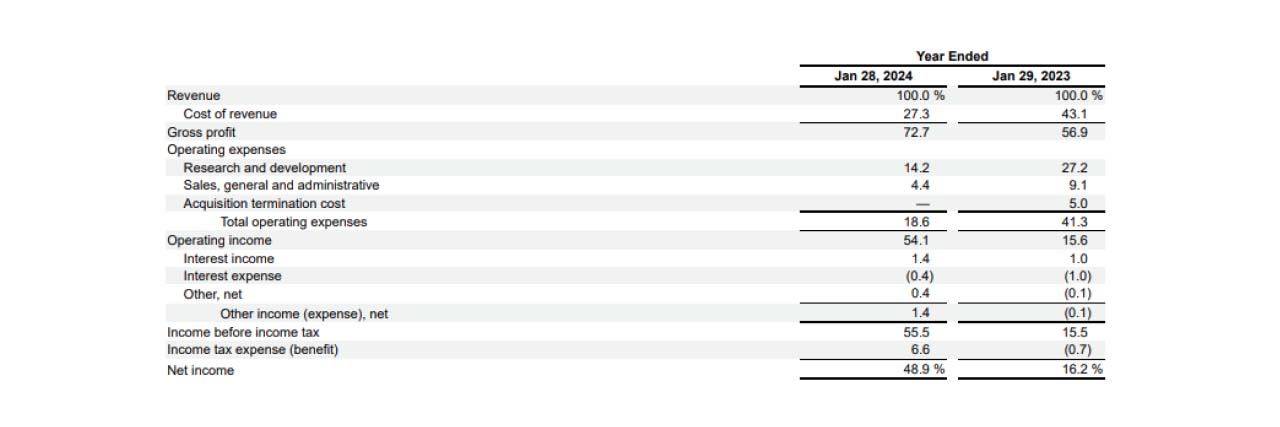

Income Statement Example

Let’s take Nvidia’s Income Statement as an example. By checking its annual report and finding the consolidated income statement, you’ll see the following format:

At the top of the income statement, you'll find some major items: revenue, cost of revenue and the widely discussed gross profit. Below we will start by introducing the three key components.

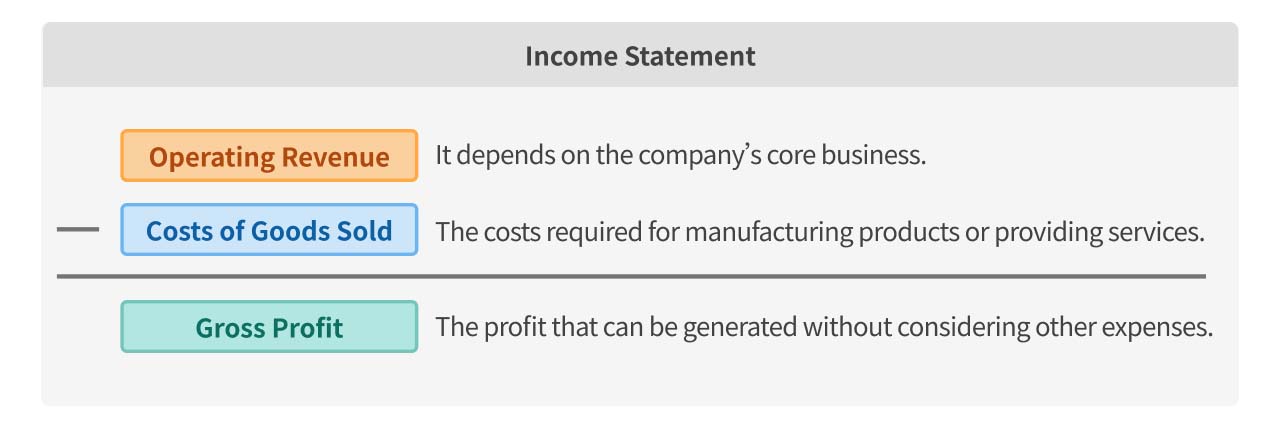

Operating Revenue and Costs

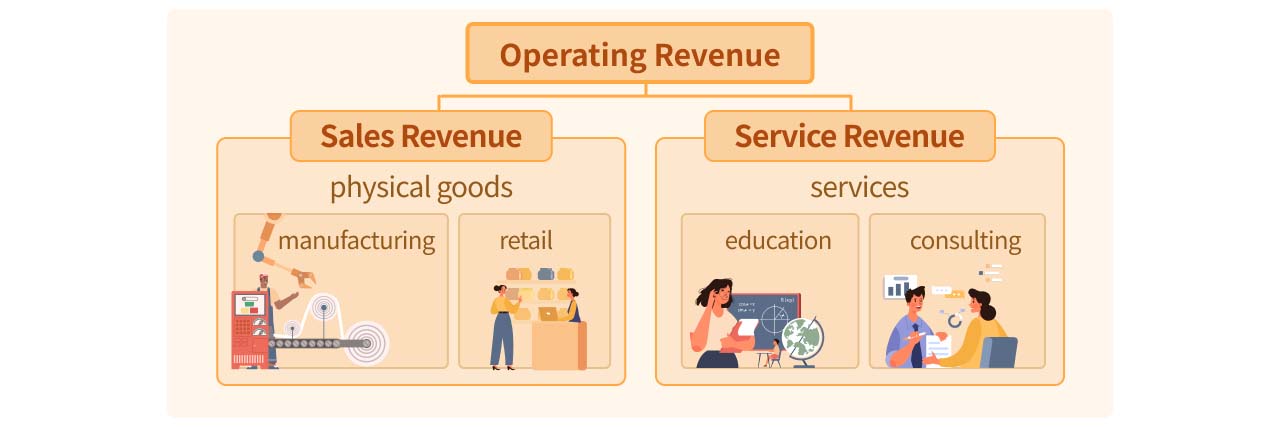

Operating Revenue: The Core Source of a Company’s Profit

A company's core revenue should theoretically come from its main business activities. The type of business varies based on the products or services sold. For example, a fruit shop generates revenue from selling fruit, a trading company earns from import/export activities, and a consulting firm provides professional advisory services. Generally, operating revenue can be classified into sales revenue (from physical goods) or service revenue (from services). In real-world cases, industries like manufacturing and retail primarily generate sales revenue, while service-oriented industries such as consulting or education generate service revenue.

Cost of Goods Sold (COGS): Direct Costs of Products and Services

The cost incurred to manufacture products or provide services is recorded as cost of goods sold (COGS) or sometimes referred to as operating costs. This includes raw materials, labor costs (salaries), and other expenses directly related to production or service delivery. These costs vary depending on the industry but are key to producing goods. Without these direct costs, the product could not be made.

Gross Profit: Direct Profit from Products

Gross Profit = Operating Revenue - COGS

Gross profit is derived from deducting the cost of goods sold from operating revenue. It reflects the profit a company generates from selling its products or services before considering other operating expenses.

Gross Margin: To better compare different companies, gross margin is calculated by dividing gross profit by operating revenue. Gross margin represents the percentage of revenue that exceeds the direct cost of producing goods. Generally, a higher gross margin indicates stronger profitability.

Gross Margin = (Operating Revenue - COGS) ÷ Operating Revenue

While gross profit represents the initial profit from core business activities, it doesn't account for all expenses. Next, we’ll explore how a company moves from gross profit to "net profit".

Operating Expenses and Profit

Indirect Costs of Business Operations

Operating expenses refer to costs incurred after producing a product and before realizing sales. For instance, after a software company successfully develops a product, it still needs support from other departments to sell it to customers. The operations team manages human resources, while the sales and marketing teams drive revenue. These functions incur costs that contribute indirectly to the sale of products. Common operating expenses include general administrative expenses, selling expenses, and research and development costs. Examples include office utilities, rent, labor costs (salaries), and advertising expenses.

| Software Company Labor Cost | Software Development Employee A | Marketing Employee B |

|---|---|---|

| Business Role | Product Development | Sales Planning and Advertising |

| Salary Recorded as | COGS | Operating Expense |

You may notice that "labor costs" appear in both COGS and operating expenses, depending on the employee’s role.

In the software company example:

- Employee A is a software developer responsible for product development, so his/ her salary is recorded as COGS.

- Employee B works in marketing, planning sales campaigns and advertisements, so his/ her salary is recorded as operating expenses, since it’s indirectly related to product production.

Operating Profit: Gross Profit Minus Operating Expenses

Operating profit is the result of subtracting operating expenses from gross profit, reflecting the profit a company earns from its core business. It’s a closer representation of the company’s actual profitability. Operating Margin: This is the percentage of operating profit to total revenue. A higher operating margin suggests the company is more efficient at turning revenue into profit.

Operating Margin = (Gross Profit - Operating Expenses) ÷ Operating Revenue

Non-Operating Gains and Losses

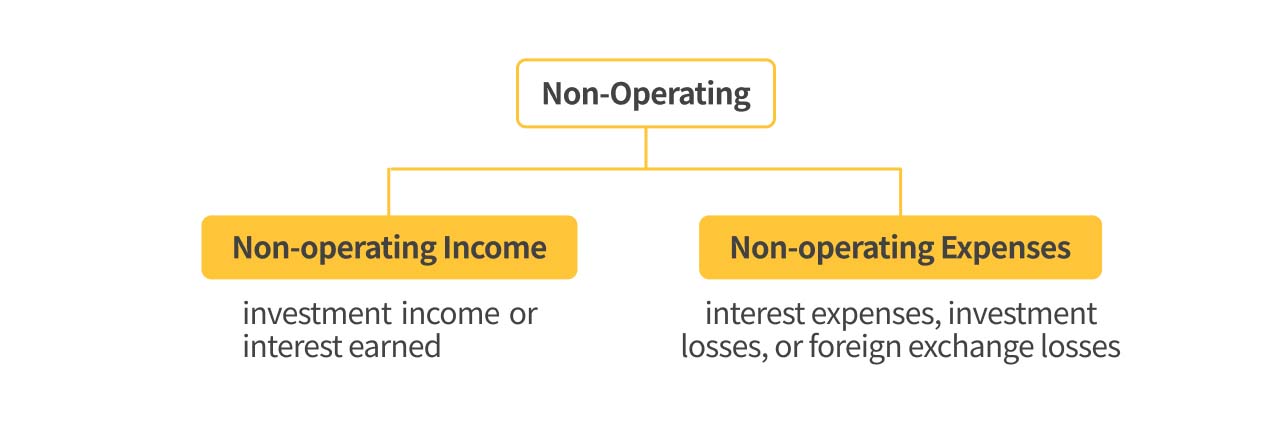

Non-Operating Income & Expenses

While operating profit reflects income from a company’s core business, some companies also engage in investments or other activities unrelated to their primary business. These gains or losses are recorded as non-operating income or expenses to avoid misleading investors about the company’s core profitability. Examples of non-operating income include investment income or interest earned. Non-operating expenses could include interest expenses, investment losses, or foreign exchange losses.

Net Profit

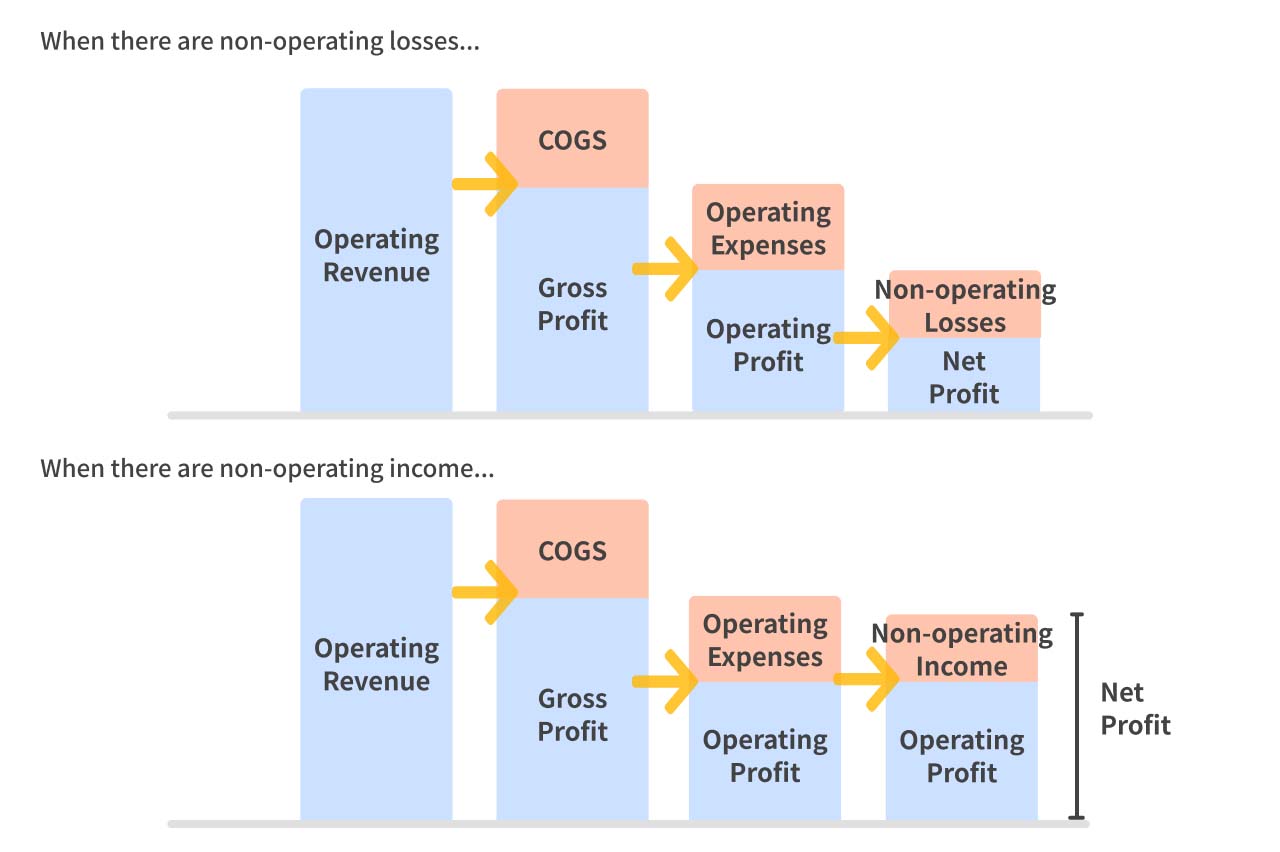

After accounting for both operating and non-operating income and expenses, the final figure is net profit.

- If non-operating income exceeds non-operating expenses, the result positively impacts net profit.

- Conversely, if non-operating expenses exceed income, the result reduces net profit.

Companies must also pay taxes based on their profits. Net profit after tax is the amount remaining after accounting for income tax. The number before tax is referred to as pre-tax profit.

For those interested in learning more about the other two key financial statements, feel free to check out our articles:

Financial Report 101: Introduction to the Balance Sheet

Financial Report 101: Introduction to the Cash Flow Statement