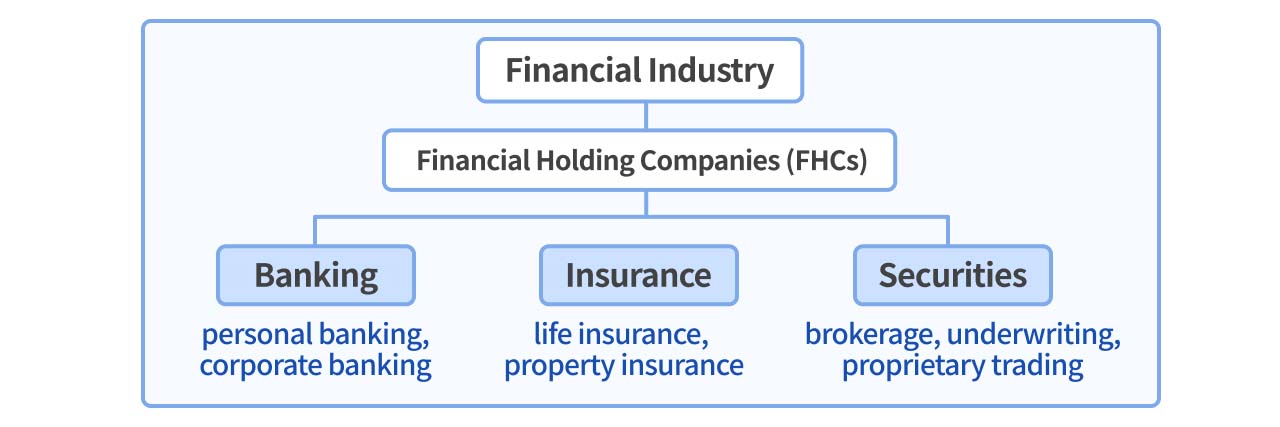

Financial services are an essential part of our lives, ranging from simple deposits and loans to investments in securities and insurance. The financial services industry is vast, and below we will introduce its main classifications. Generally, the financial sector is divided into categories such as financial holding companies, banking, securities, insurance, futures, and leasing industries.In this article, we'll focus on the most common sectors: financial holding companies (FHCs), banks, securities, and insurance.

Sector 1: Banking

The banking industry covers a wide range of services, including deposits, loans, fixed deposits, foreign exchange, and more. Banks usually cater to two main customer groups: personal banking and corporate banking. The primary sources of income for banks are the interest rate spread between loans and deposits, foreign exchange spreads, and transaction fees. In recent years, banks have also expanded into wealth management, earning commissions through the sale of funds, bonds, and other financial products.

In Taiwan, prominent domestic banks include The Shanghai Commercial & Savings Bank (5876), Chang Hwa Bank (2801), and Taiwan Business Bank (2834), while foreign banks such as Citibank, Standard Chartered, and DBS also operate locally.

Sector 2: Insurance

The insurance industry is divided into two main categories: "life insurance" and "property insurance." Life insurance covers policies such as life, medical, cancer, and critical illness insurance, while property insurance includes products like travel inconvenience insurance, car insurance, and home fire insurance. Different insurance products cater to varying customer needs.

Examples of companies in this sector include property insurers like Shinkong Insurance (2850) and Taiwan Fire & Marine Insurance (2832), as well as life insurance companies like Mercuries Life Insurance (2867).

Sector 3: Securities

The securities industry operates in areas such as brokerage, proprietary trading, and underwriting.

- Proprietary trading involves buying and selling securities to generate profits.

- Underwriting focuses on assisting unlisted companies with fundraising and issuing new shares, primarily in the primary market.

- Brokerage services act as intermediaries, helping investors buy and sell securities, such as the most well-known stock trading. Other services include financing and securities lending.

Securities companies' revenues primarily come from transaction fees, making their earnings closely tied to stock market performance. For instance, Capital Securities’s EPS reach 2.42 in the bull market of 2021, then drop to 0.39 during the bear market of 2022. Key securities companies in Taiwan include Capital Securiteies (6005), President Securities (2855), and Horizon Securities (6015).

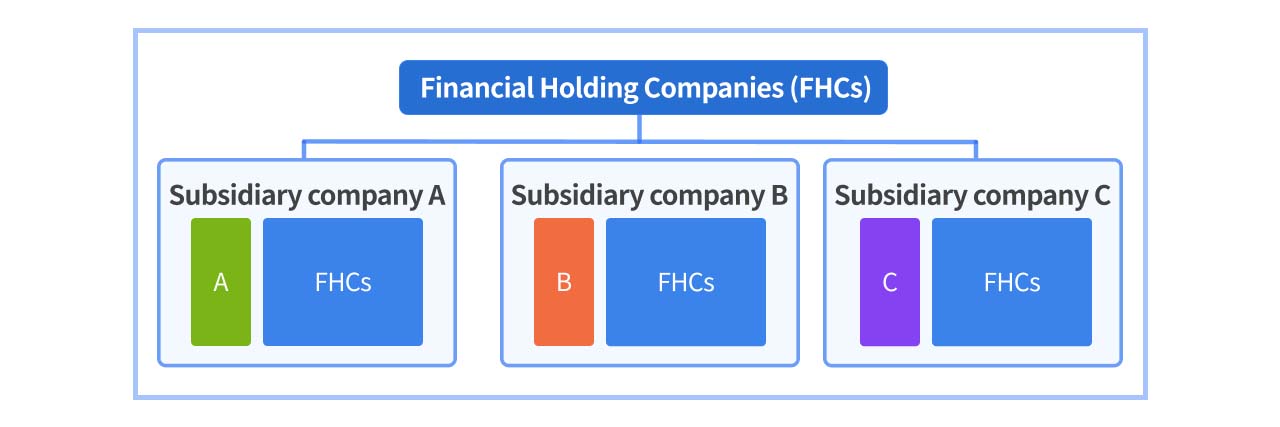

Sector 4: Financial Holding Companies (FHCs)

Financial holding companies (FHCs) integrate multiple financial institutions, such as banks, life insurance, securities, and even asset management or investment advisory firms under one group. An FHC acts as the parent company of a diversified financial group, earning income from various sectors, making it a relatively stable entity compared to individual business units. Subsidiaries operate independently but also collaborate to generate maximum synergy.

Currently, there are a lot of financial stocks in the market that are part of FHCs. Main companies in Taiwan include CTBC Financial Holding (2891), Fubon Financial Holding (2881), and Cathay Financial Holding(2882).

Now that we’ve covered an overview of the financial industry, below we will introduce some ETFs that focus on financial stocks!

Overview of Financial Stock ETFs

Financial stocks are known for their "stable dividends" and "low volatility," making them attractive to investors seeking steady cash flow and capital preservation. We’ve selected four ETFs that prioritize these features, which is why financial stocks are heavily weighted in these products:

| Yuanta/P-shares MSCI Taiwan Financials ETF (0055.TW) | Cathay TIP TAIEX+ Low Volatility Select 30 ETF (00701.TW) | SinoPac Taiwan Superior Dividend Highlight Stocks ETF (00907.TW) | Fuh Hwa FTSE Taiwan High Div Low Vol ETF (00731.TW) | |

|---|---|---|---|---|

| Inception date | 2007/07/16 | 2017/08/17 | 2022/05/24 | 2018/04/20 |

| Management fee/ Custody fee (Maximum) | 0.40%/0.035% | 0.30%/0.035% | 0.45%/0.04% | 0.30%/0. 035% |

| Listing price/ Current price(5/10) (NTD) | 15/26.62 | 20/27.88 | 15/15.88 | 50/76.90 |

| Percentage of financial stocks | 93.74% | 63.53% | 39.13% | 26.44% |

| Dividend Policy | Annual Payment | Semi-annual Payment | Bi-monthly Payment | Quarterly Payment |

| Annualized dividend yield over the past 5 years | 3.29% | 4.72% | 3.88% | 5.75% |

| Annualized return over the past 5 years (Including dividends) | 11.92% | 10.37% | 13.11% | 15.30% |

(Note: Since 00907 was launched recently, its annualized dividend yield and return are calculated from inception to the present.)

0055 Yuanta/P-shares MSCI Taiwan Financials ETF

Launched in 2007, this ETF tracks the MSCI Taiwan Financial Index, which is compiled by Morgan Stanley Capital International (MSCI). The index primarily tracks financial stocks, with some exposure to real estate companies, but more than 90% of its holdings are traditional financial institutions. This annually distributing ETF has offered an average dividend yield of 3.29% over the past five years, consistent with financial stocks’ typical range of 3% to 5%.

00701 Cathay TIP TAIEX+ Low Volatility Select 30 ETF

The stock selection criteria for 00701 focuses on "consistent profitability and low price volatility." It selects profitable companies with stable cash dividends and then chooses the 30 stocks with the lowest price volatility. As a result, more than 60% of this ETF's holdings are financial stocks, with the remainder in defensive stocks like Chunghwa Telecom, President Chain Store, and China Steel. 00701 pays dividends semi-annually, offering a five-year average dividend yield of 4.72%.

00907 SinoPac Taiwan Superior Dividend Highlight Stocks ETF

Launched in 2022, this ETF focuses on "dividend investing" and includes companies with stable dividend payments, low volatility, and strong ESG performance. Although it performs modestly during bull markets, it tends to be more resilient during downturns. Financial stocks make up nearly 40% of this ETF's holdings. It pays dividends every two months, with an average yield of 3.88%, making it suitable for investors seeking frequent cash payouts.

00731 Fuh Hwa FTSE Taiwan High Div Low Vol ETF

This ETF follows FTSE Taiwan 50 Index and FTSE Taiwan Mid-Cap 100 Index, selecting the top 60 dividend-yielding companies and further narrowing them to the 40 with the lowest volatility. Compared to the previous three ETFs, this one is more diversified across industries, with financial stocks making up slightly over 25%. Its average five-year dividend yield is the highest at 5.75%, making it appealing to investors looking for higher dividend payouts.

Top 5 Holdings Comparison

| Yuanta/P-shares MSCI Taiwan Financials ETF (0055.TW) | Holding Percentage (%) | Cathay TIP TAIEX+ Low Volatility Select 30 ETF (00701.TW) | Holding Percentage (%) | SinoPac Taiwan Superior Dividend Highlight Stocks ETF (00907.TW) | Holding Percentage (%) | Fuh Hwa FTSE Taiwan High Div Low Vol ETF (00731.TW) | Holding Percentage (%) |

|---|---|---|---|---|---|---|---|

| CTBC Financial Holding Co., Ltd. (2891) | 12.04 | CTBC Financial Holding Co., Ltd. (2891) | 8.98 | Evergreen Marine Corp. Taiwan Ltd. (2603) | 11.34 | Hon Hai Precision Industry Co., Ltd., also known as Foxconn (2317) | 13.71 |

| Fubon Financial Holding Co., Ltd. (2881) | 10.80 | Fubon Financial Holding Co., Ltd. (2881) | 8.88 | Wan Hai Lines Ltd. (2615) | 6.96 | Delta Electronics, Inc. (2308) | 8.05 |

| Cathay Financial Holding Co., Ltd. (2882) | 9.63 | Chunghwa Telecom Co., Ltd. (2412) | 8.57 | CTBC Financial Holding Co., Ltd. (2891) | 5.06 | CTBC Financial Holding Co., Ltd. (2891) | 7.24 |

| Mega Financial Holding Co., Ltd. (2886) | 9.21 | Cathay Financial Holding Co., Ltd. (2882) | 6.71 | Chung Hung Steel Corporation (2014) | 4.67 | United Microelectronics Corporation (2303) | 6.93 |

| E.SUN Financial Holding Co., Ltd. (2884) | 7.73 | Mega Financial Holding Co., Ltd. (2886) | 6.09 | SinoPac Financial Holdings Co., Ltd. (2890) | 4.41 | ASE Technology Holding Co., Ltd. (3711) | 5.89 |

From the above chart, we can observe that their top five financial holdings typically include major financial holding companies such as CTBC Financial, Fubon Financial, and Cathay Financial. These companies are large in scale and have a wide range of business operations, covering banking, insurance, and securities. Due to their diversified business models, they generally generate more stable revenue and dividends, which is why they are frequently included as core holdings in these ETFs.