OpenAI, founded in 2015 as a nonprofit organization dedicated to developing Artificial General Intelligence (AGI) for the benefit of humanity, has been considering a shift toward becoming a for-profit entity. Its founders include prominent figures such as Sam Altman and Elon Musk, and its widely know products, such as ChatGPT. Recent reports suggest that OpenAI may transition away from nonprofit board control. Simultaneously, the organization has raised $6.6 billion in funding, elevating its valuation to $157 billion, alongside significant leadership departures, including key figures such as its research director, CTO, and co-founder.

Although OpenAI maintains its nonprofit identity publicly, these developments raise questions about the organization's future direction. Let’s explore the potential paths and challenges OpenAI may face as it pursues profitability.

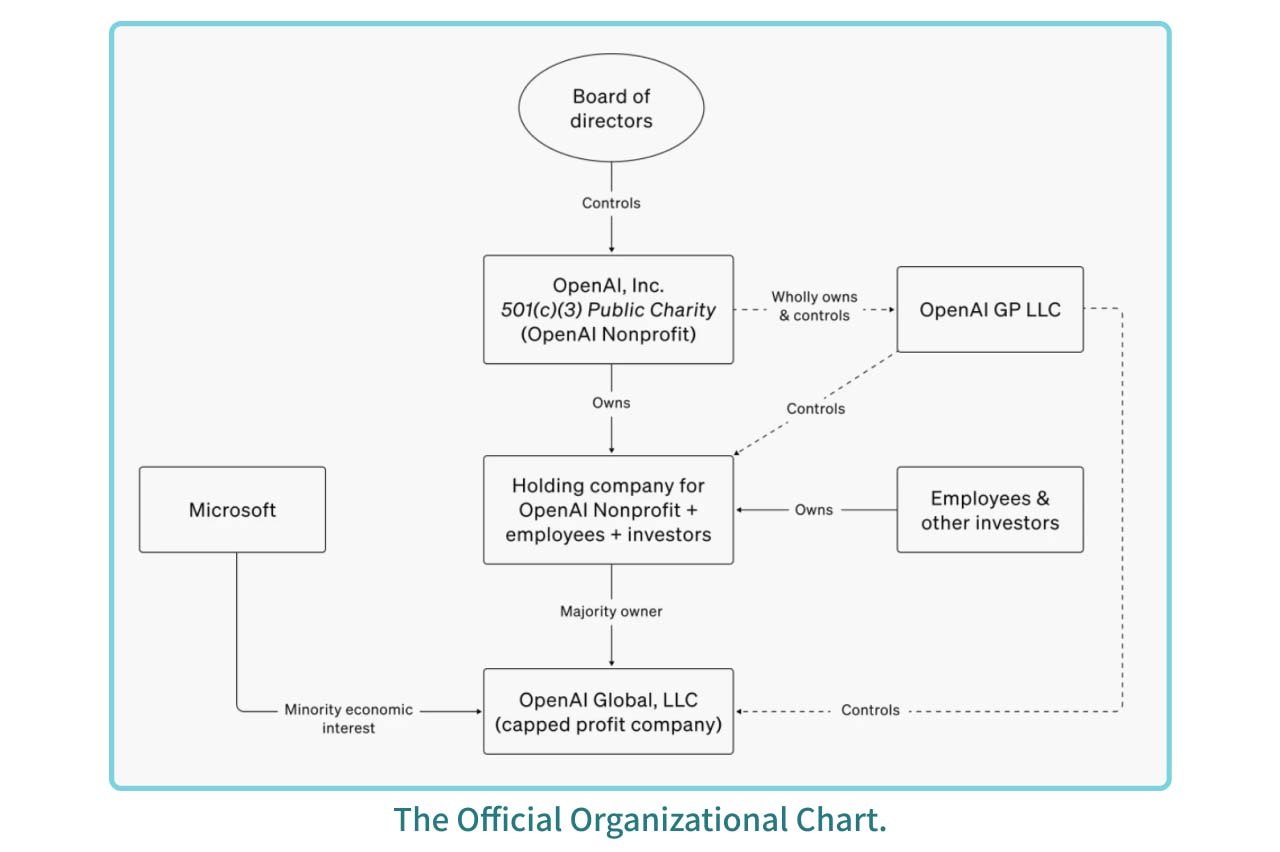

OpenAI’s Organizational Structure

OpenAI, Inc., also referred to as OpenAI Nonprofit, is the nonprofit branch overseeing the development of AGI with the primary goal of benefiting humanity, devoid of profit or financial obligations.

However, increasing operational costs prompted OpenAI to establish a for-profit subsidiary in 2019—OpenAI LP, which has since been restructured as OpenAI Global, LLC. This entity raises funds through venture capital and convertible debt, with Sam Altman as CEO.

The key principles for this for-profit subsidiary- OpenAI LP include as the following:

- Limited profit return: Investors are capped at 100x returns on their initial investments, with excess profits returned to the nonprofit branch.

- Operational control: OpenAI Nonprofit retains full control of its subsidiary through a 100% ownership structure, ensuring that the organization’s mission remains central.

Microsoft, OpenAI’s largest investor, holds a 49% stake in the subsidiary. However, its intellectual property (IP) rights and commercial agreements exclude AGI’s core technologies, preserving OpenAI’s independence.

OpenAI's Monetization Strategy

Why Consider Profitability?

One of the the reason for OpenAI to consider profitablity is likely the growing cost of AI training and development. When OpenAI LP was formed in 2019, CEO Sam Altman cited the significant resources required for early-stage AI development as a key reason. Today, competition among tech giants for computational resources and infrastructure has intensified, leading to escalating costs.

Potential Paths and Challenges for Profitability

One possible direction for OpenAI is to become a Public Benefit Corporation (PBC), which balances profit-making with a public mission. Unlike nonprofits, PBCs can issue stock and have shareholders who own equity in the company. The major challenge would be restructuring OpenAI’s current profit-sharing agreements into equity. Reports suggest that Altman may personally seek a 7% stake in OpenAI.

Managerial and Regulatory Challenges

Profitability may clash with employee beliefs, potentially leading to talent attrition and leadership turnover. The organization’s unique structure, combined with complex regulatory environments across jurisdictions, adds layers of difficulty to implementing such a change.

Microsoft’s Role and Concerns for Monopoly

Microsoft, having invested nearly $13 billion in OpenAI, wields significant influence over its operations and decisions. Concerns about monopoly risks arise from Microsoft’s dominant position, potentially threatening OpenAI’s independence. Safeguarding AGI’s core technologies from direct Microsoft control is vital to maintaining balance in the partnership.

Future Development for OpenAI

Lessons from Mozilla’s Model

OpenAI can draw parallels with Mozilla Foundation, a nonprofit supporting open-source projects. Mozilla operates several for-profit subsidiaries, such as those responsible for the Firefox browser. The key difference from OpenAI lies in Mozilla's governance structure, where each for-profit subsidiary has its own board of directors, selected annually by the nonprofit foundation's board. However, while the nonprofit board oversees the subsidiaries, it cannot interfere in personnel decisions within the for-profit entities. This structure ensures both accountability and operational independence for each subsidiary.

Opportunities and Concerns

Profitability could improve OpenAI’s operational efficiency, financial stability, and transparency. Revenue from product sales could attract significant external investment. However, critics argue that transitioning to a PBC might deviate from OpenAI’s original mission of ensuring safe and broadly beneficial AGI development.

Profit incentives could exacerbate ethical and legal challenges associated with AI. Experts suggest government regulation is necessary to address fundamental issues in the AI industry, as many companies developing AI today operate under a profit-driven model.

OpenAI’s path toward profitability presents opportunities for growth but also significant challenges. Balancing innovation, safety, and ethics with financial sustainability will be critical in shaping the organization’s future.