Why are so many people discussing stocks? This might be a common question for many beginner investors. In order to explain what a stock is properly, we will have to start with the question “why do stocks exist?”. How are companies established and operated, and what is their connection to stocks? Finally, we will be discussing what are the benefits of investing in stocks.

What Is a Stock?

Issuing Stocks Is One of the Ways for Companies to Raise Capital

In the early stages of a company, it may require a certain amount of capital for operations. What would you do if you have an entrepreneurial idea but the scale of the business cannot be achieved with your own funds alone? You might be considering pooling resources with friends! This seems like a straightforward solution. The concept of pooling resources from multiple parties is actually why stocks need to be issued. Besides of the initial phase, when a company reaches a certain scale and wants to expand further, it may issue additional stock to raise capital.

Stocks Provide a Record of Each Participant's Investment

To keep track of the percentage of each investor's ownership , issuing stocks becomes very important! A stock is a type of security (a certificate of ownership with value), and investors who hold stocks are shareholders in a corporation with a certain proportion of ownership in the company. Since investors are owning parts of the company, they have rights, including attending shareholder meetings, receiving a share of the company’s profits (dividends), and even participating in major corporate decisions (voting rights).

The ownership of Stocks Can Be Transferred through trades

As mentioned above, stock is a proof of investor's partial ownership of a company. Naturally, stock ownership is generally transferable. If another investor foresees better growth prospects for the company and is willing to purchase shares at a price higher than their current value, there might be some shareholders willing to sell their shares!

When a company reaches a certain scale, more investors may want to participate, making a fixed trading market crucial! This trading market is the stock market (such as a stock exchange). Just as many fruits and vegetables are auctioned in wholesale markets, the stock market also hosts a variety of different stocks. While the stocks differ, individual investors can still bid for them in a standardized way, and that is the advantage of a stock exchange.

Summary: Stocks Are a Direct Investment in a Company

When a company faces a funding gap—whether for initial capital or future expansion needs—issuing stocks is a way for the company to directly obtain additional capital. Unlike buying bonds, where investors become creditors to the company (lending money to the company), stock investors are considered part of the owners of the company (investing in the company). The obligations and rights associated with these two roles differ significantly.

Now that we understand why stocks are issued and how they are traded in the stock market, you might be asking: "What are the benefits of investing in stocks?"

Benefits of Investing in Stocks

Stock Investment is a Form of Financial Management

Because stocks are widely discussed, many people consider stock investing as their first step when they start managing their finances. Since stock prices fluctuate (through market trading), stock investments naturally carry risks, and returns are not guaranteed. However, it is also the potential of fluctuation that motivates many people to invest in stocks with the hope of earning a significant income.

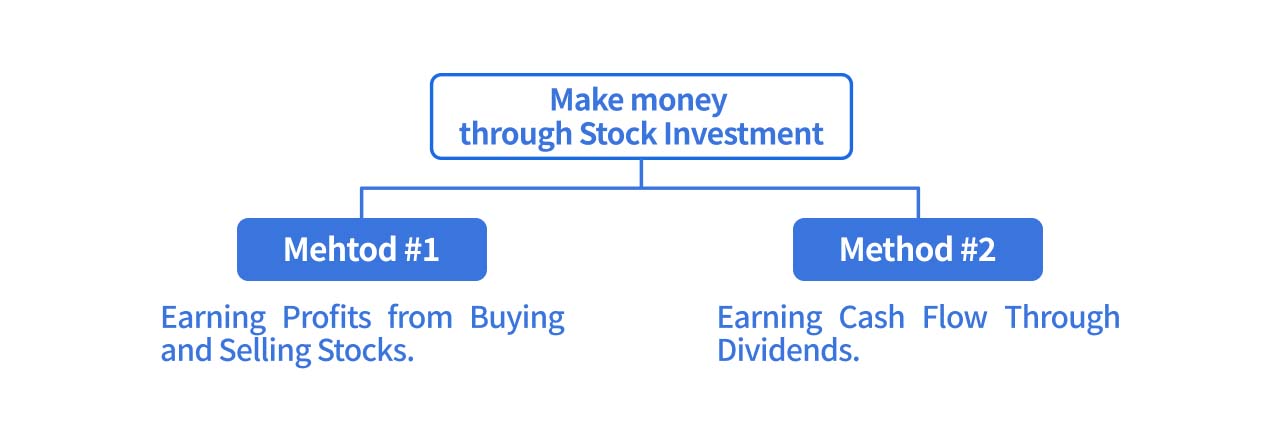

There are generally two ways to make money by investing in stocks: one is to profit from the price difference by buying and selling stocks, and the other is to earn cash flow through receiving dividends.

1. Earning Profits from Buying and Selling Stocks

To explain this, we would need to understand why stock prices fluctuate. The explanation may vary depending on the investment strategy chosen by the investor. Here’s a simple way to understand it: stock price fluctuations represent the gradual convergence of investors' perspectives on price and value.

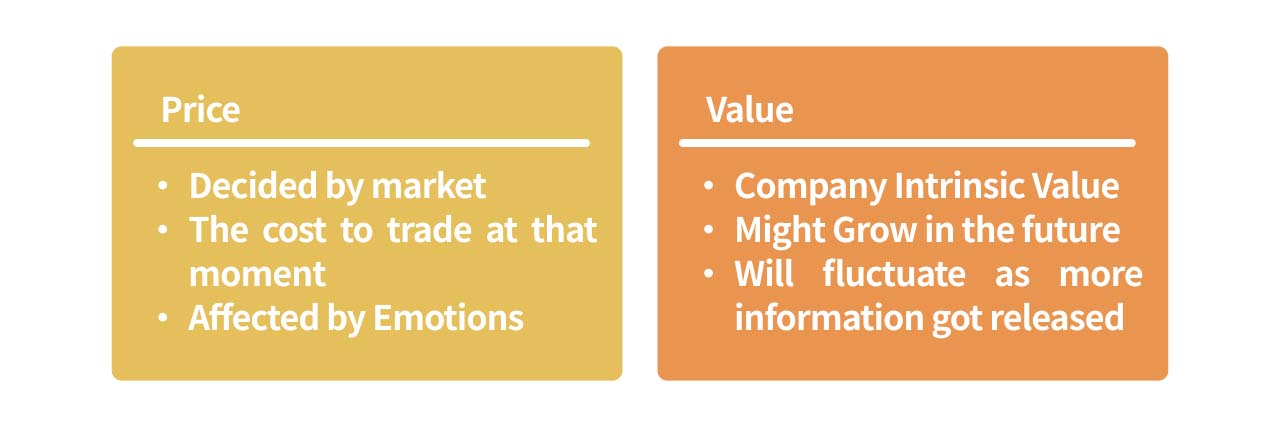

- The “price” of a stock is determined by market transactions. Imagine trading stocks as an auction process; emotions inevitably influence and are reflected in stock prices. The stock price can also be seen as the cost we are willing to pay at that moment to invest in the company.

- The “value” of a stock, on the other hand, represents the intrinsic value of a company. Many analysts in the market attempt to find the “hidden value” of a company by analyzing various clues (financial reports, news, etc.). As information becomes more transparent and verified over time (e.g., profit announcements), the “price” will gradually converge toward the “value.”

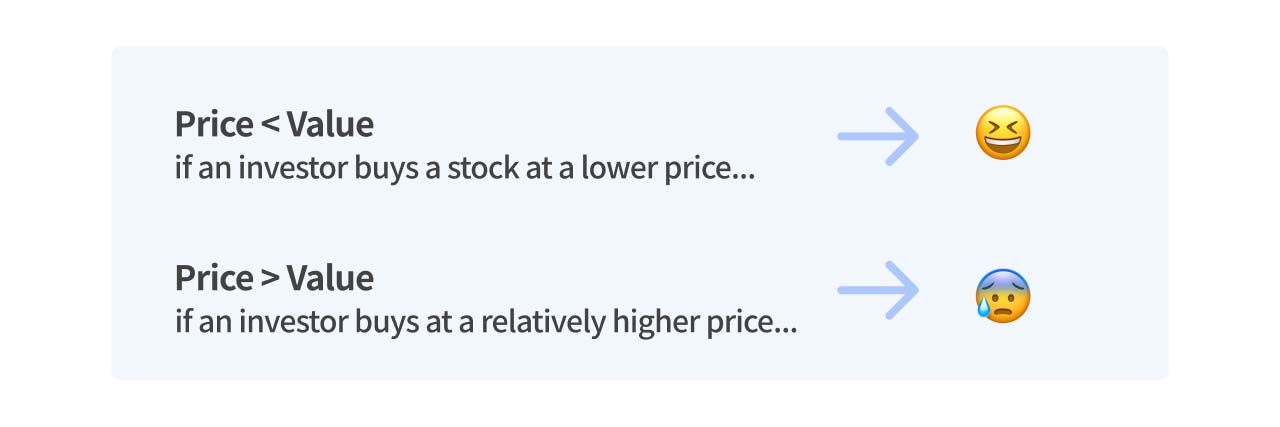

If an investor buys a stock at a lower price (price < intrinsic value), they can sell it later when the price rises to earn a profit. Conversely, if an investor buys at a relatively higher price (price > intrinsic value), they may face the risk of a loss.

2. Earning Cash Flow Through Dividends

Dividends are another way to profit from stock investments. As mentioned above, investing in stocks is becoming part of the owner of a company. Based on the concept, some companies distribute a portion of their annual earnings back to their shareholders.

Compared to capital gains from stock price appreciation, the money earned from dividends is generally more limited. However, dividends have the advantage of providing a relatively stable cash flow.

Ideally, investors aim to have this passive income (dividends, interest, etc.) support their daily expenses. If not, they aim to increase the percentage of passive income within total income, ultimately achieving financial freedom.

It’s important to note that dividend payouts do not necessarily mean investors have truly profited, a topic we will discuss in more detail later when we cover dividends.

Compared to other investment tools, stocks are relatively simple and easy to start with, which is why many investors use them as their first investment tool when beginning to manage their finances.

If you're a beginner unsure of how to start, you can continue reading our article on A must-read for stock market beginners! How should beginners start investing in stocks?