Continuing from the discussions in the previous three articles, fiisual’s 2026 Outlook series now reaches its final installment. For readers who haven’t gone through the earlier pieces yet, you may want to review them first:

2026 Outlook Series Part 1 – What’s Next for the Global Economy in the Age of AI

2026 Outlook Series Part 2 – Key Industry Focus: ASIC

2026 Outlook Series Part 3 – Key Industry: Thermal Management

Key Industry #3: Memory

The second major pillar of the 2026 AI outlook is industries facing a clearly tightening supply side. Unlike ASICs and thermal solutions, memory is a sector with relatively mature technological evolution and well-defined business cycles. However, AI-driven demand for high-density storage continues to rise, while manufacturers are allocating substantial capital expenditure to advanced nodes and new technologies. This has crowded out traditional capacity, leading to a structurally tight supply–demand balance. As supply cannot expand at the same pace as AI-driven demand growth, memory pricing has entered an upcycle since 2025 and is expected to extend into 2026, making memory a representative industry where supply shortages drive higher prices.

Memory Segmented by Usage: Market Focus on DRAM and NAND

Memory products span a wide range of technologies, including DRAM, NAND, NOR, and SRAM. In real-world applications, however, DRAM and NAND perform the two most critical functions in modern computing systems: working memory and storage memory. These two categories see the highest usage and most stable demand across servers, PCs, smartphones, and data centers, together accounting for the vast majority of global memory revenue and shipments. As a result, industry analysis typically centers on DRAM and NAND.

NAND Flash, used primarily for long-term data storage, is a key component for data retention across devices. Compared with DRAM, NAND offers slower read/write speeds but clear advantages in capacity, cost, and data retention. It features large capacity, non-volatility, and significantly lower cost per bit, making it the dominant storage technology. Applications include consumer SSDs, embedded storage in smartphones and tablets, automotive and industrial embedded storage, and enterprise SSDs deployed at scale in data centers.

DRAM (Dynamic Random Access Memory), by contrast, is designed for scenarios requiring real-time response and high bandwidth throughput. It offers extremely fast access speeds but higher cost per bit and smaller capacity, making it ideal as system memory and working space for running programs. All servers, PCs, laptops, and smartphones rely on DRAM as system memory to ensure real-time performance and processing efficiency.

HBM: Stacked DRAM Delivering High Bandwidth and Low Latency

HBM (High Bandwidth Memory) is a memory system designed specifically for AI training and inference chips, providing ultra-high bandwidth and low-latency data access for GPUs and AI ASICs. Fundamentally an extension of DRAM, HBM differs significantly in structure: it uses TSV-based 3D stacking to vertically integrate multiple DRAM dies into a single stack, combined with wide I/O interfaces and advanced packaging. This dramatically increases effective bandwidth per package while delivering superior power efficiency. As a result, HBM has become a critical 3D-stacked DRAM solution placed adjacent to AI chips, forming the foundation for continued performance gains in large-scale model training and inference.

NAND Supply Shortage Driven by Production Cuts and Surging Demand

Conservative Capex and Slow Capacity Expansion Since Late 2024

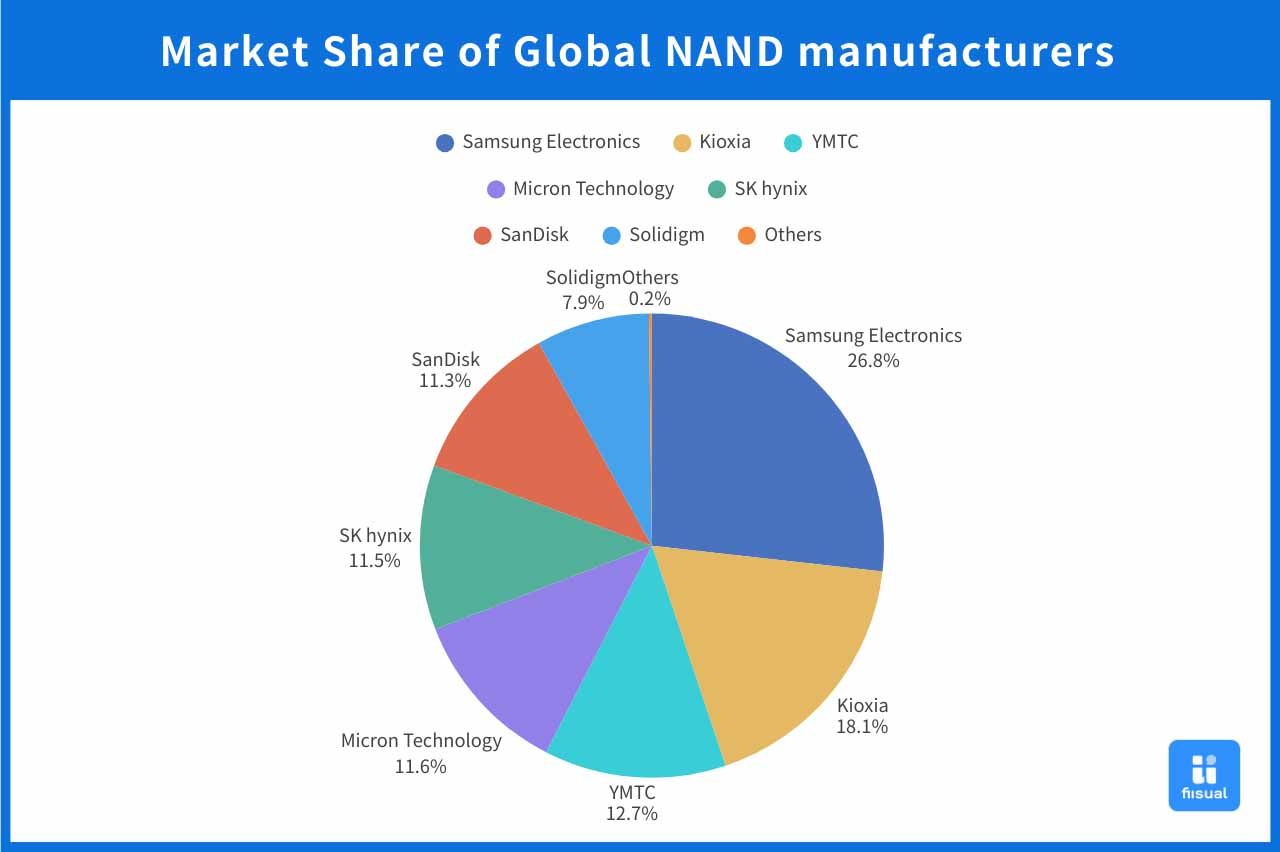

NAND supply is relatively diversified, with major suppliers including Samsung, SK hynix, Kioxia, Micron, SanDisk, and YMTC. Market share is more fragmented, resulting in a multi-oligopoly competitive landscape.

Since late 2024, expectations of weaker future demand have led major NAND manufacturers to adopt stricter capex discipline. NAND bit output growth in 2025 is estimated at only ~11%, with capex growth of just 4%, focused mainly on node migration and maintenance rather than new capacity. Some vendors have further reduced wafer starts in 2025, with production cuts ranging from 5% to 30%, led by Samsung.

While Yangtze Memory Technology (YMTC) continues to expand aggressively under China’s localization policy, most of its output serves the domestic market and has limited impact on global supply. As a result, even with a modest recovery in wafer starts in 2025, overall supply remains well below prior peaks, with the industry prioritizing price stability and profitability over rapid share expansion.

AI Data Centers and Enterprise SSD Demand Far Exceed Expectations Starting in 2H25

On the demand side, NAND end applications span PCs and smartphones, consumer electronics, data centers, and SSDs. The market had initially expected a limited recovery in consumer electronics in 2025, leaving most NAND demand in an inventory adjustment phase. However, conditions reversed sharply starting in 2H25: cloud service providers (CSPs) broadly accelerated the buildout of AI data centers, creating a supply shortfall in HDDs, the primary storage medium. Due to long lead times and years of underinvestment in capacity expansion, HDDs were unable to meet near-term capacity requirements, forcing CSPs to substitute with enterprise-grade SSDs. This significantly boosted NAND demand and pushed overall market demand well above prior expectations.

| SSD | HDD | |

|---|---|---|

| Read speed | High | Low |

| Latency | Low | High |

| Cost per unit of storage | High | Low |

| Storage density | High | Low |

| Shock resistance / noise | Better | Worse |

| Durability | Shorter | Longer |

At the same time, as inference token counts continue to rise and image generation and multimodal applications rapidly proliferate, the share of AI servers in the NAND consumption mix has increased substantially. AI and inference workloads are creating structural incremental demand that not only offsets weakness in traditional segments but also reshapes the demand curve of the storage market. Total server NAND demand in 2025 is estimated to grow 19% year over year to 321 EB, lifting its share of global NAND consumption to around 30% and making it the core driver of NAND’s next growth cycle.

Tight Supply Through 2026 Raises NAND Price Upside Risk

NAND prices began recovering in 2Q25 and strengthened significantly in 3Q25, reflecting both supply tightening and demand recovery. Looking ahead to 2026, sustained AI capex is expected to keep data center and enterprise SSD demand strong. However, supply expansion remains the key variable.

Although many manufacturers have announced mid- to long-term expansion plans, most new capacity will not come online until after 2027. YMTC’s incremental bit supply is also unlikely to materially impact the market until after 2026. Under accelerated AI infrastructure deployment, the global NAND market is expected to face a ~2% supply gap in 2026, potentially widening to 5–8% if SSD substitution for HDDs accelerates faster than expected, significantly increasing price upside risk.

DRAM: Technology EOL and HBM Capex Drive Price Upside

DRAM products are currently dominated by the DDR (Double Data Rate) family. DDR, short for Double Data Rate, was first introduced in 2000 as the successor to SDRAM. As applications continue to demand higher bandwidth and efficiency, DRAM manufacturers typically roll out a new DDR generation every few years, with ongoing improvements in operating frequency, data transfer bandwidth, and power efficiency. At present, DDR4 and DDR5 are the mainstream standards in the market.

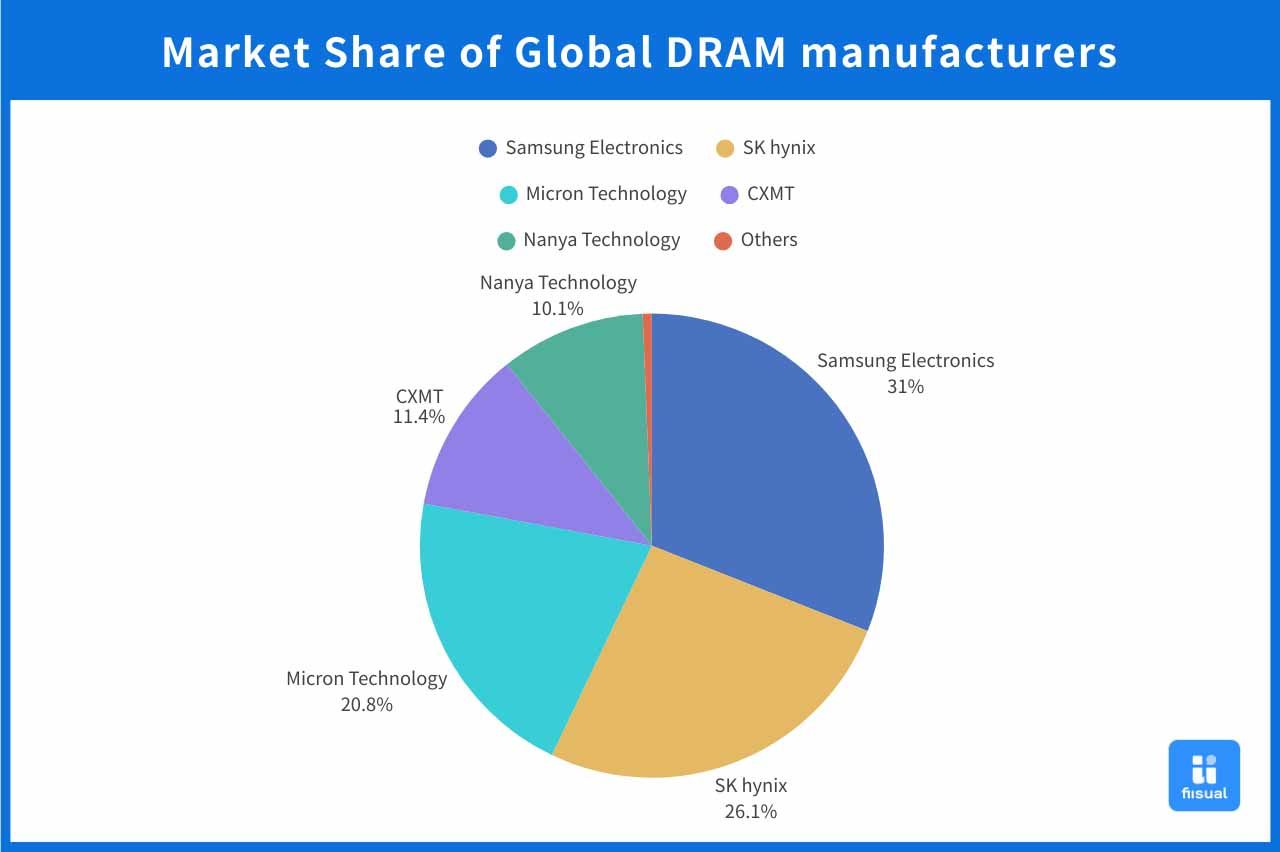

Compared with NAND, DRAM supply is far more concentrated. The market is dominated by three major manufacturers—Samsung, SK hynix, and Micron—which together account for more than 85% of global market share, forming a highly oligopolistic structure. In recent years, China-based ChangXin Memory Technologies (CXMT) has expanded aggressively and has become the largest DRAM supplier outside the top three, rapidly catching up in certain mid- to low-end product segments. In Taiwan, Nanya Technology and Winbond also operate DRAM capacity, but they primarily focus on specific application niches and together account for only a single-digit percentage of the overall DRAM market.

DDR4: A Mature Standard Sustained at Elevated Levels Under EOL

DDR4 is the most mature and widely adopted DRAM generation, broadly used in traditional servers, PCs/notebooks, industrial equipment, and automotive electronics—applications with long product lifecycles. These use cases typically involve long qualification cycles, high costs for design changes, and strong sensitivity to pricing and system stability. As a result, even though DDR5 has become the mainstream upgrade path, DDR4 remains difficult to fully replace across many existing platforms in the short term.

DDR4 Enters EOL at Major Manufacturers; Taiwanese Vendors Benefit from Order Shifts

As new memory technologies continue to advance and deliver higher performance and value, once the mass production cost of new nodes approaches that of older generations, manufacturers tend to reallocate capacity toward newer, higher-margin products. Accordingly, DDR4 officially entered the End of Life (EOL) phase at major manufacturers starting in 2025, with capacity increasingly shifting toward DDR5.

Major suppliers had initially laid out clear DDR4 EOL timelines. Samsung planned to reduce DDR4’s share of monthly wafer starts to the “mid-single-digit” percentage range by 4Q25, and further to the low-to-mid single digits by 2H26. SK hynix planned to fully terminate DDR4 production before 2Q26. However, a clear inflection emerged in mid-2025: U.S. reciprocal tariffs triggered a sharp increase in downstream inventory stocking, while ongoing EOL announcements heightened concerns over supply risk among brand customers and module makers. To secure future DDR4 supply, buyers raised bids aggressively, prompting manufacturers to delay their EOL schedules.

| Company | Original EOL Timeline | Revised EOL Timeline |

|---|---|---|

| Samsung | Sharply reduced to “mid-single-digit” share in 2H25 | Supply extended to mid-2026 |

| SK hynix | Full termination before 2Q26 | Supply extended to 4Q26 |

| Micron | Most DDR4 lines EOL between end-2025 and 1Q26, retaining only limited applications | – |

| CXMT | DDR4 EOL officially initiated in 2Q25 | Limited DDR4 supply in 2026 |

Although most DRAM manufacturers chose to delay DDR4 EOL due to sharply rising DDR4 prices starting in 2025, the overall direction remains a gradual shift of capacity toward DDR5, with DDR4 supply continuing to decline. Because end applications have not been able to migrate at the same pace, Taiwanese suppliers Nanya Technology and Winbond—both still heavily focused on DDR4—have instead benefited from order transfers, expanding capacity counter-cyclically to fill market gaps. According to estimates, Nanya’s DDR4 monthly wafer starts will reach 52 kwpm in 2026, officially surpassing Samsung and SK hynix to become the world’s largest DDR4 supplier. Winbond is also expected to increase DDR4 capacity to around 15–18 kwpm in 2026, capturing additional demand as major vendors accelerate EOL.

Overall, while global DRAM leaders are rapidly transitioning to DDR5, persistent DDR4 demand in long-lifecycle applications has given Taiwanese vendors a rare opportunity for structural growth amid supply contraction and order shifts.

Long-Lifecycle Applications Support Rigid DDR4 Demand

DDR4 remains the most mature and widely adopted DRAM type. Although most PCs and servers are gradually migrating to DDR5, long-lifecycle applications such as industrial control, automotive, and networking equipment continue to exhibit stable and irreplaceable demand for DDR4. These systems are often not directly compatible with DDR5, and requalification cycles are lengthy and cost-sensitive, allowing DDR4 demand to remain meaningful over the medium term.

Overall, DDR4 bit demand in 2026 is estimated to remain around 192 billion gigabits, indicating that despite entering maturity, DDR4 still commands a non-negligible demand base in specific application markets.

DDR4 Supply Contraction Far Outpaces Demand Decline, Cementing a Shortage in 2026

From an overall supply–demand perspective, while end demand for DDR4 is gradually declining, supply is falling much faster as manufacturers aggressively promote DDR5 and accelerate DDR4 EOL, resulting in a clear shortage. More importantly, major DRAM suppliers have reiterated that they will not reverse course by restoring DDR4 capacity, confirming that DDR4 will remain structurally tight through 2026.

On pricing, historical experience from the DDR3-to-DDR4 transition shows that when legacy memory supply contracts rapidly, DDR3 prices briefly exceeded DDR4 and remained elevated for roughly three quarters. In the current cycle, DDR4 prices officially surpassed DDR5 in June 2025, signaling entry into a classic supply-scarcity phase. Based on historical patterns, elevated DDR4 pricing is expected to persist at least through 1Q26.

This cycle’s demand momentum is even stronger than the prior one. Delays in design changes and qualification for long-lifecycle applications, along with better-than-expected server demand, should continue to support robust DDR4 demand in 1H26. As a result, DDR4’s strong pricing environment is likely to extend through at least 2Q26, and potentially longer than in past cycles. Key indicators to watch include progress in customer redesigns and qualification, as well as the price spread between DDR4 and DDR5.

DDR5: Mainstream Standard with Demand-Driven Price Upside

Compared with DDR4, DDR5 offers higher bandwidth and improved performance and represents the mainstream direction for next-generation high-end DRAM. Demand is driven by three primary application areas. On the server side, the rapid adoption of high-core-count CPUs and AI accelerator platforms is pushing per-system memory capacity higher, making DDR5 standard in enterprise and AI servers. In the PC market, replacement demand driven by AI PCs and the Windows 10 EOL is accelerating DDR5 penetration in consumer devices, establishing it as the baseline specification for next-generation PCs. On the mobile side, LPDDR5/LPDDR5X serve as the primary counterparts—while technically distinct, they share the same generational positioning and performance characteristics as DDR5.

DDR4 EOL Lifts DDR5 Penetration, but HBM Crowding Limits Supply Growth

Benefiting from capacity reallocation driven by DDR4 EOL, DDR5 penetration is expected to reach around 80% of the overall DRAM market in 2025, firmly establishing it as the mainstream standard. However, DDR5 supply growth is not linear and remains constrained by several structural factors.

First, global DRAM investment remains conservative. Manufacturers are prioritizing process migration and product mix optimization rather than sharply increasing wafer starts, meaning DDR5 supply growth mainly comes from higher output efficiency per wafer rather than new capacity. Second, the rapid growth of HBM is crowding out DDR5. As HBM stack heights increase and the number of DRAM dies per unit rises significantly, the three major manufacturers must allocate advanced-node wafer capacity to HBM first, leaving less capacity for DDR5 and compressing its effective supply.

Looking ahead to 2026, DDR5’s supply dynamics are expected to mirror those of 2025. With HBM demand continuing to grow rapidly and stack heights increasing further, competition for advanced-node wafer capacity will continue to constrain conventional DRAM output, keeping DDR5 expansion relatively slow. A meaningful supply inflection is unlikely before 2027, when new capacity ramps, HBM yields and process maturity improve, and advanced-node bottlenecks gradually ease.

Server Stockpiling Far Exceeds Expectations, Worsening DDR5 Imbalances

DDR5 demand is primarily driven by servers, PCs, and smartphones. In 2025, the key driver behind DDR5 price strength has been server memory stockpiling by CSPs, which significantly exceeded market expectations. To mitigate supply risks, CSPs also pulled forward a large portion of their 2026 memory orders to secure adequate inventory levels. This concentrated stockpiling behavior has extended peak DDR5 demand conditions through the end of 2026, not only boosting server procurement intensity but also crowding out supply available to PCs and mobile devices, keeping the DDR5 market persistently tight.

Expanding DDR5 Supply Gap to Sustain Tightness and Price Increases Through End-2026

Based on supply–demand trends over 2025–2026, although supply increases gradually through process migration and product mix optimization, it continues to lag demand growth significantly. As a result, the market has been structurally undersupplied since 2025, with DDR5 prices on a sustained upward trajectory. Capacity expansion resources remain prioritized for HBM, limiting DDR5 allocable capacity, while much of the 2026 CSP demand has already been locked in. Consequently, effective supply remains even tighter. Overall, DDR5’s tight market conditions and price uptrend are expected to persist through the end of 2026, with limited near-term relief.

DDR4 and DDR5 Both in Structural Shortage; 2H26 Key for Price Reversal

Overall, DDR4 supply is declining far faster than demand, while DDR5 demand is growing much faster than supply. Both dynamics lead to structural shortages and sustained price increases. DDR4 price gains currently exceed those of DDR5, reflecting stronger market sensitivity to DDR4 scarcity. Going forward, close attention should be paid to changes in the price spread between DDR4 and DDR5 to assess cross-generation substitution and downstream purchasing behavior.

As for the timing of a price reversal, the key determinant remains the actual pace of supply expansion. While most manufacturers have signaled plans to launch a new round of capacity expansion starting in 2027, specific mass production nodes and timelines have yet to be detailed, making 2H26 a critical observation window. At that time, market participants will need to closely track actual expansion progress, advanced-node transition efficiency, and yield ramp-up to determine whether DRAM supply–demand conditions could shift from tight to loose, and thus identify a potential inflection point in the pricing cycle.

HBM: Core Growth Engine of DRAM Over the Next Few Years

HBM is a high-bandwidth memory specifically designed for GPUs and AI ASICs. It integrates multiple DRAM dies in a 3D stacked structure using TSV (through-silicon via) vertical interconnect technology, and is then co-packaged with GPUs or ASICs on the same substrate or within the same package through 2.5D/3D advanced packaging. This architecture delivers extremely high bandwidth at the level of multiple terabytes per second, along with superior energy efficiency per bit compared with DDR5. Within system architecture, HBM is not intended for long-term data storage; rather, it serves as real-time, high-throughput working memory for large-model training and inference, helping to break through the traditional DRAM “memory wall” bottleneck. As a result, HBM demand is highly correlated with AI accelerator shipment cycles and is widely regarded as the most critical DRAM sub-segment in the AI era.

HBM is also the primary growth driver for DRAM over the coming years. From a market structure perspective, HBM’s share of total DRAM value has surged from just 1% in 2022 and is expected to reach approximately 42% by 2026, highlighting a rapid shift in DRAM revenue toward AI accelerators. In terms of bit demand, HBM’s share has accelerated from 1%/4%/7% during 2022–2024 to an estimated 17% in 2025 and 31% in 2026. Looking to the medium and long term, the HBM market is expected to exceed USD 100 billion by 2027, with its bit demand growth rate continuing to outpace that of overall DRAM and establishing HBM as a core DRAM product category.

In 2026, supply and demand for earlier-generation HBM are expected to gradually move toward balance, while HBM4 will remain structurally tight.

Due to the extremely high technological barriers of HBM, global supply is currently highly concentrated among three manufacturers: SK hynix, Samsung, and Micron. Among them, SK hynix has secured approximately 80% market share by leveraging its advantages in process technology, stacking capability, and power efficiency in the HBM3E generation. It also clearly leads peers in HBM4 certification and customer adoption progress, maintaining its position as the industry frontrunner.

However, as Samsung and Micron gradually pass HBM3E and HBM4 certifications and accelerate collaboration with major cloud service providers (CSPs) and GPU vendors, their competitive positions have begun to improve. This is expected to gradually erode SK hynix’s pricing power and bargaining leverage in the HBM market. That said, SK hynix continues to hold advantages in technology maturity, mass production experience, and customer stickiness, and remains the dominant player in the HBM supply chain in the near term.

In 2025, the HBM market was characterized by rapid expansion and severe supply shortages, as manufacturers’ capacity expansions had yet to come online and Samsung’s HBM3E certification was delayed due to thermal-related design adjustments. As a result, overall supply fell well short of demand, leaving pricing power firmly in the hands of suppliers.

Entering 2026, as capacity expansions by the three major manufacturers gradually come online and Samsung completes HBM3E certification, overall HBM supply is set to increase meaningfully, allowing earlier-generation products to move toward supply–demand balance. HBM2E, HBM3, and Samsung’s newly certified HBM3E are expected to reach relatively balanced conditions during 2026, with price support weakening noticeably compared with 2025. By contrast, the latest-generation HBM4 will still be in the initial mass production stage in 2026, with only SK hynix having passed early certification so far (Samsung and Micron are expected to announce certification results in 4Q25). Given disparities in certification progress, limited available capacity, and strong demand from Rubin platforms and CSPs’ in-house ASICs, HBM4 is expected to be the only generation that remains structurally undersupplied.

GPU and ASIC Generation Upgrades Drive Accelerated HBM Bit Demand in 2026

HBM demand primarily comes from GPUs and ASICs, with GPUs requiring higher bandwidth and capacity than ASICs, making them the key driver of HBM generational upgrades. Based on 2025 product specifications, NVIDIA’s GB200 and GB300 adopt HBM3E in 8-high and 12-high configurations, respectively, while AMD’s MI350 also uses HBM3E 12-high. In contrast, CSP in-house ASICs predominantly adopt HBM3E 8-high, reflecting relatively more conservative specifications.

From 2026 onward, as new platforms are introduced, HBM specification requirements are expected to move higher in tandem. NVIDIA’s R100, scheduled for launch in 2H26, is expected to officially adopt HBM4 12-high, becoming the main engine of the next wave of bit demand growth. At the same time, Google’s TPU v7—whose shipment forecasts have been repeatedly revised upward—is expected to upgrade from HBM3 to HBM3E, further accelerating HBM bit shipments in 2026.

Overall, GPU generational upgrades and rising ASIC penetration are set to jointly drive accelerated HBM demand growth in 2026, making HBM4 and HBM3E the dominant demand sources in the market.

HBM3E Prices Ease, While HBM4 Retains Strong Pricing Power

HBM average selling prices (ASPs) are influenced by both supply and demand dynamics. On the supply side, because HBM carries the highest margins among DRAM products, manufacturers prioritize it in their expansion strategies, meaning the pace of capacity ramp-up directly affects ASP trends. On the demand side, HBM typically evolves at an almost “one generation per year” pace. Once a new generation is introduced, downstream customers quickly shift to the latest products, causing ASPs of older generations to decline noticeably.

Against this backdrop, 2026 is set to mark a key inflection point in HBM pricing structure. As manufacturers’ capacity expansions are completed and HBM4 certification progresses, the supply environment will shift from the extreme tightness seen in 2025 toward improvement. As a result, HBM3E will be the first to face pricing pressure, with its ASP expected to decline by approximately 17% year over year in 2026, reflecting the market’s gradual move toward supply–demand rebalancing.

Nevertheless, the latest-generation HBM4 remains in the early stages of mass production, with differences in certification timelines and technology maturity among the three major manufacturers. At the same time, strong demand from Rubin platforms and CSPs’ in-house ASICs continues to support the adoption of high-spec HBM. As a result, HBM4 is expected to remain highly undersupplied in 2026 and, among all HBM generations, will be the only product line able to maintain strong pricing power during that year.

Summary: Memory Enters Broad-Based Shortage in 2026, with NAND the Biggest Beneficiary

Overall, both NAND and DRAM are expected to enter a phase of structural undersupply in 2026 as a result of supply contraction. While certain HBM generations are gradually moving toward supply–demand balance, the initial tightness of HBM4 and the sharp increase in bit shipments will continue to drive strong market growth.

Among the three major memory product lines, NAND is expected to benefit the most. This is primarily because supply continues to decline while incremental demand from AI data centers and enterprise SSDs has far exceeded prior market expectations. With both supply and demand dynamics working in its favor, NAND suppliers are well positioned to experience the most favorable environment in 2026, marked by simultaneous strengthening of profitability and pricing momentum.

Taiwan Focus Stocks

Phison Electronics (8299.TW)

Phison is a global leading supplier of NAND flash controller ICs and integrated storage module solutions, with customers including international memory brands and manufacturers such as Kioxia, Micron, Kingston, and Seagate. Phison’s business model is divided into two main segments based on customer needs: standalone controller sales and complete storage module shipments. Historically, the company focused primarily on consumer USB drives and memory cards. However, as its product mix has continued to upgrade, non-consumer applications accounted for more than 80% of revenue by 3Q25, reflecting Phison’s successful transformation into a comprehensive storage solution provider.

Looking ahead to 2026, Phison’s growth momentum is expected to come mainly from three areas:

- Its enterprise PCIe Gen5 SSD business, in collaboration with DDN, is expected to lift the revenue contribution of enterprise SSDs to approximately 10% in 2025 and 14% in 2026, making it a core growth engine over the next two to three years.

- The aiDAPTIV+ software solution is expected to gradually penetrate the PC and edge device markets starting in 2026, forming an integrated solution when combined with Phison’s own controllers and modules.

- Leveraging long-term partnerships with NAND manufacturers and stable supply chain management, Phison is expected to secure sufficient NAND supply and BT substrate resources in 2026, even as NAND supply tightens and manufacturers’ capacity is nearly fully booked.

Overall, supported by a strong pricing cycle, volume growth in enterprise SSDs, and the commercialization momentum of aiDAPTIV+, Phison is well positioned to sustain high growth and strong profitability in 2026, while further solidifying its role as a key hub in the global NAND controller and storage module supply chain.

Winbond Electronics (2344.TW)

Winbond Electronics is a Taiwan-based niche memory IDM, with core operations spanning Code Storage Flash, customized memory solutions (CMS), and MCU and other logic IC businesses through its strategic investment in Nuvoton. It is also one of the world’s top five DRAM manufacturers.

Looking ahead to 2026, Winbond is set to benefit from three major growth drivers simultaneously:

- Continued contraction in DDR4 and specialty DRAM capacity has created a long-term supply gap in niche DRAM, driving DDR3/DDR4 prices higher starting in 2H25, with the uptrend expected to extend into 2026.

- NOR flash prices have entered a moderate uptrend since 3Q25, supported by rising raw material costs and a recovery in end demand. Meanwhile, SLC NAND is expected to see continued price increases from 4Q25 onward, underpinned by tight supply and solid demand from industrial, automotive, and server applications.

- A significant expansion in capital expenditure, together with medium- to long-term volume ramp-up of CUBE, is laying the foundation for Winbond’s next growth curve.

Overall, Winbond’s differentiated strategy—centered on specialty DRAM, NOR/SLC NAND, and CUBE—has successfully avoided direct competition with Korean and U.S. memory giants in standard DRAM and NAND products, positioning the company as a key global supplier in niche memory and NOR flash markets. With the AI-driven memory upcycle expected to extend into 2026, along with medium- to long-term mass production of 16nm DRAM and CUBE, Winbond is well positioned to see a meaningful acceleration in revenue and profitability during 2026–2027.