With the official unveiling of Nintendo’s latest-generation console, the Switch 2, this gaming device not only represents a significant hardware upgrade but also marks a strategic battle within the global technology supply chain. This release has sparked excitement among gamers while also drawing attention to Taiwan’s crucial role in supporting the manufacturing process and the broader competitive landscape of the global market. How will Taiwan’s supply chain play a key role in the production of the Switch 2?

Below we will be exploring the design highlights, industrial value, and technological strength behind the Switch 2.

Product Overview

Design Innovations: A Dual Upgrade in Technology and Player Experience

The Switch 2 continues the hybrid "portable + home gaming" model of its predecessor while introducing comprehensive hardware upgrades to meet gamers’ growing demands for performance and experience:

- Enhanced Chip Performance: Equipped with the NVIDIA Tegra T239 chip, supporting DLSS technology, significantly improving graphics processing capabilities.

- Memory Upgrade: Increased from 4GB to 12GB LPDDR5, delivering a noticeable boost in gaming performance.

- Optimized Display and Screen: Features an 8-inch 1080P high-resolution screen, offering sharper visuals for an enhanced viewing experience.

- Dual USB-C Ports: A newly added USB-C port at the top of the console expands connectivity for external devices, broadening its use cases.

- Magnetic Joy-Con Controllers: Redesigned controllers adopt a magnetic attachment system with a mechanical lock, improving stability and handling.

These hardware improvements not only elevate the gaming experience but also solidify Nintendo’s leadership in the portable gaming market.

Taiwan’s Role in the Switch Supply Chain

Key Players and Technological Strengths

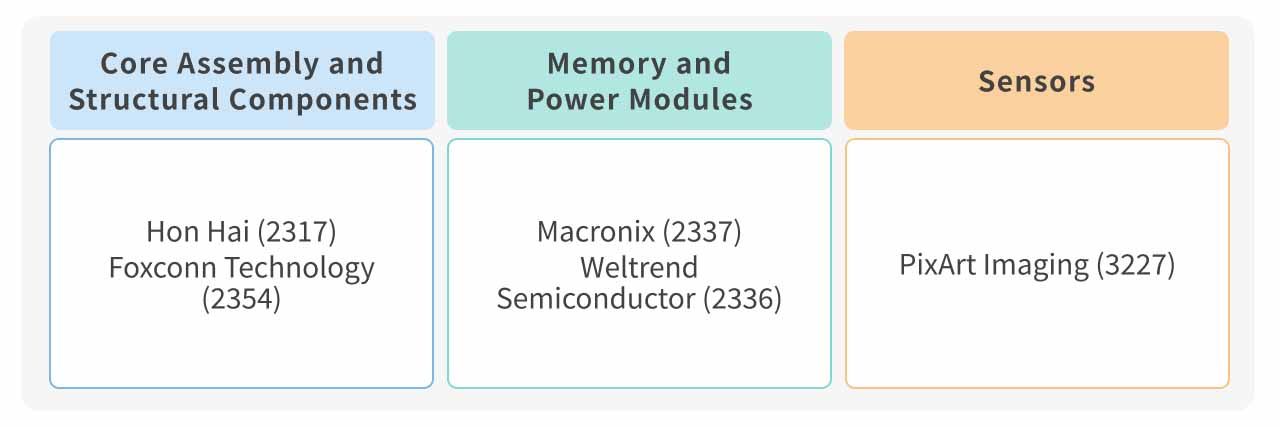

The development of the Switch 2 once again highlights Taiwan’s leading position in the global technology supply chain. The following are the key Taiwanese partners and their contributions:

Core Assembly and Structural Components

- Hon Hai (2317.TW): Responsible for final console assembly, ensuring timely global shipments of the Switch 2.

- Foxconn Technology (2354.TW): Supplies console casings.

Memory and Power Modules

- Macronix (2337.TW): Manufactures game card memory, benefiting from the growing demand for memory in the gaming market.

- Weltrend Semiconductor (2436.TW): Provides power ICs, ensuring system stability and enhancing hardware durability.

Sensors

- PixArt Imaging (3227.TW): Supplies sensor ICs to support interactive features, improving game responsiveness and precision.

Industry Impact & Market Competition

Global Market Strategy and Challenges

Nintendo plans to produce 20 million units of the Switch 2 in its first year, surpassing the 15 million units of the original Switch, ensuring sufficient market supply. The Switch 2’s hybrid "portable + home" gaming model will continue to compete with Sony and Microsoft’s high-end home consoles while maintaining its dominance in the portable gaming sector.

Some analysts predict that the mass production of the Switch 2 will drive growth for related Taiwanese manufacturers (such as Hon Hai , Macronix, and TSMC) from Q4 2024 to Q1 2025, with sustained supply chain expansion over the next 1-2 years. Investors could monitor the potential revenue increases for these related companies due to Switch 2 orders, while considering the impact of hardware upgrades versus market expectations on sales performance.

Conclusion

The Switch 2 represents another bold move by Nintendo in the gaming console market. Through hardware enhancements and a strengthened supply chain, it reinforces its position in both the portable and home gaming segments. For Taiwan’s supply chain, the success of the Switch 2 not only drives short-term revenue growth but also enhances its technological innovation capabilities and global competitiveness.