As 2025 begins, the Federal Reserve (Fed) is welcoming a new lineup of policymakers, with changes to the voting members of the Federal Open Market Committee (FOMC). The policy stance and economic outlook of these new voting members will have a significant impact on U.S. monetary policy, interest rate trends, and global financial markets. Against the backdrop of cooling inflation and slowing economic growth, markets are closely monitoring these decision-makers in search of clues about future rate decisions.

This article provides an in-depth introduction to the new 2025 FOMC voting members, their backgrounds, policy leanings, and potential impact, helping investors and market participants better understand the direction of the U.S. central bank’s decisions.

FOMC Structure

The FOMC consists of 12 voting members, including:

- 8 permanent members: 7 Fed Governors appointed by the U.S. President (one of whom serves as Fed Chair). The President of the New York Federal Reserve Bank, who typically serves as the FOMC Vice Chair.

- 4 rotating seats: Filled by the presidents of the remaining 11 regional Fed banks, serving one-year terms on a rotating basis.

What is the FOMC? The Federal Open Market Committee (FOMC) is the key decision-making body within the Federal Reserve System, responsible for formulating U.S. monetary policy, primarily through open market operations that influence economic activity.

For more details on the Fed's structure and functions, check out this article: The Federal Reserve System & Structure of the Fed

Introduction to the 2025 FOMC Voting Members

| 2025 New Voting Members | Current Position | Policy Stance | Education & Background |

|---|---|---|---|

| Austan D. Goolsbee | President, Chicago Fed | Dovish | • B.A. in Economics, Yale University • Ph.D. in Economics, MIT • Professor of Economics, University of Chicago Booth School of Business • Chair, U.S. President’s Council of Economic Advisers under Obama |

| Susan M. Collins | President, Boston Fed | Neutral | • B.A. in Economics, Harvard University • Ph.D. in Economics, MIT • Professor of Economics, Georgetown University • Senior Fellow, Brookings Institution • Senior Economist, U.S. President’s Council of Economic Advisers • Provost & Executive Vice President for Academic Affairs, University of Michigan • Dean, Gerald R. Ford School of Public Policy, University of Michigan |

| Alberto G. Musalem | President, St. Louis Fed | Hawkish | • B.A. & M.A. in Economics, London School of Economics • Ph.D. in Economics, University of Pennsylvania • Economist, International Monetary Fund (IMF) • Managing Director & Partner, Tudor Investment Corporation • EVP & Advisor to the President, New York Fed • CEO & Co-Chief Investment Officer, Evince Asset Management LP |

| Jeffrey R. Schmid | President, Kansas City Fed | Hawkish | • B.A. in Business Administration, University of Nebraska-Lincoln • Graduate, Southwestern Graduate School of Banking • Field Examiner, FDIC Kansas City Office • President, American National Bank • Chairman & CEO, Mutual of Omaha Bank • President & CEO, Southwestern Graduate School of Banking at SMU Cox School of Business |

Market Implications

More Hawkish Voting Members?

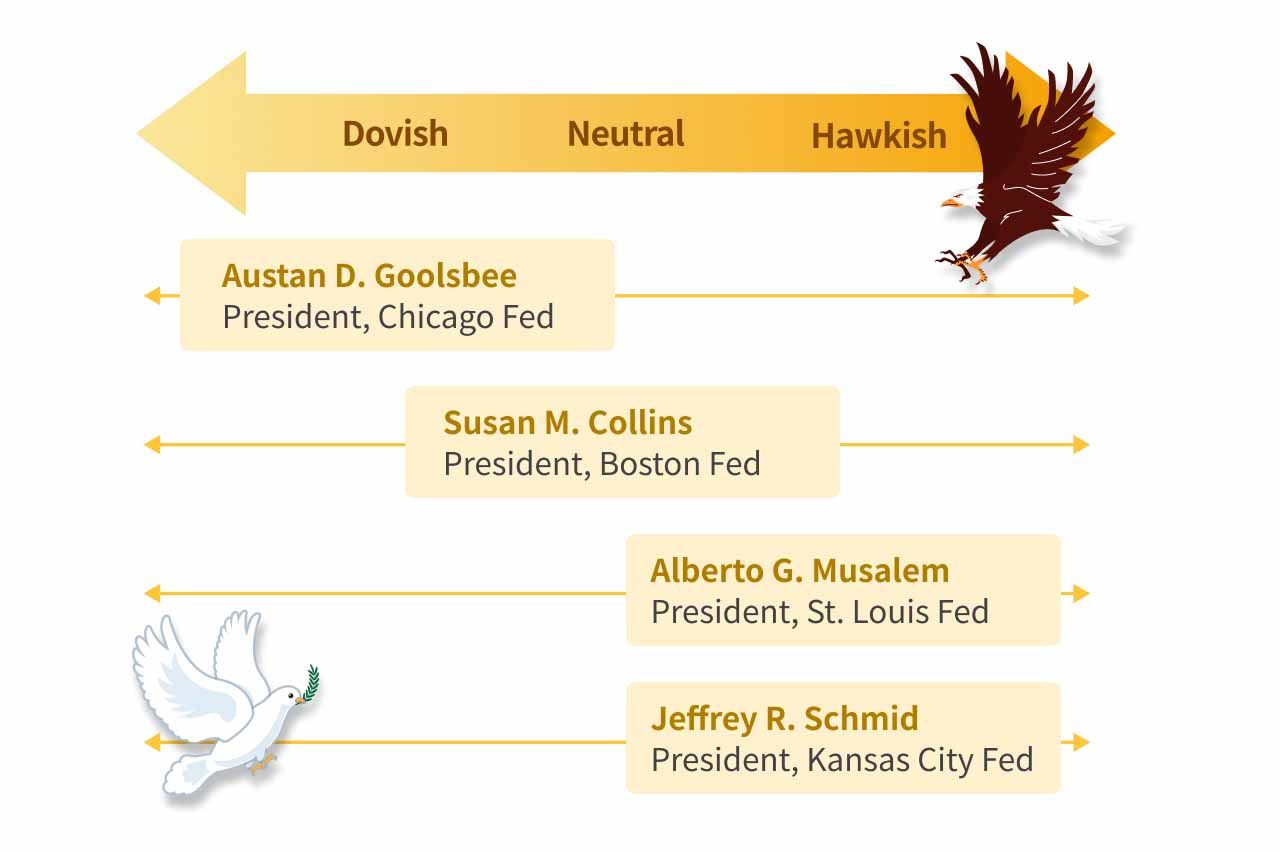

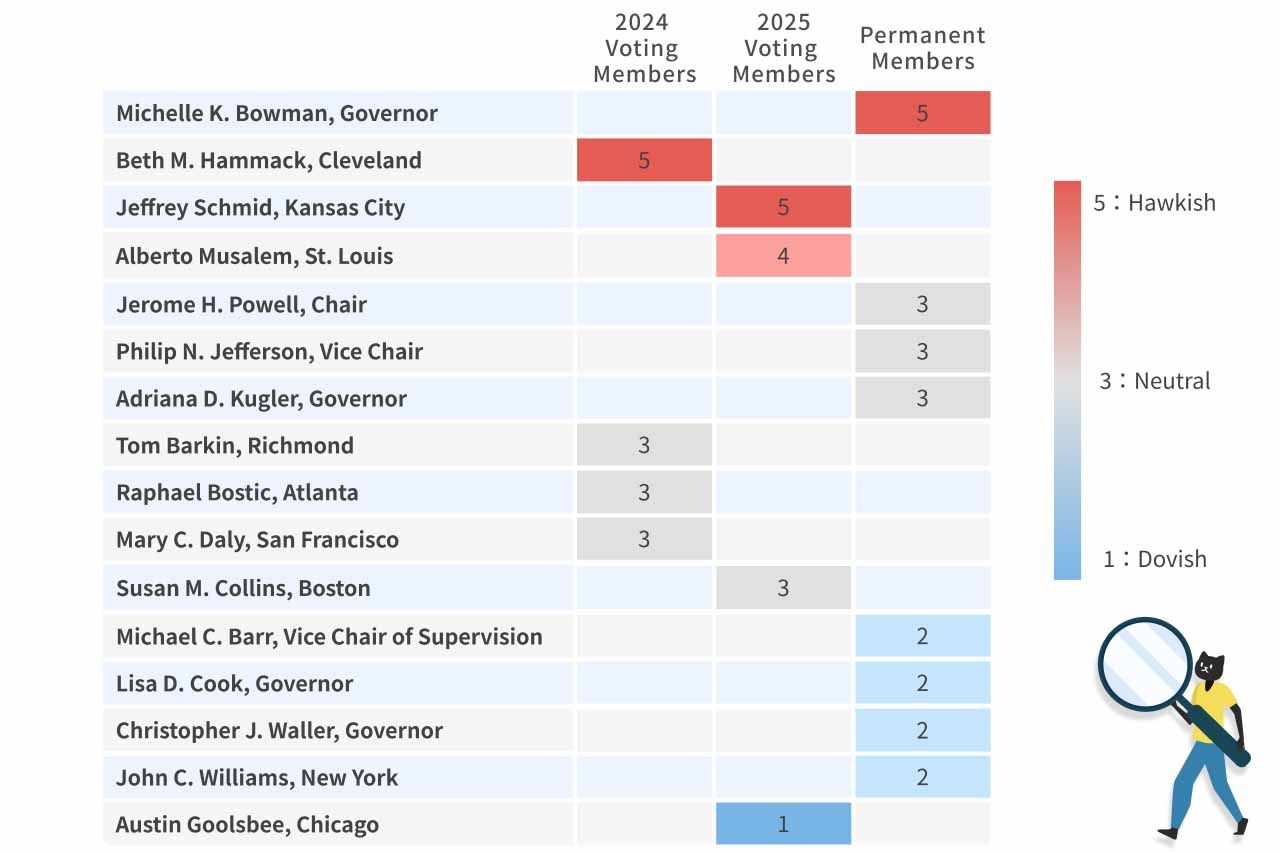

According to Deutsche Bank’s assessment of FOMC members' policy leanings (on a scale of 1 = most dovish to 5 = most hawkish), the 2025 lineup is more polarized than the previous year. The number of neutral members has decreased, and the addition of two hawkish policymakers has led markets to anticipate a slower pace of rate cuts in 2025.

Academia vs. Industry Backgrounds

| Academic-Oriented Members | Industry-Oriented Members | |

|---|---|---|

| Policy Stance | Goolsbee & Collins (Dovish/Neutral) | Musalem & Schmid (Hawkish) |

Among the four new voting members:

- Goolsbee & Collins have strong academic backgrounds, emphasizing long-term economic trends and data-driven policymaking, with a focus on employment stability and economic growth.

- Musalem & Schmid, with extensive industry experience, prioritize financial market stability and lean toward more conservative monetary policies.

This composition suggests a divide between dovish-leaning academics and hawkish-leaning industry professionals in the 2025 FOMC.

Recent Comments from New FOMC Members

Susan M. Collins (01/09/2025): Inflation in 2025 is likely to be slightly higher than previous forecasts, with risks shifting upward.

Collins emphasized the importance of maintaining price stability while ensuring a healthy labor market. While restrictive monetary policy has helped rebalance supply and demand, she noted that concerns over labor market vulnerabilities have recently diminished, given the stabilization of unemployment after its rise in early 2024. However, persistent high prices have eroded purchasing power, underscoring the need to not just restore, but sustain price stability.

Jeffrey R. Schmid (01/14/2025): Forward-looking indicators (such as new rental prices) suggest that inflationary pressures could ease further.

Schmid believes recent inflation was largely due to supply-demand imbalances and overheating of the economy. While inflation has cooled following the Fed's rapid tightening, monetary policy should remain cautious. Given that inflation is nearing target levels and economic growth remains resilient, Schmid supports a neutral policy stance, neither tightening nor easing further for now.

🔺 Update (02/27/2025): Rising consumer inflation expectations have increased his concerns about inflation trends. Additionally, growing economic uncertainty may put pressure on economic growth, requiring the Fed to balance inflation risks with economic stability.

Austan D. Goolsbee (02/20/2025): Overall, the inflation outlook seems fine—barring policy, geopolitical, and other uncertainties.

Goolsbee noted that January CPI was concerning, and upcoming PCE data is unlikely to show significant improvement. While inflation has declined significantly from its 40-year high in 2022, policy uncertainty, particularly regarding Trump’s proposed tariffs, could pose inflationary risks similar to pandemic-era supply shocks.

🔺 Update (02/28/2025): Speaking on productivity growth and monetary policy, Goolsbee highlighted that post-pandemic productivity gains could boost economic growth without fueling inflation. However, he warned that over-optimism—similar to the 2001 tech bubble—could lead to excessive investment and eventual economic downturns.

Alberto G. Musalem (02/20/2025): Rates will remain unchanged until inflation shows further progress.

Musalem believes that the risk of stalled progress on inflation is greater than the risk of a significant weakening in the labor market. Inflation has come down substantially from its mid-2022 peak, but it remains above the FOMC's 2% target. The January Consumer Price Index report showed sharp monthly increases across goods, services, and housing prices, as well as in both core and headline inflation. Based on the CPI and PPI reports, the core and overall PCE price indices are expected to rise about 0.3% in January. If that’s the case, the 12-month core inflation rate would be 2.6%, and the overall inflation rate would be 2.4%. Residual seasonality is considered a contributing factor—at least in the case of the CPI. But these reports suggest that more work is needed to achieve price stability.

🔺 Update (03/03/2025): Recent data has fallen short of expectations, particularly in consumer spending and housing, raising downside economic risks. While Musalem is optimistic about inflation’s downward trajectory, he stresses the need for continued monetary policy measures to ensure price stability.