Many market watchers are familiar with terms like the "Federal Reserve" or simply "the Fed." You might be a U.S. stock trader, waiting eagerly for the Fed's monetary policy announcements late at night, or a fixed-income investor, considering how Fed interest rate adjustments affect your strategy. Every move by the Fed is closely scrutinized by the markets, showcasing its significant influence.

Our team at fiisual has prepared a detailed overview to help you better understand what the Federal Reserve actually is. We'll start with the Fed’s founding background and introduce the tools it uses in open market operations, both past and present. Lastly, we’ll provide a brief update on its current status and the composition of its members.

The Background of the Federal Reserve: The Panic of 1907

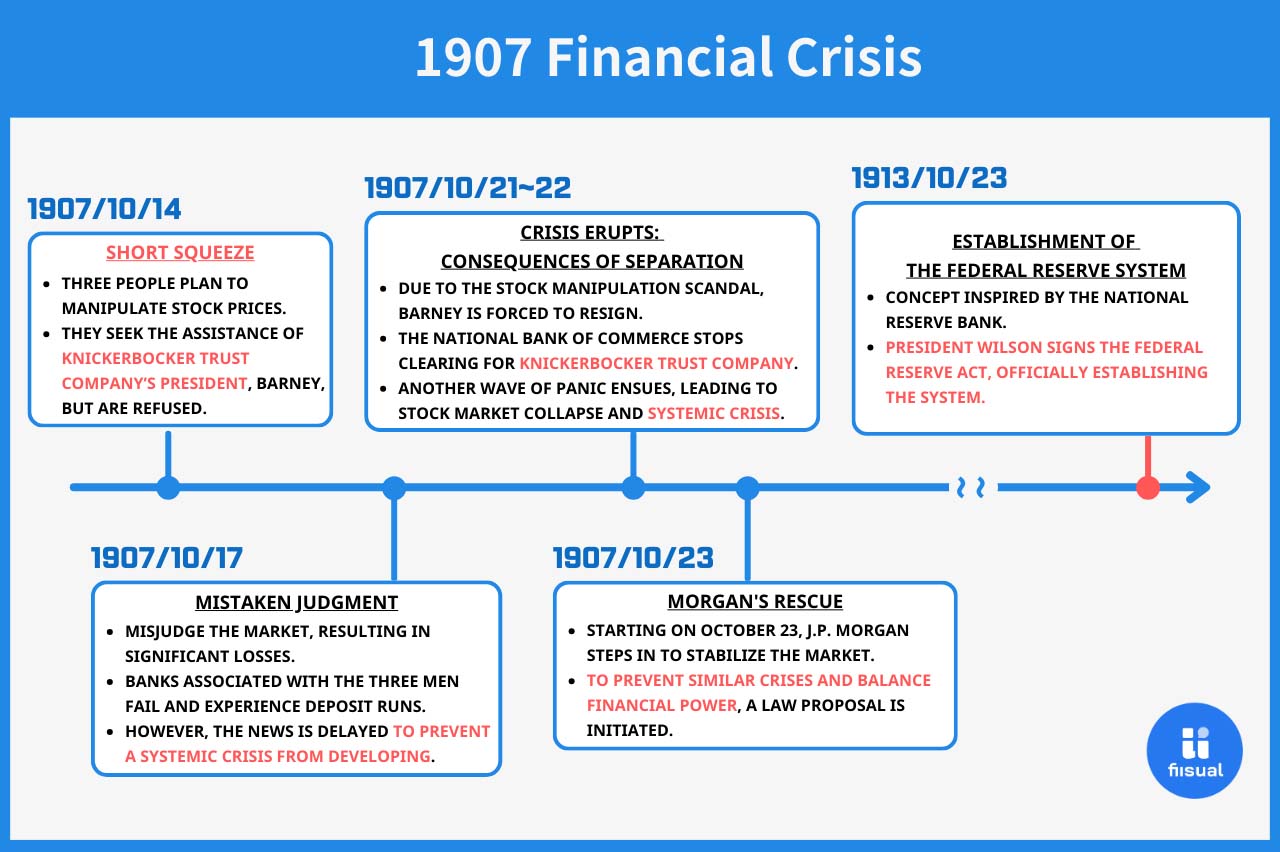

Before 1907, the U.S. was thought to be stable enough to not require a central bank, thanks to its solid economy and decentralized federal system, which made unified financial oversight challenging. However, the 1907 financial crisis became a pivotal moment, highlighting the need for a central banking system.

The Panic Begins: A Failed Stock Manipulation

The crisis was triggered by F. Augustus Heinze, a successful copper entrepreneur known as the "Copper King," and his bank, the Butte Savings Bank in Montana. Attempting to earn more profits, Heinze tried to manipulate United Copper Company’s stock in a "short squeeze" scheme, collaborating with notorious banker Charles W. Morse and his brother Otto.

After securing funds from Knickerbocker Trust, one of the largest trust companies, the manipulation plan launched on October 14. However, the stock value unexpectedly collapsed and leads to the bankrupttcy of Butte Savings Bank as Heinze couldn't repay the loans.

The Knickerbocker Crisis and Systemic Panic

As news spread, other banks connected to Heinze and Morse faced bank runs. While these banks initially held enough funds, a turning point came on October 21, when Knickerbocker Trust’s president resigned amidst the crisis, and J.P. Morgan declared no association with the bank, sparking further withdrawals.

The banking issues, compounded by panic and lack of lending, caused stock market and liquidity collapses as a financial crisis. On October 23, J.P. Morgan intervened, stabilizing the financial system.

The Birth of the Federal Reserve System

Though the immediate crisis was resolved, financial leaders sought to prevent future crises without relying on Morgan’s private intervention. In a 1910 meeting, they designed the Federal Reserve System, formally established under the Federal Reserve Act on December 23, 1913, by President Woodrow Wilson.

What is the Federal Reserve System?

The Federal Reserve System serves as the U.S. central bank, aiming to maximize employment, stabilize prices, and control long-term interest rates—collectively known as the "Dual Mandate”. This system is larger and more complex than central banks in many countries, with specialized roles across various departments.

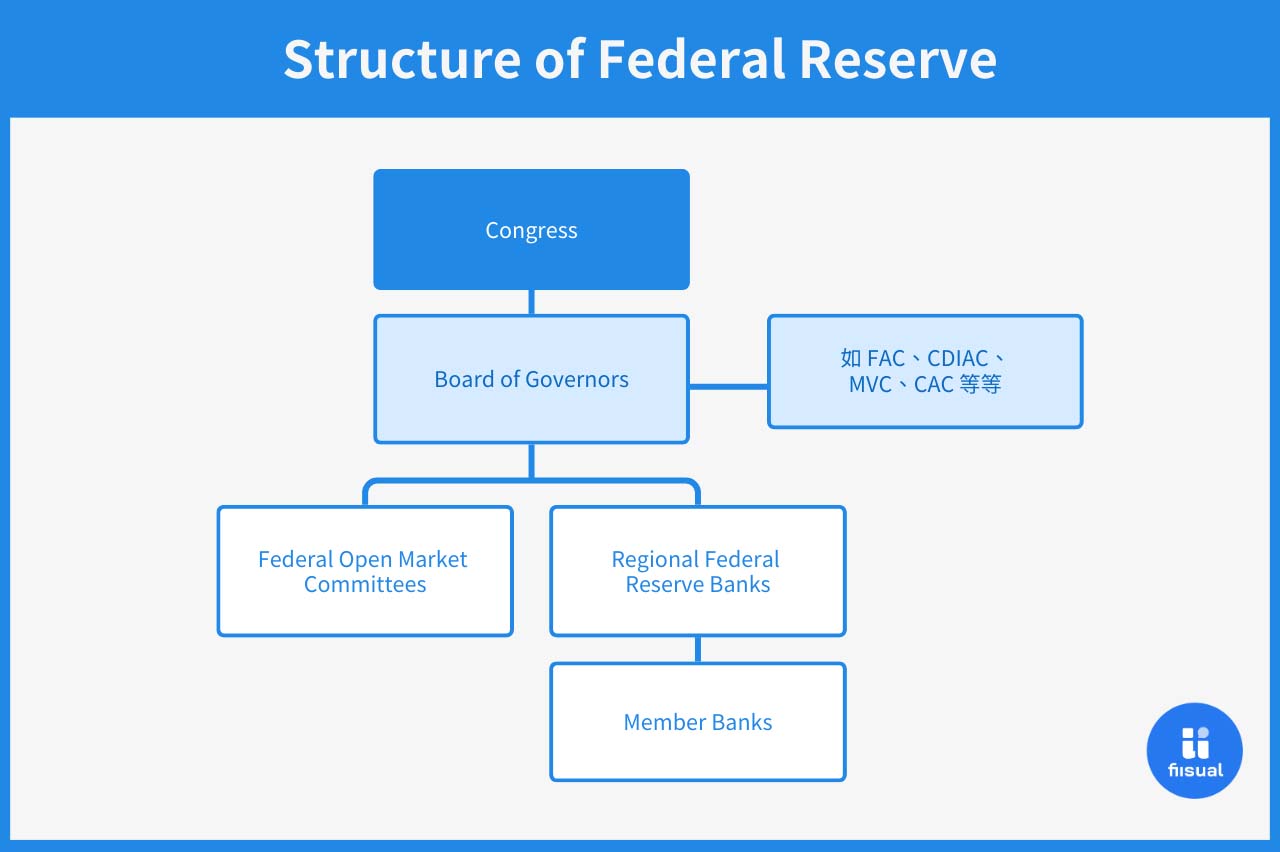

According to the Federal Reserve Act, the system includes the Federal Reserve Board of Governors, the Federal Open Market Committee (FOMC), 12 regional Federal Reserve Banks, advisory committees, and member banks.

The Federal Reserve Board of Governors

It consists of seven members appointed by the President and confirmed by the Senate. Each serves a 14-year term, with staggered tenures to prevent monopolizing decision power. The President appoints the Chair and Vice Chair from among the members, each serving a 4-year renewable term within the 14-year limit.

The Board is the Fed’s core, overseeing regional Reserve Banks and ensuring the stability of the banking system.

Federal Open Market Committee (FOMC)

The Federal Open Market Committee (FOMC) comprises 12 voting members who hold the final decisions on key policies, most notably interest rate decisions. These voting members include:

- The 7 members of the Board of Governors.

- The President of the New York Federal Reserve Bank, who holds a permanent voting seat due to the unique role of the New York Fed’s Open Market Trading Desk, responsible for conducting open market operations.

- The remaining 4 voting seats are filled by presidents from the other 11 regional Federal Reserve Banks, rotating annually.

Traditionally, the Chair of the FOMC is the Chair of the Board of Governors, and the Vice Chair is the President of the New York Fed.

In summary: FOMC’s 12 Members = 7 Board Members + New York Fed President + 4 Rotating Regional Bank Presidents

The FOMC holds eight regular meetings each year, with the option to convene additional emergency meetings in times of financial crisis at the discretion of the Chair. While all regional Federal Reserve Bank presidents are invited to attend and participate in these discussions, only the 12 designated voting members hold the final decision-making authority.

The FOMC’s primary responsibility is to set policies that target price stability, maximize employment, and manage long-term interest rates. Through these meetings, the FOMC aims to achieve these objectives by carefully assessing and discussing relevant economic policies.

The three main tools currently used by the Federal Reserve are: Open Market Operations, Discount Rate adjustments, and Reserve Requirements adjustments. We’ll provide more details on the Fed's policies and these tools in the next post.

Federal Reserve Policies & Related Tools

Regional Federal Reserve Banks

According to the Federal Reserve Act, the United States is divided into 12 regions based on population and distribution, each with a Regional Federal Reserve Bank, which functions as the central bank for that region.

These regional banks have Boards of Directors with nine members, who can nominate the regional president, though the Federal Reserve Board has final approval. The nine board members are divided into three categories—Class A, Class B, and Class C—each selected by different methods:

- Class A Directors: Elected from shareholders of the regional bank by large, medium, and small member banks within the district. Each bank category can only vote for candidates of the corresponding size. Three representatives are elected in total, with no veto power from the Federal Reserve Board.

- Class B Directors: Nominated by member banks and approved by the Board, these directors represent the public interest in decision-making, holding three seats.

- Class C Directors: Appointed directly by the Federal Reserve Board, these three directors also represent the public interest.

The role of a regional Federal Reserve Bank is similar to that of a regional central bank. In addition to supervising local member banks, maintaining system stability, and acting as the lender of last resort, regional banks also collect and conduct research on economic data both within their districts and nationwide (e.g., the St. Louis Fed). Each regional bank also has a chance to serve on the FOMC in rotation and is responsible for implementing monetary policy decisions.

Member Banks

At the most fundamental level of the Federal Reserve System are the member banks, which are similar to the everyday commercial banks people are familiar with.

To become a member of the Federal Reserve System, banks must meet the standards of their regional Reserve Bank, which generally involves maintaining reserve accounts, accessing and utilizing the system’s support measures, and adhering to regional regulations. Additionally, member banks must hold stock in their respective regional Reserve Bank without selling them.

Currently, over one-third of U.S. banks are part of the Federal Reserve System. Notably, state-chartered banks can choose whether to join, while national banks are required to be members.

Beyond their primary roles as banks and deposit institutions, member banks must comply with the system's regulations, follow policies set by the FOMC, and have the right to participate in the nomination and election of directors on their regional Reserve Bank's Board of Directors.

Advisory Committees

Within the Federal Reserve System, there are several advisory committees such as the Federal Advisory Council (FAC), the Community Depository Institutions Advisory Council (CDIAC), the Model Validation Council (MVC), and the Community Advisory Council (CAC).

These committees primarily provide guidance to the Board on public policy matters, playing a significant role within the system. However, as they are not directly linked to financial markets, we won’t go into further detail here.

This concludes a brief introduction to the origins, authority structures, and affiliated institutions of the Federal Reserve!