On August 16, 2024, gold’s spot price surged past $2,500 per ounce for the first time, continuously setting new historical highs. Gold, widely regarded as one of the rarest and most treasured precious metals, was among the earliest currency units. Today, beyond its use in jewelry, it has become one of the favored investment asset. Below we will be introducing the diverse uses and asset characteristics of gold.

Uses of Gold

Gold serves four main purposes: jewelry, industrial materials, central bank reserves, and private investment. Jewelry consumption includes accessories, clothing, and various decorative items, making up nearly half of global gold demand. Additionally, as a highly conductive and malleable material, gold is used extensively in electronics, dental, and medical industries. The other half of demand comes from investments, including both national reserves and private investment. Due to gold’s stable value and high liquidity, central banks use it as an emergency payment tool alongside foreign exchange reserves. For private investors, gold investments include gold bars and coins, spot and derivative trading, and increasingly popular gold ETFs.

Gold’s Key Feature: Hedge

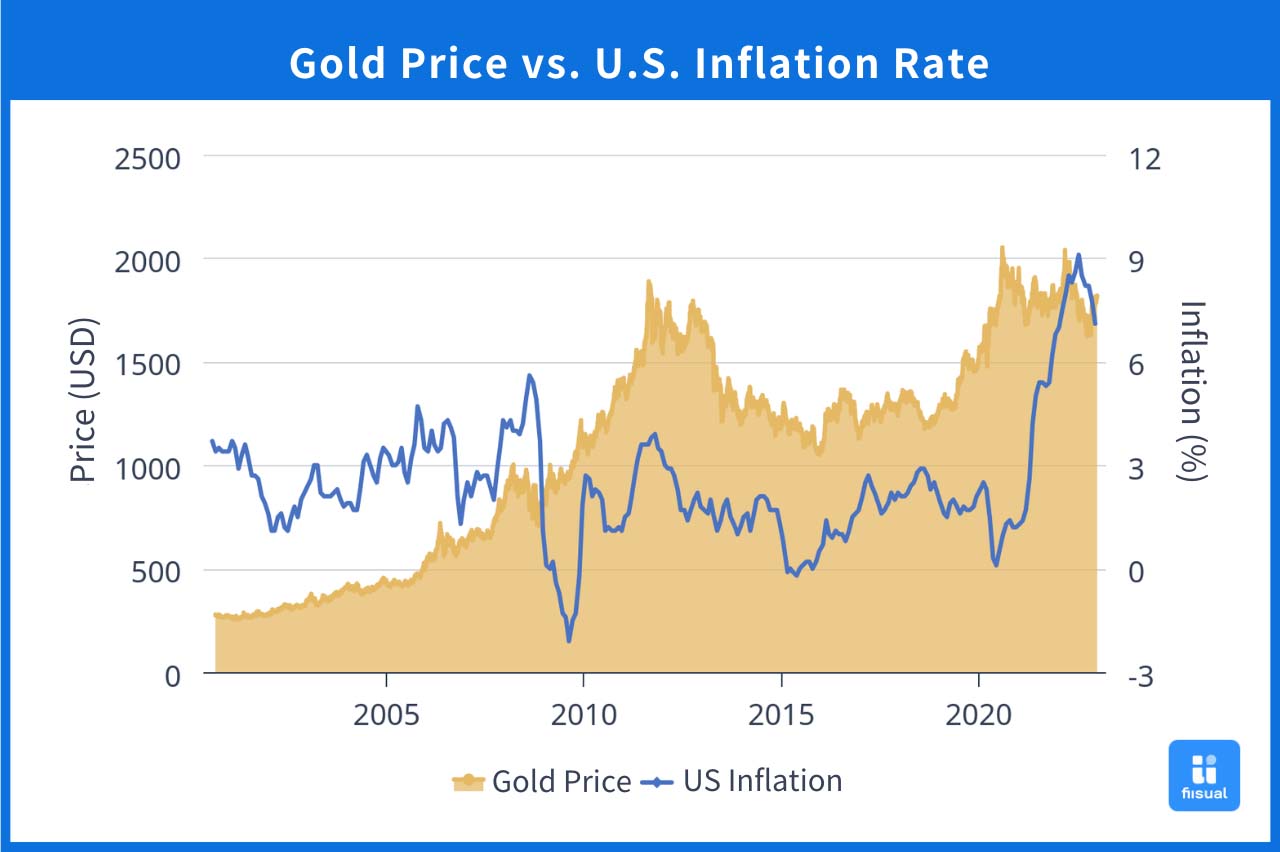

Gold’s most defining feature is its “inflation-hedging” ability. Over the long term, when inflation drives up prices and reduces cash purchasing power, gold’s value often rises due to its scarce and stable supply, offering strong preservation of value. Therefore, when a country’s currency depreciates due to the fall of interest rates or trade deficits, investors may turn to gold to safeguard their assets and counter potential losses.

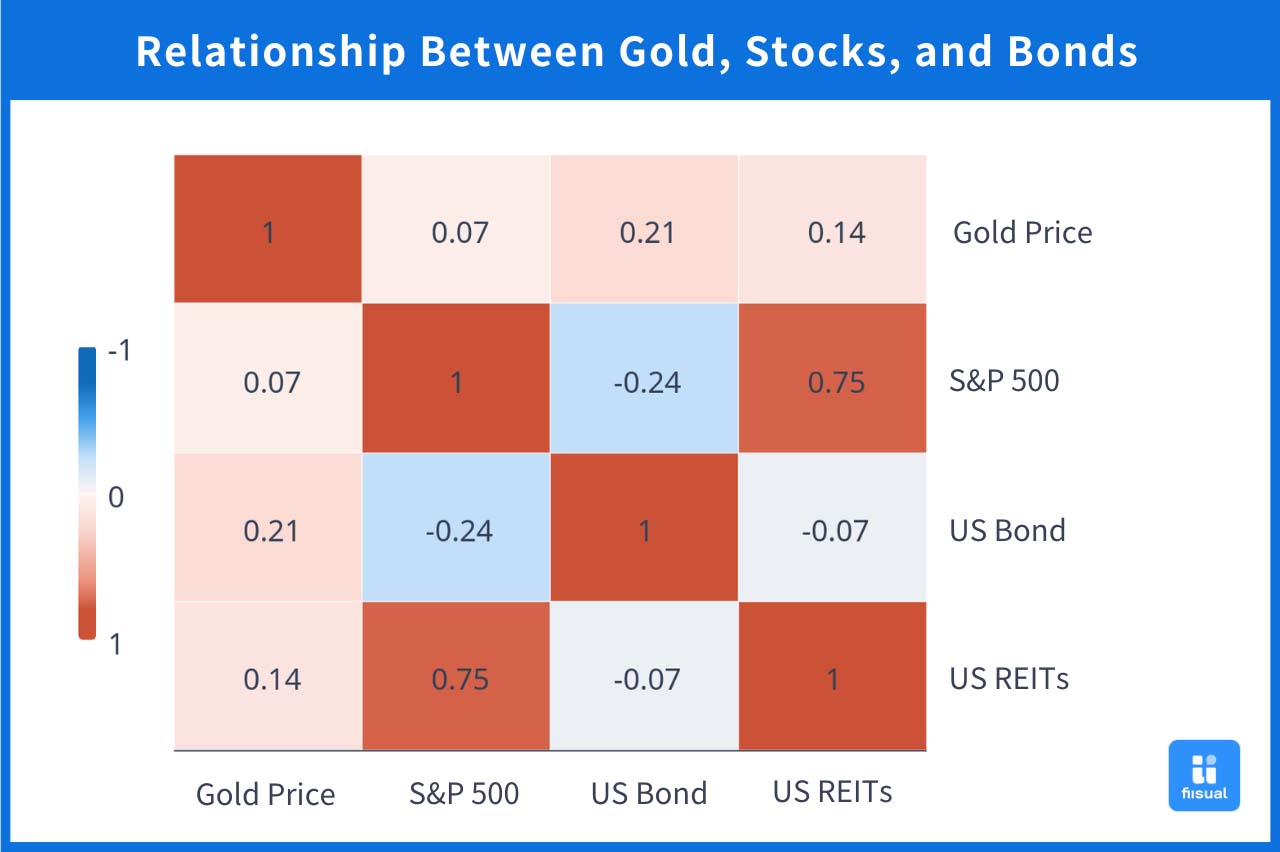

Furthermore, gold has low correlation with assets such as stocks and bonds. During times of economic uncertainty—such as recessions or heightened geopolitical risks that may severely impact major markets—gold investments may suffer minimal losses or even gain value. This is why many investors include gold in their long-term portfolios as a hedge against the volatility of stocks and other risky assets.

How to Invest in Gold

Most gold trading occurs in over-the-counter (OTC) markets organized by the London Bullion Market Association (LBMA), which is primarily for large financial institutions, suppliers, and developers.

For retail investors, the most accessible options include gold futures, ETFs, and physical gold. ETFs, which can be directly purchased on stock exchanges, are one of the most convenient investment vehicles. For example, in Taiwan, the Yuanta S&P GSCI Gold ER Futures ETF(00635U) tracks the S&P GSCI Gold Excess Return Index, primarily investing in gold futures contracts. Internationally, the SPDR Gold ETF (GLD) is currently the largest gold ETF, and the iShares Gold Trust (IAU), which focuses on investing in physical gold bars, is the second-largest gold ETF. Of course, investors can also opt to buy physical gold or gold passbook accounts, where the bank holds the gold and can make it available for withdrawal as needed.

Since gold is a tangible asset, investments in gold do not yield dividends, so investors hoping for cash flow should be mindful of this aspect.

Conclusion

Gold’s versatility and stable value due to its scarcity have made it an “alternative currency” to fiat money, attracting many dedicated gold enthusiasts!