When first starting to invest in stocks, the sheer number of options can make people feel overwhelming. Here, we’d like to share five common stock classification methods that can serve as a starting point for you to research. By observing these factors, you can gain a better understanding of how to categorize stocks and begin investing more confidently!

If you haven’t yet read our previous article, check out A must-read for stock market beginners! How should beginners start investing in stocks?

Classification 1: Market Capitalization

Market Cap Isn’t Always Tied to Stock Price

The calculation for market capitalization is straightforward: multiply the stock price by the number of outstanding shares, and you’ll get the stock’s market cap.

The formula is: Market Cap = Stock Price × Outstanding Shares

- Taiwan Stock Market

| Market Cap Classification | Index Name |

|---|---|

| Large-Cap Stocks | Taiwan 50 |

| Mid-Cap Stocks | Taiwan Mid 100 |

| Small-Cap Stocks | Small-Cap 300 |

For Taiwan stocks, large-cap companies are those ranked among the top 50 by market capitalization (i.e., constituents of the Taiwan 50 Index). Large-cap stocks tend to be less volatile, highly liquid, and have a significant impact on the weighted index. If you’re looking for more stable investments, large-cap stocks might be a good choice. Conversely, small-cap stocks often carry higher risks and lower liquidity, but they may also offer high returns in the future.

- U.S. Stock Market

| Market Cap Classification | Stock Value |

|---|---|

| Large-Cap Stocks | > $10 billion |

| Small-Cap Stocks | < $2 billion |

In the U.S. market, stocks with a market cap exceeding $10 billion are generally considered large-cap, while small-cap stocks typically have a market cap below $2 billion.

Classification 2: Shareholder Rights

Preferred Stocks Offer Stable Dividends; Common Stocks Provide Voting Power

| Common Stock | Preferred Stock | |

|---|---|---|

| Dividend Distribution | V Varies with company profits | V Generally more stable |

| Claim on Assets in Liquidation | After preferred stock | Before common stock |

| Voting Rights | V | X |

| Liquidity | Higher | Lower |

Based on shareholder rights, stocks can be categorized into common stocks and preferred stocks. One of the key differences is how dividends are distributed. Common stock dividends are variable, depending on the company’s profits each year (or quarter). In contrast, preferred shareholders have a higher claim on profits than common shareholders, resulting in generally more stable dividends. Additionally, if the company dissolves, preferred shareholders have priority over common shareholders in claiming remaining assets. While preferred shareholders have advantages in dividends and asset claims, it’s important to note that they typically do not have voting rights at shareholder meetings.

Classification 3: Stock Exchange

The Exchange Might Hint at the Industry Type

Since different stock exchanges have varying listing requirements, and exchanges tend to attract similar companies, the type of industry may influence where a company chooses to list. For example, in the U.S., the main exchanges include the New York Stock Exchange (NYSE), National Association of Securities Dealers Automated Quotations (Nasdaq), and American Stock Exchange (AMEX).

The NYSE, known for its long history, trades companies like Warren Buffett’s Berkshire Hathaway (BRK.B), oil and gas company ExxonMobil (XOM) , and financial services Visa (V). Nasdaq, the first exchange to adopt electronic trading, and with relatively easier listing requirements, has attracted numerous tech companies such as Apple (AAPL), Microsoft (MSFT), and Google (GOOGL). As for popular index ETFs, they are often traded on AMEX, including SPY, DIA, and QQQ.

Classification 4: Growth Potential

Growth Potential is an Evaluation Indicator

| Expected Growth | Valuation Ratios | Dividends | |

|---|---|---|---|

| Growth Stocks | Higher | Higher | Not always consistent |

| Value Stocks | Lower | Lower | More stable |

Growth potential is another way to categorize stocks. Typically, companies with strong growth potential are viewed more favorably by investors, leading to higher valuation ratios. Value stocks, on the other hand, belong to companies with more stable growth. Although you might not see explosive increases in their revenue, steady cash flow often results in more consistent annual dividends, making them a popular choice for dividend-focused investors.

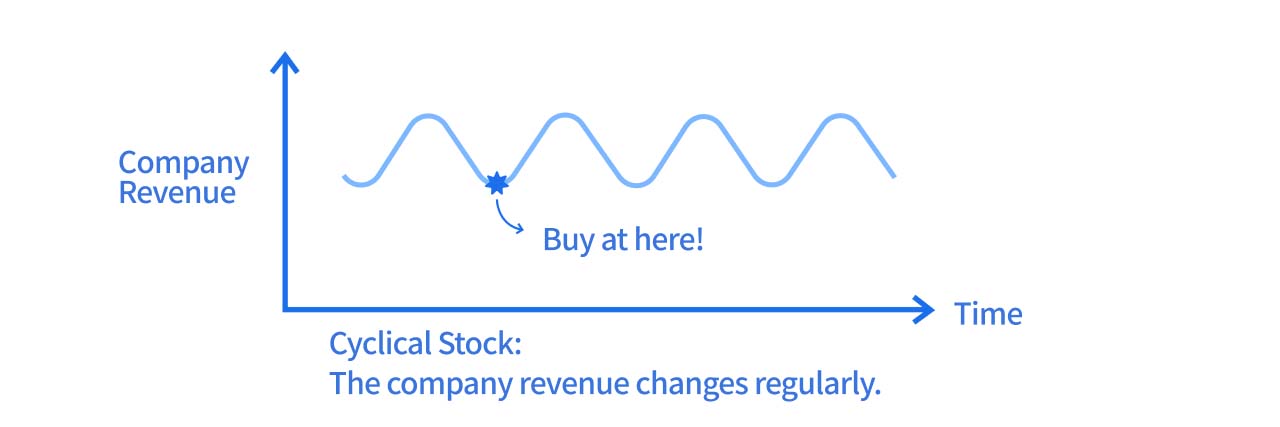

If a company’s growth is influenced by cyclical patterns, it can be categorized as a cyclical growth stock. For example, economic cycles have defined periods and phases. When a company’s revenue is closely tied to these cycles, the stock is often referred to as a "cyclical stock." The growth of these companies typically follows a cyclical pattern.

Additionally, the growth of financial stocks is often influenced by interest rate cycles in the market, which is another common example of cyclical growth.

Classification 5: Industry

Industry Can Influence a Company’s Valuation

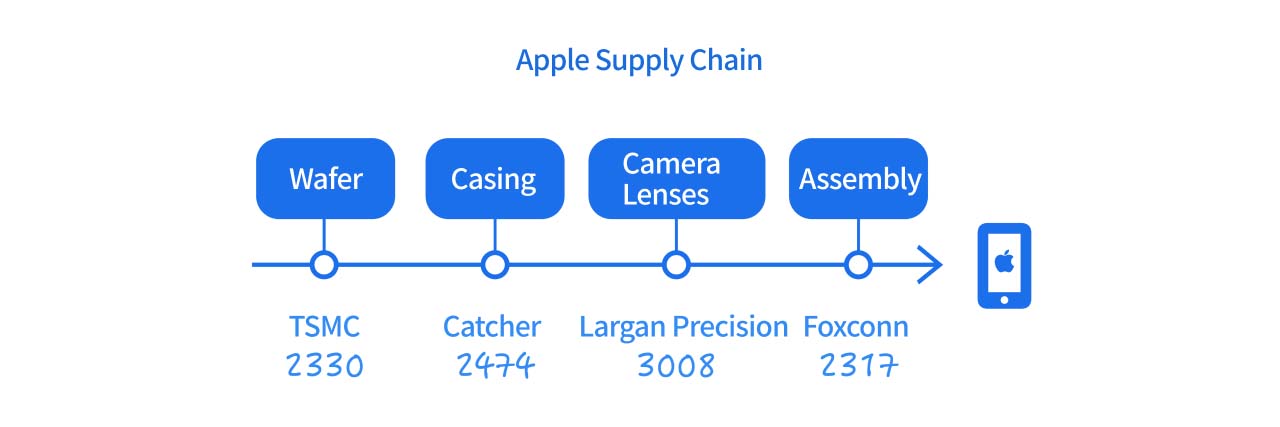

The industry supply chain often serves as a way to categorize stocks. For instance, the “Apple supply chain” refers to the series of companies involved in manufacturing or assembling Apple products. The stock performance of these companies is often closely linked to Apple’s sales figures.

The market frequently uses industry sectors to classify stocks. In Taiwan’s stock market, major categories include semiconductors, consumer electronics, optical components, telecommunications, food processing, textiles, and biotechnology. The industry a stock belongs to can also impact its valuation. Since growth potential and stability can vary across industries, institutional investors would analyze and evaluate a company based on the valuation ratios of its industry.

For example, the Apple supply chain might include businesses ranging from wafer fabrication and casing to optical lenses and assembly.

The above are five common stock classification methods we’ve summarized: market capitalization, shareholder rights, stock exchange, growth potential, and industry. We hope these guidelines help you find investment targets that suit your needs.