What is a Bond

Combining Borrowing and Investing

Utilizing Bonds to Meet the Needs of Both Parties in a Funding Gap

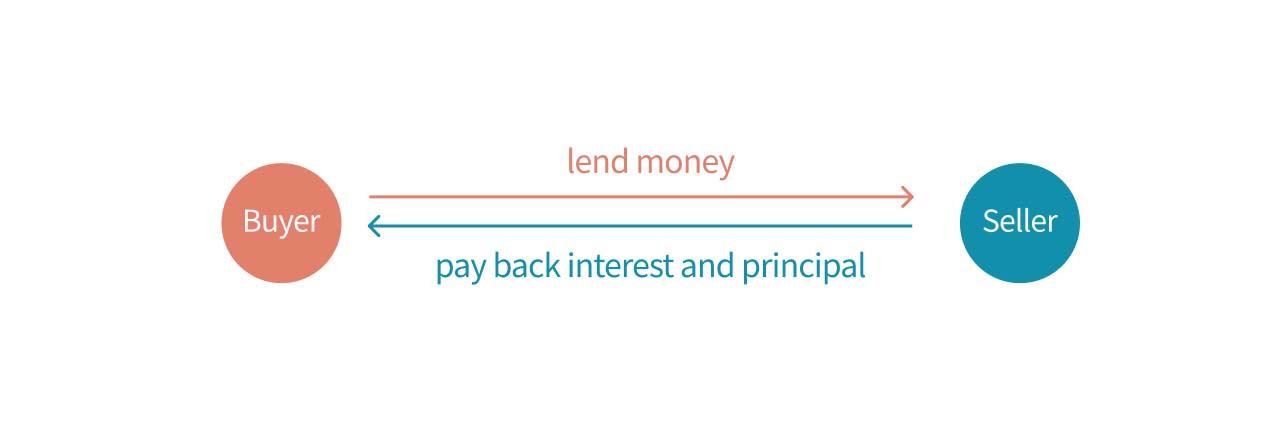

When a party in the market is lacking of funds, bond is one of the channels to obtain capital. The party in need of funds can issue bonds to raise a certain amount of money. Of course, this is not a free transaction; the bond issuer must regularly pay interest to the bondholders. In other words, bonds create a legally binding debt relationship between the buyer and seller, using the bond as evidence. The seller of the bond is the party in need of funds, while the buyer of the bond is the investor, who hopes to earn regular income from the investment. Hence we often see the term "fixed income" to describe these financial products.

The total amount of bonds issued is generally large, and the bond issuer, acting as the borrower, needs a certain level of creditworthiness to successfully raise the total issuance amount. Common bond issuers include countries, local government agencies, and large corporations.

Characteristics of Bonds

Characteristic 1: Bonds Generally Have Interest

Generally, bonds often provide investors with a certain interest rate, which is the coupon rate, which is usually set at the time of issuance. Investors considering bond investment can assess the issuer's repayment ability to decide whether or not to invest in the bond. However, in special cases, bonds may be zero-coupon, meaning the investor does not receive interest payments until maturity.

Characteristic 2: Bonds Have Credit Ratings

As mentioned above, bond investors make their final investment decision based on the bond issuer's repayment ability. Different issuers have different expected repayment capabilities. Typically, governments are often given higher credit ratings compared to private companies, indicating a perceived higher repayment ability. However, some corporate bonds may have higher credit ratings than certain government bonds, depending on the financial situation.

Advantages of Investing in Bonds

Lower Risk and Volatility

Compared to other investment products, bonds generally have lower risk. The main risk of bonds lies in whether or not the issuer can repay the debt as agreed. Bonds with extremely low default risk, such as U.S. Treasury bonds, are popular investment choices. Bonds also tend to have lower volatility compared to stocks, making them attractive to investors concerned about market fluctuations.

Fixed Income Nature

While other financial products such as stocks can also provide regular income through dividends, bond interest payments are predetermined and stipulated on the bond contract itself. This provides investors with a more stable fixed income source.

Basic Terminology of Bonds

The First Step Before Buying Bonds

Bond terminology include two main characteristics: principal and interest. Below, we will introduce some basic terms you need to know before investing in bonds, using a coupon bond as an example.

1. The Issuer:

The entity that issues the bond. Common bond issuers include governments and corporations. In the debt relationship, the issuer is the borrower (debtor), who is borrowing from others (creditors).

2. Face Value (Par Value):

The initial value set when the bond is issued. The issuer must repay this amount to the bondholder at maturity. It is sometimes referred to simply as the bond's principal.

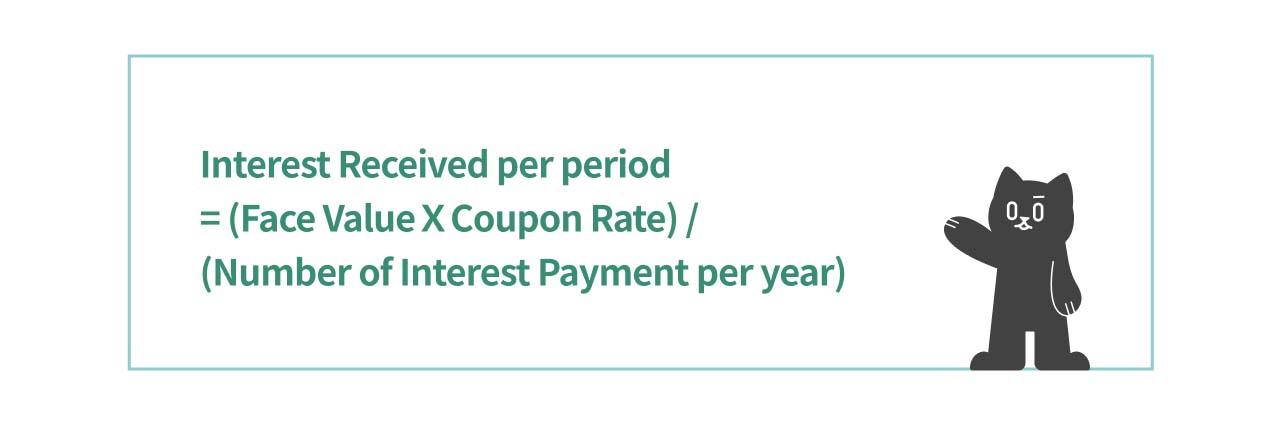

3. Coupon Rate:

The coupon rate is the rate agreed upon by the issuer and the bondholder. By multiplying the coupon rate by the face value, investors can calculate the interest payment received. Since the coupon rate is typically set as an annual rate, the actual interest payment received would depend on the payment frequency. For example, if the bond pays interest semiannually, then the the calculation would be:

Interest received per period = Face Value × Coupon Rate / 2

4. Maturity Date:

The agreed-upon date when the issuer repays the principal to the bondholder.

5. Coupon Payment Date:

The actual date when interest is paid. Investors need to be aware of the interest payment schedule and frequency.

6. Redemption Price (Trading Price):

Bonds, as a type of security, can also be traded before maturity. The trading price represents the cost of buying the bond, significantly impacting the overall investment return.

Types of Bonds

Basic Bond Classification

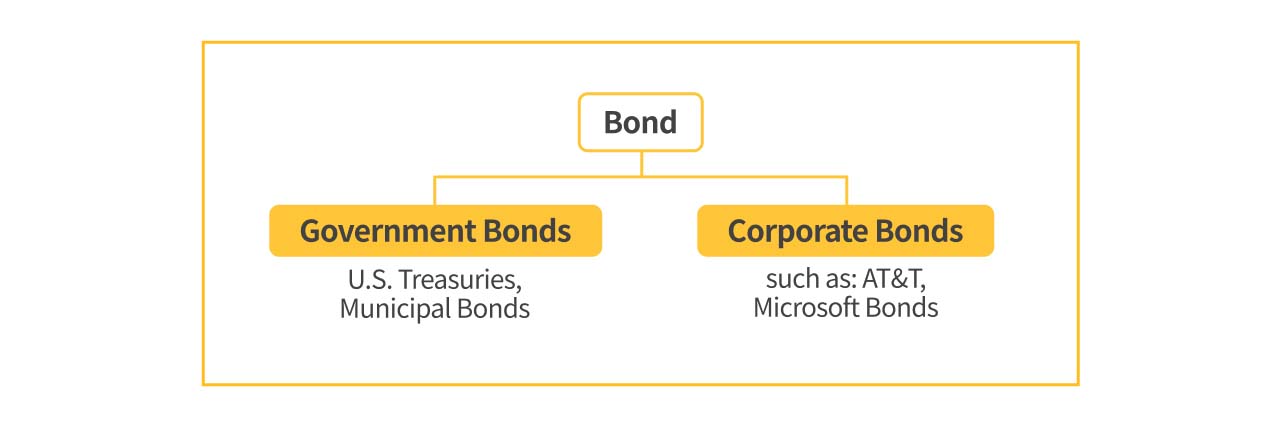

Classification by Issuer

Common issuers include governments and corporations.

1. Government Bonds: Issued by Governments

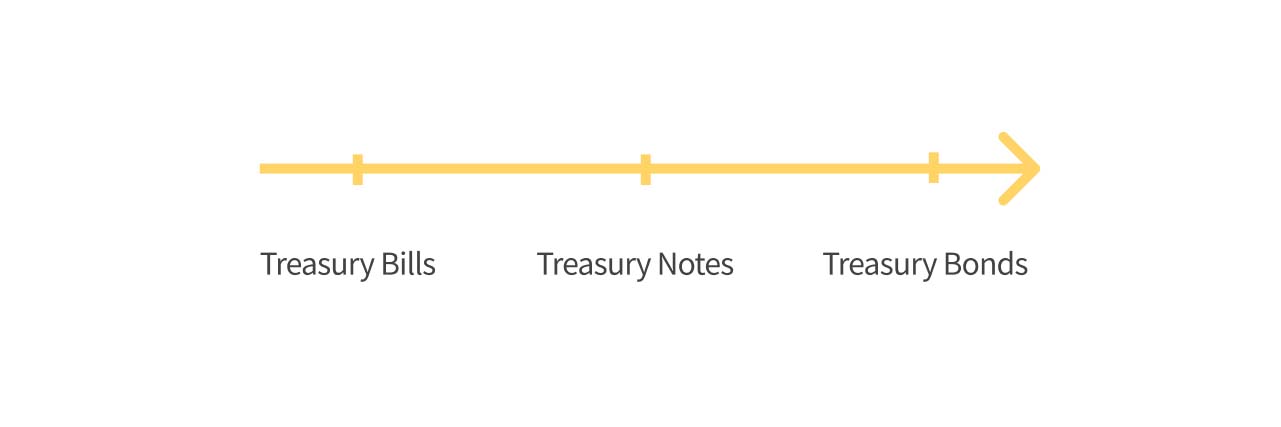

Government bonds are often viewed as stable fixed-income products, especially those issued by creditworthy countries, such as U.S. Treasuries. Depending on the maturity date, US treasuries can be categorized as long-term (Treasury Bonds), medium-term (Treasury Notes), and short-term (Treasury Bills). Maturity dates can range from 30 years to as short as 1 month.

Some local governments also issue bonds. For example, in the U.S., there are two common types of bonds: General Obligation Bonds, which are backed by regular tax revenue, and Revenue Bonds, which are supported by specific income sources such as public utilities.

2. Corporate Bonds: Issued by Corporations

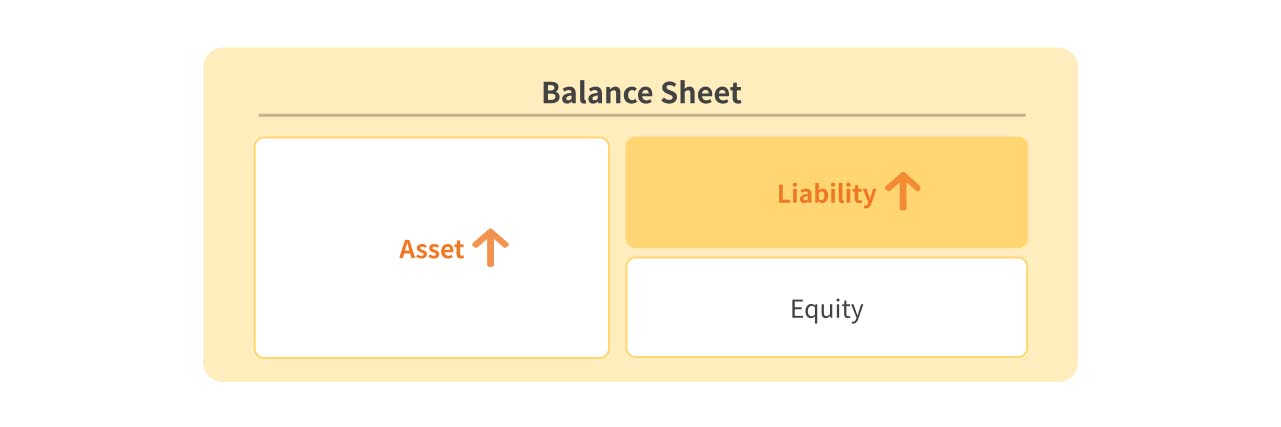

Typically, creditworthy corporations can also issue bonds to raise funds. Unlike equity financing, which might dilute shareholder equity, issuing bonds increases liabilities without affecting shareholder equity.

Classification by Interest and Rates

Whether bonds pay interest and whether the interest rate is fixed.

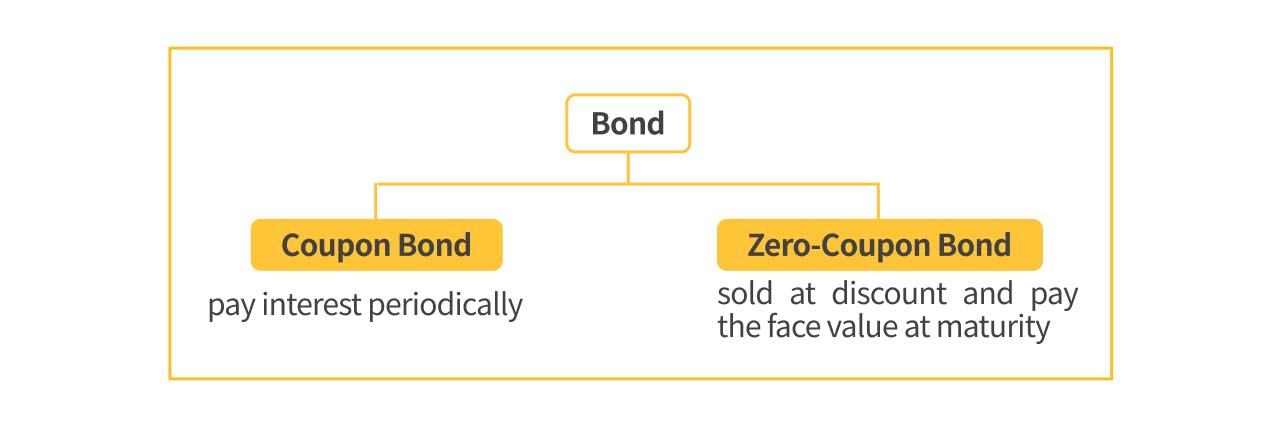

1. Coupon and Zero-Coupon Bonds

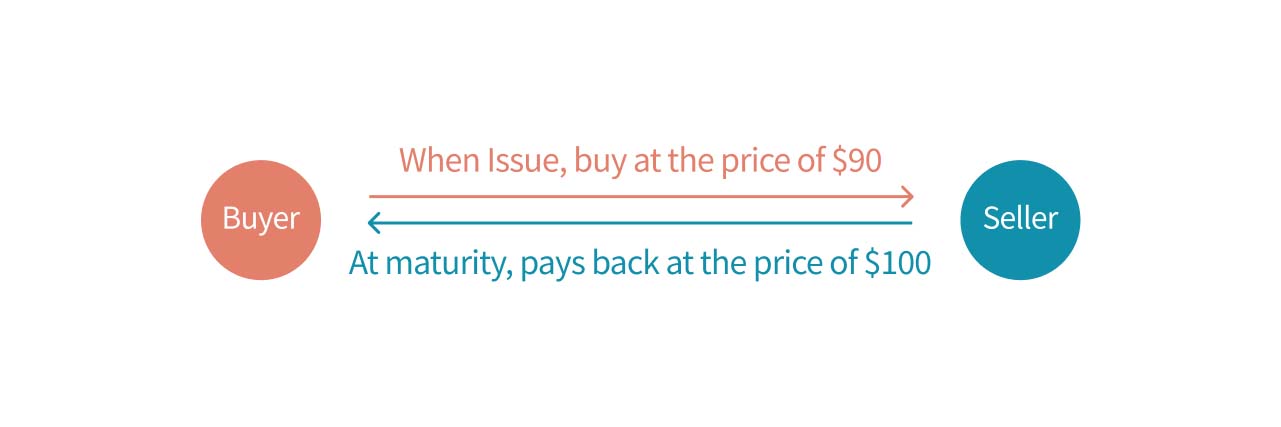

First, we can classify bonds based on whether or not they pay interest. If a bond pays interest periodically, it is called a coupon bond. Zero-coupon bonds do not pay interest before maturity; instead, they are sold at a discount and pay the face value at maturity. Here's an example to explain zero-coupon bonds more simply.

Zero-coupon bonds are sold at a discount, allowing investors to profit from the price difference. For example, a bond with a face value of 100 may be sold for 90. At maturity, the investor receives 100, earning a profit of 10.

2. Fixed-Rate & Floating-Rate Bonds

In general, the coupon rate of a bond is set at the time of issuance. With this rate, investors can decide whether or not to invest in the bond by evaluating the issuer’s ability to repay and the desired return on this investment. However, this fixed-rate (income) payment also exposes investors to interest rate risk. If market interest rates continue to rise, the bond investment may not maximize capital gains. Therefore, some bonds adjust according to market interest rates before maturity. For example, Treasury Inflation-Protected Securities (TIPS) use floating rates instead. The interest rate on TIPS adjusts according to the current inflation rate. As inflation increases, investors receive higher interest payments from TIPS.

Classification 3: Collateral

Whether the Bond Has Collateral

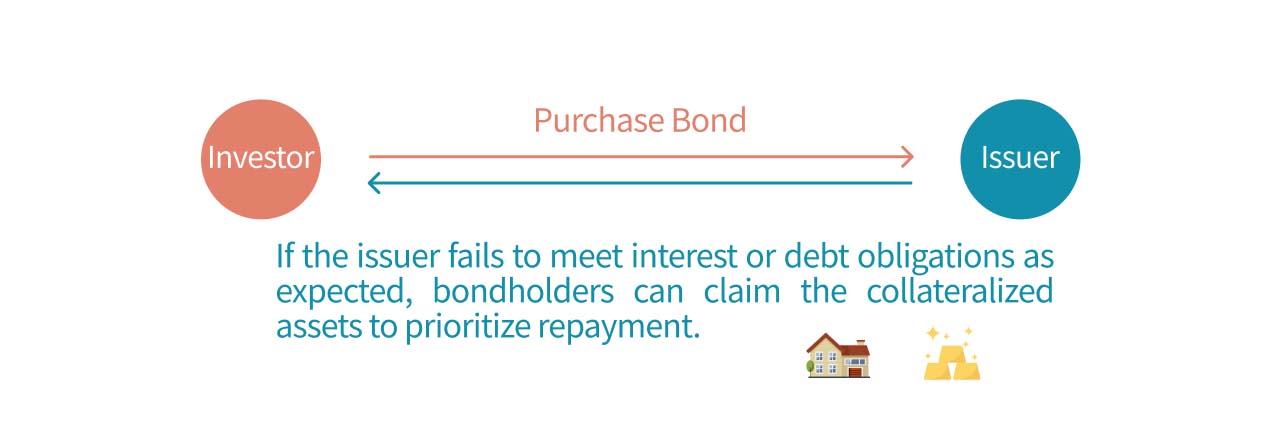

Some bond issuers can convince investors that their revenue would be sufficient to cover future interest payments and principal repayment without needing specific collateral. In such cases, bonds that are not tied to specific collateral are called unsecured bonds.

In other cases, if the bond issuers' revenue is unstable, they lack a strong credit history, or they aim for a lower interest rate, the issuer may link the bond to specific assets. If the issuer fails to meet interest or debt obligations as expected, bondholders can claim the collateralized assets to prioritize repayment. Common forms of collateral include real estate, personal property, or third-party guarantees.

Classification 4: Special Features

Some Bonds May Have Special Features

Typically, bond investments focus on generating fixed income. This creates a scenario that companies borrow to fund business expansion, and bond investors receive fixed interest payments, regardless of the company's success or failure.

However, with certain kinds of bonds, investors can go beyond this limitation. In addition to receiving fixed interest payments, they also have the opportunity to benefit from the company's success in using the debt to create assets. Convertible bonds have this feature, allowing bondholders to convert their debt into equity if certain conditions (such as the stock price exceeding the agreed conversion price) are met. This changes the bondholder's role from creditor to shareholder.

Finally, evaluating the risk and characteristics of each bond is essential before making an investment decision. We hope the categories outlined above guide you in selecting the investment that best aligns with your goals.