Many people may have noticed a key factor in recent news about intense global stock market fluctuations: the Bank of Japan's interest rate hike, which has led to yen appreciation and the unwinding of large-scale yen carry trades. However, how is this Bank of Japan rate hike affecting U.S. stocks? And what exactly are carry trades? Here, we’ll introduce the concept of carry trade and explore the factors that drive it.

What Is Carry Trade?

A carry trade is an investment strategy where investors borrow a currency from one country with a low-interest rate and exchange it for another currency with a high-interest rate, earning a profit from the "rate differential."

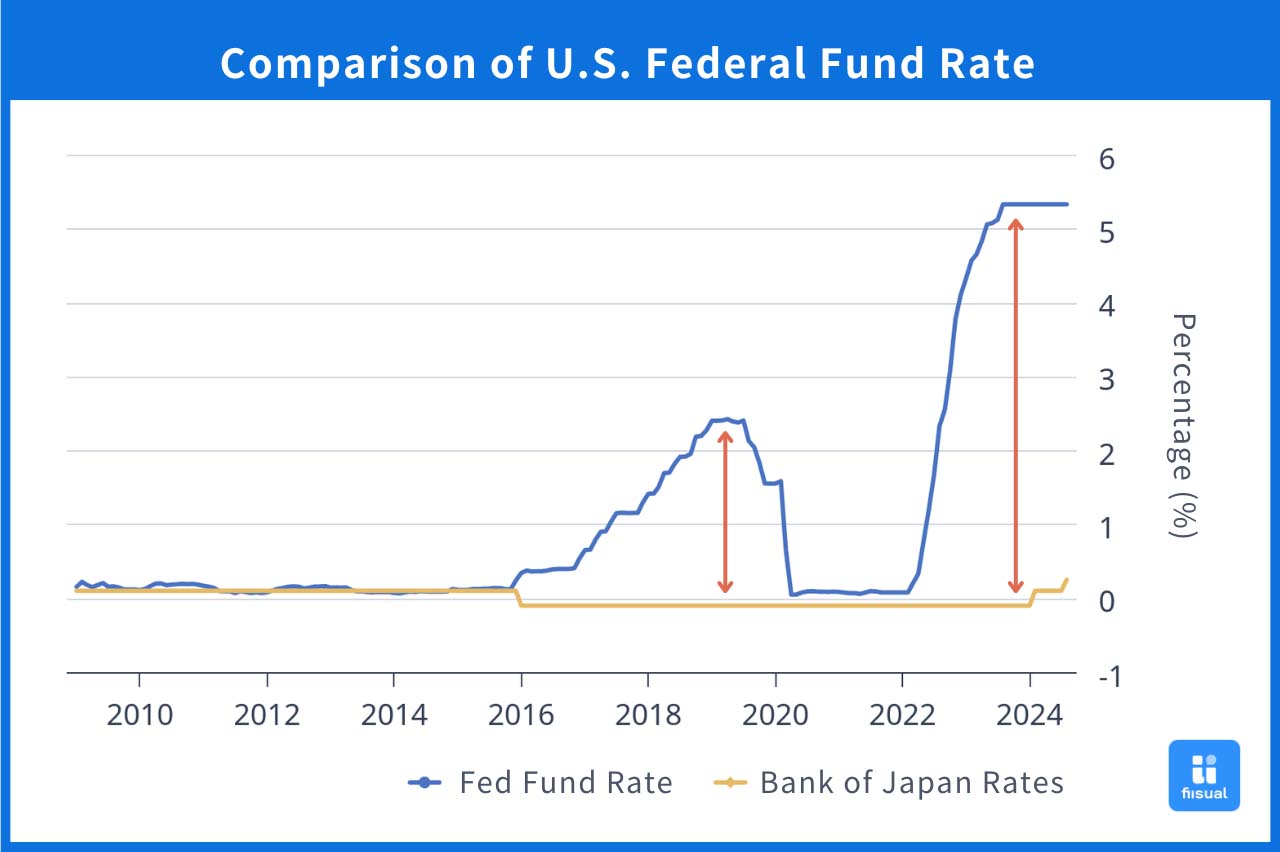

In practice, a common approach is to borrow yen and invest in assets such as U.S. Treasury bonds or U.S. stocks. Since Japan has maintained ultra-low or even negative interest rates since the 2008 financial crisis, the cost of borrowing yen is nearly zero, allowing investors to access capital at an extremely low cost. Following by the Federal Reserve's aggressive rate hikes since 2022, borrowing yen to invest in U.S. Treasury assets has provided a significant rate differential. More aggressive investors might even allocate borrowed funds to U.S. stocks or fixed-income products, seeking dividends, interest, or even capital gains for higher returns.

Risks of Carry Trades

However, it’s essential to note that carry trades come with considerable risks.

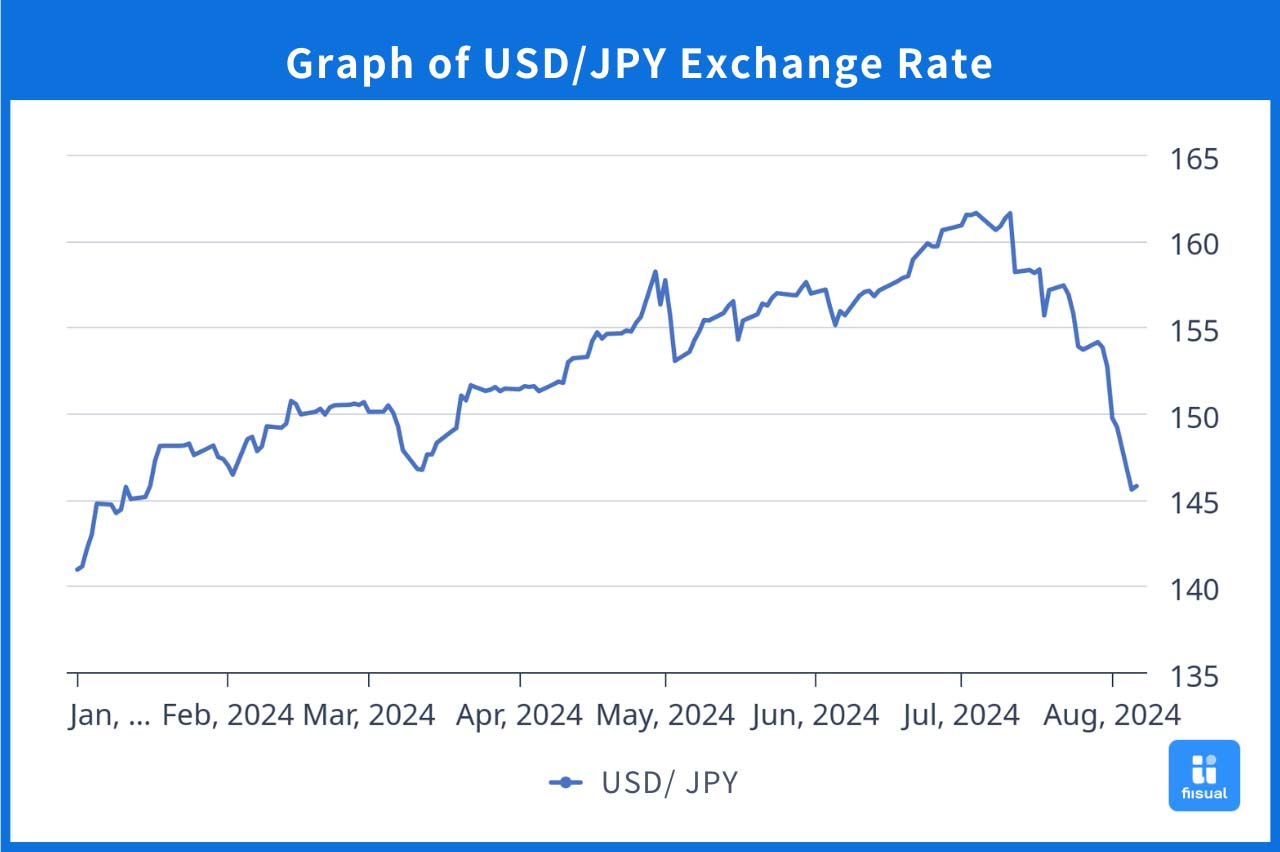

- Currency Risk: This includes the risk when the rate policy changes, causing the rate differential to narrow. During the trade process, there would be two currency conversions. If the yen appreciates during the trade, the value of dollars exchanged back may decrease, potentially eroding profits and creating currency risk.

- Liquidity Risk: Additionally, investors may face liquidity risk if they cannot sell their investments at the desired price when needing to repay the principal, potentially having to sell at a loss.

For more currency related articles, check out our A Basic Introduction to Foreign Exchange (Forex)

Potential Volatility from Carry Trades

With a basic understanding of carry trades, we can better grasp the current stock market dynamics.

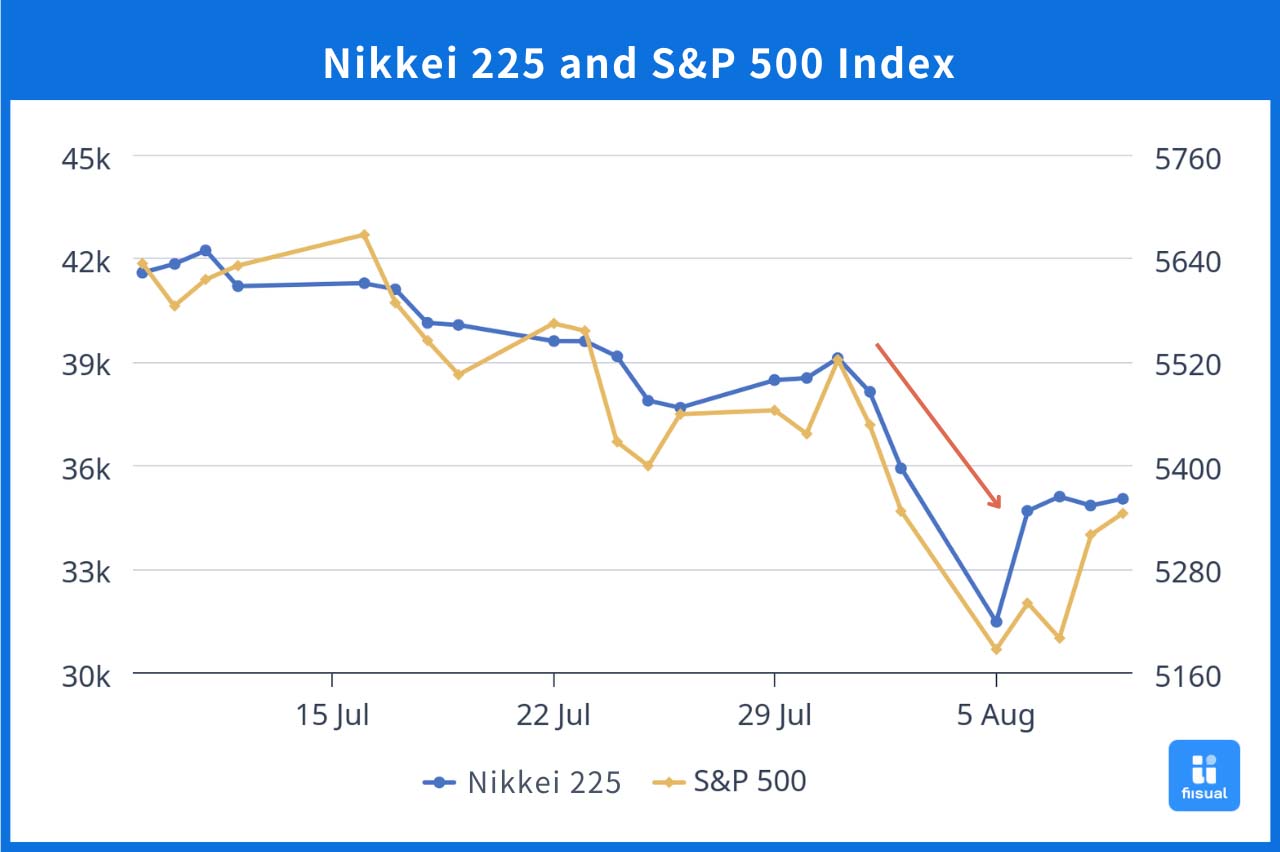

As the Bank of Japan’s unexpected rate hikes and bond purchase tapering led to a yen appreciation, currency risk surged. Carry trade investors began accelerating their exits, selling off stocks or bonds to repay the principal. This widespread selling has intensified market selling pressure. Over the long term, the rise in Japanese interest rates means higher borrowing costs for yen, and with expectations of a Federal Reserve rate cut in September, the allure of carry trade profits is waning. Consequently, investors are less inclined to borrow more funds for carry trades, reducing market liquidity.

To put it simply, think of capital flow like water. Over the past decade, Japan’s low-interest environment has been like a constantly flowing faucet. When investors needed capital, they “fetched a bucket of water” from Japan and poured it into various markets. However when Japan raises interest rates, the faucet has been tighten, reducing the flow of liquidity into the markets. Therefore, investors should monitor the Bank of Japan’s rate policy closely, as they are a key factory in influencing global capital flows!