Price Trend Summary

| May 19 Opening | May 30 Closing | Price Change | |

|---|---|---|---|

| Brent Crude | 64.73 | 62.78 | -3.0% |

| WTI Crude | 62.75 | 60.79 | -3.1% |

| Dubai Crude | 64.03 | 63.73 | -0.5% |

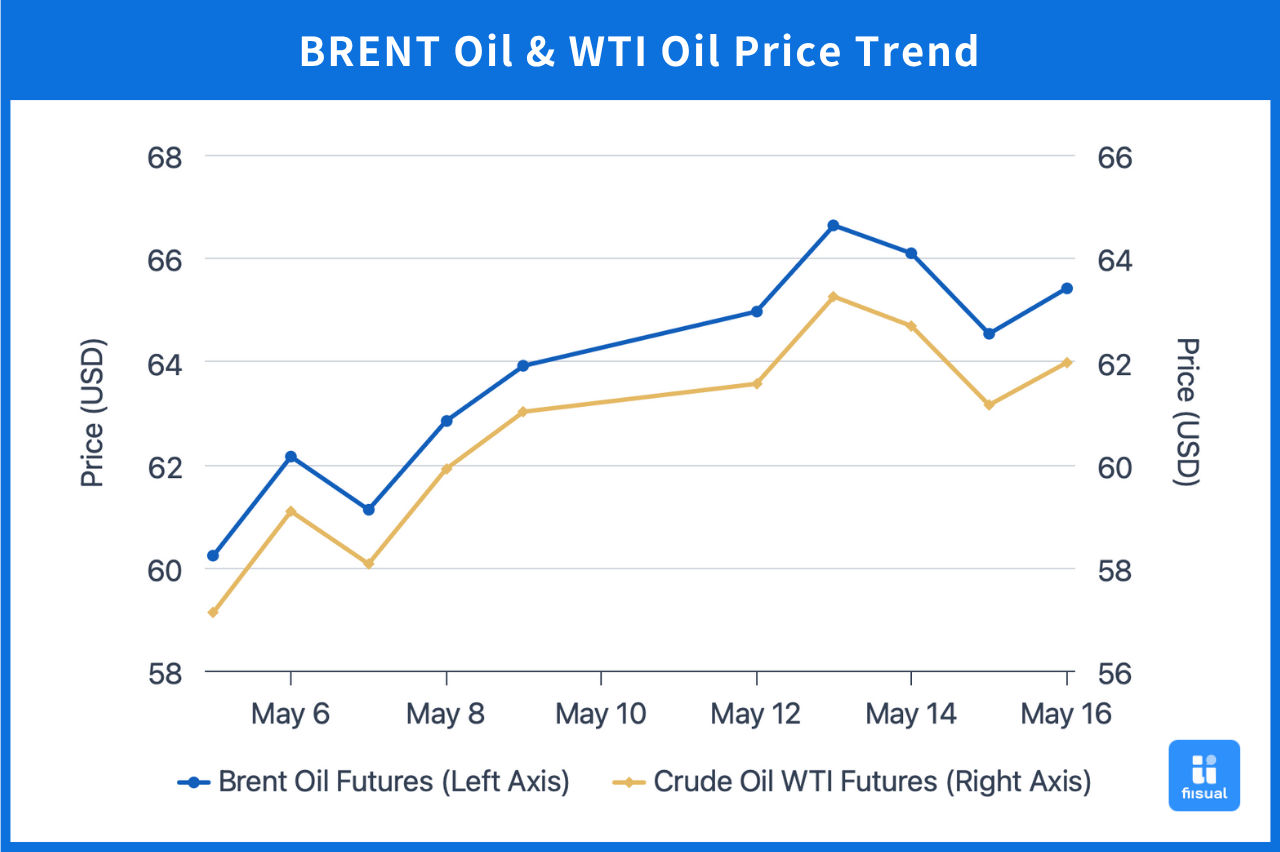

In the first week, oil prices entered consolidation due to a lack of progress in U.S.-Iran negotiations. Midweek, news that Israel might strike Iranian nuclear facilities—combined with reports that OPEC+ may raise output in July—led to price volatility, with gains later erased. Oil ended the week down about 1%.

In the second week, the market continued to observe OPEC’s stance and U.S. tariff developments, maintaining a consolidation trend. Midweek, the EIA reported a larger-than-expected crude inventory draw, and a U.S. federal court ruled that Trump’s April reciprocal tariffs were unlawful, supporting a temporary price rebound. However, in the latter half of the week, a federal appeals court temporarily reinstated the tariff policy, and renewed expectations of OPEC output hikes led oil prices to fall again, posting a 1–2% weekly decline.

Crude Oil Data Update

Crude Inventories Remain Healthy; Refined Product Draws Continue

Low Prices Suppress Investment Willingness Among Shale Producers

| May 30, 2025 | May 21, 2025 | May 14, 2025 | |

|---|---|---|---|

| Inventory (million bbl) | |||

| Commercial Crude (ex-SPR) | 440.4 (-2.8) | 443.2 (+1.4) | 441.8 |

| Strategic Petroleum Reserve | 401.3 (+0.8) | 400.5 (+0.8) | 399.7 |

| Motor Gasoline | 223.1 (-2.4) | 225.5 (+0.8) | 224.7 |

| Distillates | 103.4 (-0.7) | 104.1 (+0.5) | 103.6 |

| Production Activity | |||

| Rig Count | 465 (-8) | 473 (-1) | 474 |

| Refinery Utilization (%) | 90.2 (-0.5) | 90.7 (+0.5) | 90.2 |

Over the past two weeks, U.S. commercial crude inventories fell by a total of 1.4 million barrels, maintaining a relatively healthy level. Meanwhile, SPR replenishment accelerated, with a cumulative increase of 1.6 million barrels. As the summer driving season begins, gasoline demand has risen, leading to a 1.6 million-barrel draw in motor gasoline and a smaller 0.2 million-barrel decline in distillate stocks—signaling stable industrial and freight activity. On the supply side, active rig count fell sharply by 9 units, reflecting declining upstream investment appetite among shale producers under low price pressures. On the other hand, refinery utilization remained high as companies built inventories in anticipation of deferred tariffs and peak demand season.

International Developments

Trump Raises Steel and Aluminum Tariffs

On May 30 (local time), Trump announced that starting June 4, the existing 25% tariffs on imported steel and aluminum would be raised to 50%, aiming to protect the domestic steel industry. This move poses a dual risk to the oil market:

- Steel and aluminum are key materials for energy infrastructure. Rising costs may curb capital expenditures by shale producers and refiners.

- Heightened global trade tensions could weigh on economic growth expectations, in turn suppressing oil demand. This increases downside risks for oil prices in the short term.

OPEC+ Announces Third Output Hike

On May 31, OPEC+ announced a third round of output increases starting in July, raising production by 411,000 barrels per day. This continues the ramp-up that began in April, aimed at disciplining overproducing members like Kazakhstan and Iraq and regaining market share.

Given that the market had largely anticipated this move and it was partially priced in, oil prices are expected to remain in a low consolidation range in the short term.

Commentary

Oil prices remain range-bound at the low end. On the geopolitical front, U.S.-Iran negotiations have stalled. If no agreement is reached, the U.S. may tacitly permit Israeli military action against Iran. Meanwhile, the Russia-Ukraine war appears to be intensifying, which may disrupt crude supply. On the OPEC+ front, market sensitivity to output hikes has clearly decreased compared to previous months. The market is gradually adjusting to the group's shift from price stabilization to market share defense. In the near term, oil prices are likely to continue fluctuating in response to headlines. Key developments to monitor include the risk of escalation in geopolitical tensions, the trajectory of the trade war, and whether U.S. driving season demand meets expectations.

Conclusion

While geopolitical risks continue to support oil prices, ongoing OPEC+ output hikes and volatile U.S. trade policies are increasing supply pressure and macro uncertainty. As a result, oil prices still lack clear short-term upward momentum. Focus areas going forward include geopolitical headlines, tariff negotiation progress, and actual U.S. driving season demand realization.